The allure of the global currency market, Forex, is undeniable. With trillions of dollars changing hands every day, it promises the potential for significant profits. But navigating this complex landscape can be daunting, especially for newcomers. That’s where Forex trading online platforms come in. These powerful tools provide traders with the infrastructure they need to access the market, analyze trends, execute trades, and manage their risk.

Image: www.youtube.com

My journey into the world of Forex began with a simple curiosity about the forces that shape the global economy. I was fascinated by how even a small shift in interest rates could ripple through currencies worldwide. But it wasn’t until I stumbled upon a user-friendly online platform that I truly appreciated the accessibility of Forex trading. It opened up a whole new dimension of financial possibilities, and I knew I had to share this experience with others.

Understanding Forex Trading Platforms: Your Essential Toolkit

Think of a Forex trading platform as your personal cockpit for navigating the global currency market. It’s where you’ll find all the essential tools and information you need to make informed trading decisions. These platforms act as intermediaries between your trading orders and the market, providing real-time data, advanced charting capabilities, and secure execution functionalities.

The right Forex trading platform can be the difference between success and failure. It should be reliable, secure, and offer a user-friendly interface that caters to your individual needs. From beginners seeking a simple and intuitive platform to seasoned traders demanding advanced technical analysis tools, there’s a platform out there for every level of experience.

Navigating the Landscape: Key Features of Forex Trading Platforms

Forex trading platforms come in all shapes and sizes, each with its unique set of features. To make an informed choice, you need to understand the functionalities that matter most. Here’s a rundown of some key features to look for:

1. Real-Time Market Data: Your Window to Global Markets

Access to real-time market data is critical for successful Forex trading. You need to stay up-to-date on current exchange rates, economic indicators, and news events that could impact currency movements. Look for platforms that provide reliable data feeds from trusted sources, ensuring accuracy and timely updates.

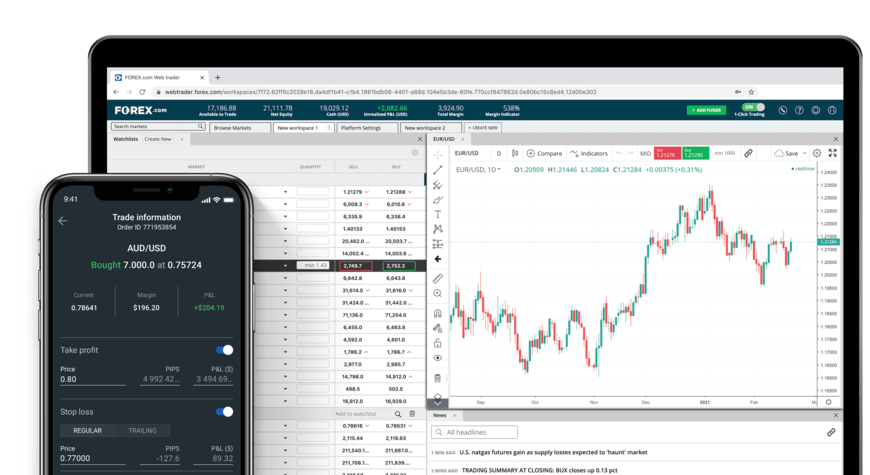

Image: www.forex.com

2. Charting Tools: Visualizing Trends and Patterns

Charting tools are essential for analyzing price movements and identifying potential trading opportunities. Look for platforms that offer a variety of charting types, including candlestick, line, and bar charts, and allow for customization with technical indicators, trend lines, and other overlays.

3. Order Execution: Executing Your Trades with Precision

The ability to execute trades quickly and efficiently is paramount. Platforms should offer a variety of order types, including market orders, limit orders, and stop-loss orders, and provide confirmation of order execution in real-time.

4. Trading Signals: Gaining Insights from Experts

While you should focus on developing your own trading strategy, some platforms offer valuable trading signals based on technical analysis or expert opinions. These signals can help you identify potential opportunities and confirm your own analysis.

5. Risk Management Tools: Protecting Your Investments

Risk management is an integral part of responsible trading. Look for platforms that offer tools for setting stop-loss orders, managing your leverage, and monitoring your account balance.

6. Educational Resources: Building Your Forex Knowledge

If you’re new to Forex trading, choose a platform that provides comprehensive educational resources, such as tutorials, webinars, and eBooks. These resources can help you understand the basics of Forex trading, develop trading strategies, and build your confidence.

