Introduction

In the bustling world of financial trading, the forces of supply and demand hold sway, dictating the ebb and flow of prices like a symphony of economic forces. This dynamic plays an especially crucial role in foreign exchange trading (forex), where currencies from around the globe dance in a constant ballet of value exchange. To navigate this intricate dance and make informed trading decisions, it is imperative to grasp the fundamental principles of supply and demand in forex.

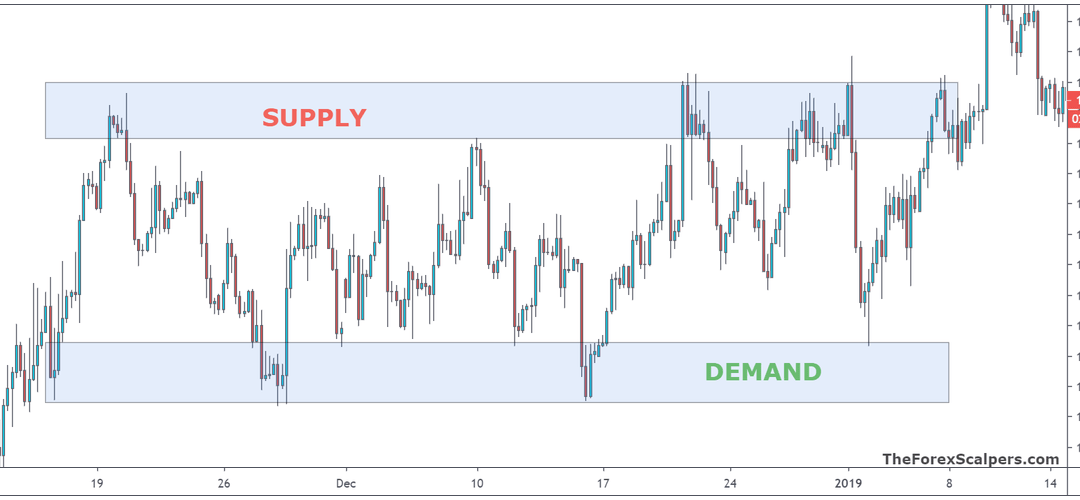

Image: theforexscalpers.com

Supply and Demand in Forex: The Basics

Supply, in the realm of forex, refers to the amount of a currency that is available for sale at a given price, while demand represents the amount of that same currency that traders are willing to buy at that price. When supply exceeds demand, it creates downward pressure on the currency’s value, leading to a decrease in its price. Conversely, if demand outstrips supply, an upward force is exerted, resulting in an increase in the currency’s value.

Factors Influencing Supply and Demand

A myriad of factors can influence the supply and demand dynamics of a currency, including economic data, political events, central bank decisions, and global market sentiment. Strong economic growth, low inflation, and a stable political environment tend to boost demand for a currency, making it more valuable. On the other hand, economic weakness, rising inflation, and political instability can erode demand and lead to a decline in a currency’s value.

Central Bank Influence

Central banks play a pivotal role in managing supply and demand in forex markets through monetary policies, influencing the availability and cost of money. By adjusting interest rates, central banks can stimulate or cool economic activity, thus impacting the demand for currencies. For example, raising interest rates can strengthen a currency by making it more attractive to investors and increasing demand for the country’s bonds and assets.

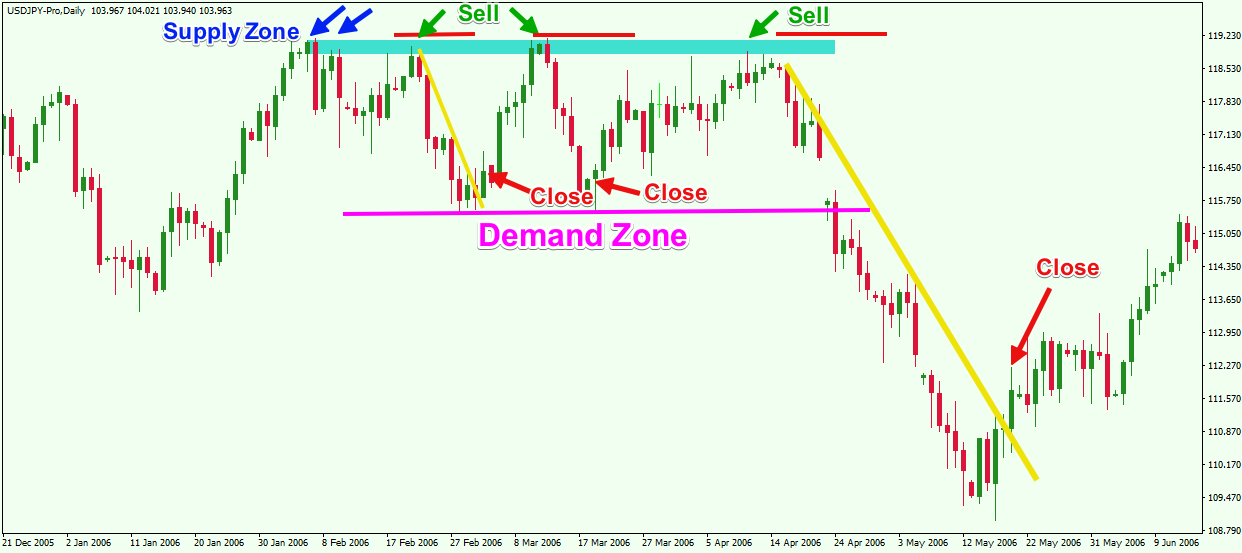

Image: bceweb.org

Real-World Applications

Understanding supply and demand in forex is crucial for traders to make informed decisions, assess market sentiment, and identify potential trading opportunities. By analyzing supply and demand imbalances, traders can gauge the market’s direction and make strategic trades to capitalize on anticipated price movements.

Expert Insights

According to renowned forex expert Michael J. Carr, “Supply and demand analysis is the cornerstone of successful forex trading. By studying these forces, traders can gain a deep understanding of market dynamics and make more accurate predictions about currency price movements.”

Actionable Tips for Traders

Here are some practical tips for traders to apply supply and demand principles:

- Use technical analysis tools like charts and indicators to identify supply and demand zones.

- Monitor economic data and geopolitical events for potential impacts on supply and demand.

- Be patient and disciplined, waiting for the right trading opportunities to emerge.

- Manage risk effectively by using stop-loss orders and proper position sizing.

What Is Supply And Demand Forex

Conclusion

The interplay of supply and demand is a fundamental force that shapes the world of forex trading, providing traders with insights into market behavior and opportunities to capitalize on price movements. By mastering the principles of supply and demand and leveraging the strategies outlined in this article, traders can navigate the complexities of the forex market with greater confidence and a higher probability of success. Remember, the dance of supply and demand never truly ends, but by becoming an adept observer and participant, you can empower yourself to make informed decisions and dance to the rhythm of the market’s ever-changing currents.