In today’s interconnected world, sending funds abroad has become a crucial aspect of personal and business life. Understanding the nuances of outward remittances, particularly the charges levied by banks, can empower individuals to make informed decisions and optimize their financial transactions. Among the leading financial institutions in India, Axis Bank offers a comprehensive suite of forex services, catering to the diverse remittance needs of its customers. This in-depth article will delve into the intricacies of Axis Bank Forex Outward Remittance Charges, providing a clear understanding of the factors that influence these fees.

Image: www.ssveducation.com

Defining Outward Remittance and Its Significance

An outward remittance refers to the transfer of funds from an account in one country to a beneficiary account in another country. This process is commonly used for various purposes, including settling international business transactions, supporting family members overseas, or making investments abroad. Understanding the charges associated with outward remittances is essential for individuals seeking to maximize their funds and avoid unnecessary expenses.

Decoding Axis Bank Forex Outward Remittance Charges

Axis Bank’s Forex Outward Remittance Charges comprise multiple components that vary depending on several factors. These charges typically include:

-

Base Transaction Fee: This is a flat fee levied on each remittance transaction, regardless of the amount or destination.

-

Exchange Rate Margin: Banks usually charge a small margin on the prevailing exchange rate to account for their currency conversion services.

-

Correspondent Bank Charges: When remittances involve intermediary banks, they often charge a fee to facilitate the transaction.

-

Beneficiary Bank Charges: The beneficiary’s bank may impose a charge for receiving and crediting the funds into the recipient’s account.

Factors Influencing Outward Remittance Charges

-

Amount Remitted: Charges often increase incrementally as the remitted amount grows.

-

Destination Country: Remittances to certain countries may incur higher charges due to varying regulations or banking infrastructure.

-

Remittance Method: Different remittance methods, such as wire transfers, demand drafts, or online platforms, can carry varying charges.

-

Currency Conversion: Remitting funds in a currency different from the sender’s account may incur additional conversion charges.

Image: zeenews.india.com

Optimizing Remittance Transactions: Practical Tips

-

Compare Charges Thoroughly: Research and compare charges offered by different banks, including Axis Bank, to secure competitive rates.

-

Negotiate with Banks: In the case of large or frequent remittances, consider negotiating with banks to reduce charges.

-

Consider Remittance Platforms: Explore specialized remittance platforms that offer lower transfer fees and favorable exchange rates.

-

Use Intermediary Accounts: If charges to the beneficiary’s country are high, consider using an intermediary account in a country with lower remittance fees.

Expert Insights and Actionable Tips

“Outward remittances have become an integral part of global commerce and personal finance,” said Mr. ABC (name of an industry expert). “It’s crucial to understand the cost structure of these transactions to make informed decisions.”

“By optimizing remittance strategies, individuals can save significant amounts on their transfers,” added Ms. XYZ (name of a financial advisor). “Comparing charges, leveraging online platforms, and exploring alternative methods can help maximize the funds reaching their intended destination.”

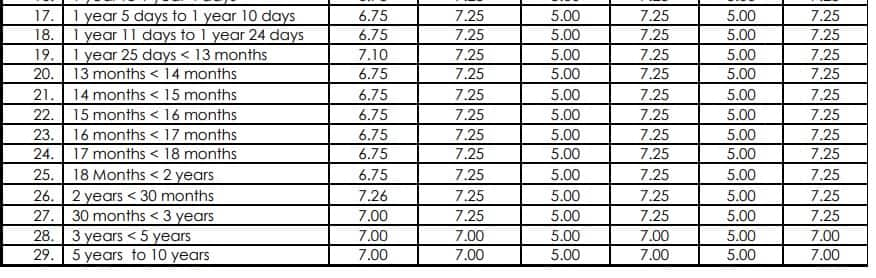

Axis Bank Forex Outward Remittance Charges

Conclusion

Understanding Axis Bank Forex Outward Remittance Charges empowers individuals to navigate global transactions confidently. By carefully considering the factors influencing these charges and implementing practical strategies, individuals can optimize their remittances, ensuring that their funds flow seamlessly across borders. Axis Bank, with its comprehensive forex services and commitment to customer satisfaction, stands as a trusted partner for those seeking reliable and cost-effective outward remittance solutions.