The Future of Forex Trading Platforms: Innovation and Evolution

The Forex trading platform landscape is constantly evolving. New technologies and innovations are being introduced to enhance the trading experience, making it more accessible, efficient, and personalized. Here are some of the latest trends and developments shaping the future of Forex trading platforms:

1. Artificial Intelligence (AI) and Machine Learning: Optimizing Trading Strategies

AI and machine learning are being integrated into Forex trading platforms to automate tasks, analyze market data, and provide personalized trading insights. These technologies can identify patterns and opportunities that humans may miss, leading to more efficient and potentially profitable trades.

2. Mobile Trading: Untethered Trading Experience

The rise of mobile trading apps has made Forex trading more accessible than ever before. Traders can now monitor market movements, execute trades, and manage their accounts from anywhere with an internet connection. This convenience allows for greater flexibility and responsiveness to market changes.

3. Social Trading: Learning from the Crowd

Social trading platforms are gaining popularity as traders seek insights and strategies from their peers. These platforms allow users to follow other traders, share ideas, and even copy their trades, providing a valuable learning experience and fostering a sense of community.

4. Cryptocurrency Integration: Expanding Trading Horizons

The growing popularity of cryptocurrencies has led to the integration of digital assets into some Forex trading platforms. Traders can now buy, sell, and trade cryptocurrencies alongside traditional currencies, broadening their investment horizons.

Expert Tips and Advice: Optimizing Your Forex Trading Journey

My journey into Forex trading has taught me valuable lessons about choosing the right platform and navigating the market with success. Here are some insights that might benefit your own trading experience:

1. Start with a Demo Account: Practice Before You Invest

Before risking your own money, practice with a demo account. It allows you to familiarize yourself with the platform’s interface, experiment with different trading strategies, and test your risk management skills – all without any financial risk.

2. Choose a Regulated Platform: Ensuring Safety and Security

Select a platform regulated by a reputable financial authority. This ensures that the platform adheres to industry standards and provides safeguards for your funds. Look out for licenses from organizations like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

3. Focus on Education: Continuously Improve Your Skills

Forex trading requires ongoing education and continuous learning. Stay updated on market trends, economic developments, and new trading strategies. Many platforms offer educational resources, while external sources like books, online courses, and webinars can supplement your learning.

4. Start Small and Gradually Increase Your Investment

Don’t risk more than you can afford to lose. Begin with a small investment and gradually increase your capital as you gain experience and confidence. This approach helps manage risk and protect your investment.

5. Keep a Trading Journal: Track Your Performance and Learn from Mistakes

Maintain a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement. It will help you learn from both your wins and losses. This practice allows for a comprehensive understanding of your trading strategies and helps you make informed adjustments for future trades.

Frequently Asked Questions

Q: What types of Forex trading platforms are available?

A: Forex trading platforms come in various forms, each catering to different needs and experience levels. Here are a few common types:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry-standard platforms known for their robust functionality, customization options, and wide availability.

- Web-Based Platforms: Accessible through any web browser, offering convenience without the need for software downloads.

- Mobile Apps: Allow traders to access their accounts and execute trades anytime, anywhere.

- Proprietary Platforms: Developed by individual brokers, often offering unique features and integrations tailored to their specific services.

Q: How do I choose the right Forex trading platform?

A: There’s no one-size-fits-all answer. Consider these factors:

- Your Trading Experience: Beginners may prefer user-friendly platforms with educational resources, while experienced traders might seek platforms with advanced charting tools, technical indicators, and order types.

- Your Trading Style: Scalp traders might prioritize platforms with fast order execution, while long-term investors might value platforms with comprehensive market analysis and research tools.

- Platform Features: Evaluate the functionalities offered by the platform, including charting tools, technical indicators, order types, risk management tools, and educational resources.

- Security and Regulation: Ensure the platform is regulated by a reputable financial authority and safeguards your funds.

- Customer Support: Choose a platform that provides reliable and responsive customer support in case you encounter issues.

Q: What are the risks associated with Forex trading?

A: Forex trading involves significant risks. Here are some key risks to consider:

- Market Volatility: The Forex market is inherently volatile, with currency prices fluctuating constantly. This volatility can lead to sudden losses.

- Leverage: Leverage allows you to control larger positions with smaller capital, but it can amplify both profits and losses.

- Currency Pairs: Trading multiple currency pairs can increase complexity and risk.

- Geopolitical Events: News events and political developments can impact currency valuations significantly.

Forex Trading Online Platform

Conclusion: Your Forex Trading Journey Begins Here

Choosing the right online platform is the cornerstone of a successful Forex trading journey. It provides you with the tools, resources, and security you need to navigate the global currency market and potentially unlock its opportunities. Remember, education, practice, and responsible risk management are essential for success in this challenging yet rewarding arena.

Are you interested in learning more about Forex trading platforms and exploring the potential of the global currency market? Share your thoughts and questions below. I’m eager to hear from fellow traders and share my experience to help you embark on your own exciting Forex trading journey!