In the intricate tapestry of the foreign exchange market, institutional supply and demand play a pivotal role in shaping price dynamics and influencing the direction of currency pairs. This sophisticated interplay between major financial institutions, central banks, and multinational corporations forms the bedrock of the currency markets.

Image: theforexscalpers.com

Institutional Market Participants

The institutional forex market consists of a diverse ensemble of participants, each wielding significant influence:

- Commercial Banks: Acting as intermediaries, commercial banks facilitate currency transactions on behalf of their clients, bridging the gap between retail and institutional traders.

- Investment Banks: Specialized in high-volume currency trading, investment banks execute complex transactions for institutional clients and engage in proprietary trading.

- Hedge Funds: Employing sophisticated strategies, hedge funds actively trade currencies to generate capital gains for investors.

- Central Banks: Responsible for implementing monetary policy, central banks intervene in the forex market to influence the value of their national currency.

- Multinational Corporations: Engrained in global trade, multinational corporations engage in large-scale currency transactions to facilitate cross-border operations.

Understanding Supply and Demand

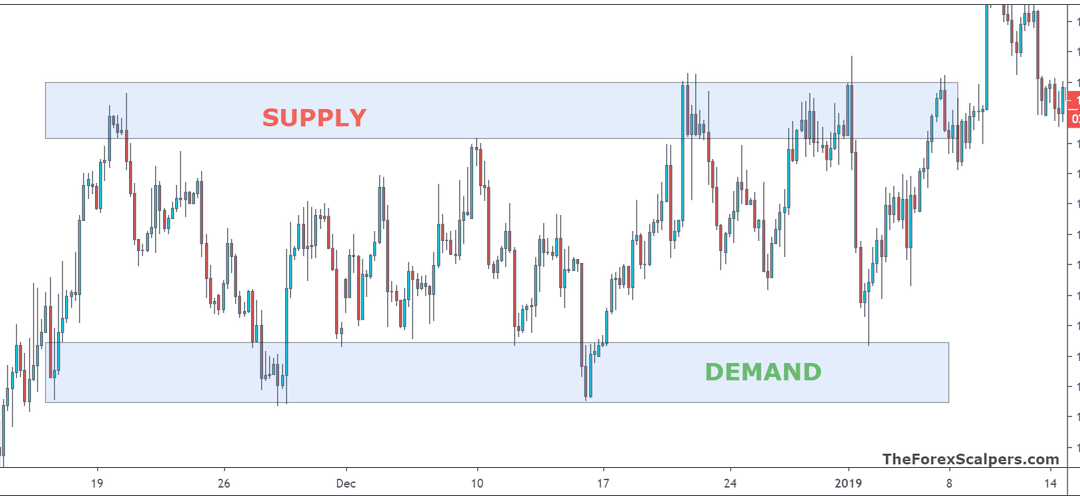

The foreign exchange market, like any other market, operates on the fundamental principles of supply and demand. Supply refers to the willingness of market participants to sell a currency, while demand represents the willingness to buy. When supply exceeds demand, the value of the currency tends to depreciate. Conversely, when demand exceeds supply, the value typically appreciates.

Institutional supply and demand, however, introduce an added layer of complexity. These large players often engage in hedging strategies to mitigate currency-related risks, which can significantly impact the overall supply and demand dynamics.

Historical Significance

Historically, institutional supply and demand have played a defining role in currency markets. The Bretton Woods Agreement of 1944, which established fixed exchange rates, was heavily influenced by the interplay of institutional actors. In the wake of the 1973 collapse of the Bretton Woods system, the floating rate regime allowed institutional players to exert even greater influence on currency valuations.

Image: www.pinterest.com.mx

Forecasting Market Direction

While predicting the direction of currency pairs is inherently challenging, analysts often scrutinize institutional supply and demand data to gauge market sentiment. Changes in institutional holdings, news and rumors, central bank speeches, and economic data can provide valuable insights into the potential future direction of exchange rates.

Expert Insights and Tips

Navigating the complexities of institutional supply and demand requires expertise and an understanding of market dynamics. Here are some valuable tips:

- Follow institutional activity: Monitor the trades and holdings of large financial institutions to gauge market sentiment and potential price movements.

- Consider central bank announcements: Pay close attention to monetary policy decisions and speeches from central bank officials, which can significantly impact currency values.

- Stay informed about economic data: Keep abreast of key economic indicators, which can provide insights into the underlying supply and demand forces affecting currency markets.

Frequently Asked Questions

Q: How does institutional supply and demand differ from retail supply and demand?

A: Institutional supply and demand involve significantly larger transactions and are driven by complex hedging strategies, corporate transactions, and central bank interventions.

Q: What are the risks associated with relying on institutional supply and demand for trading?

A: While institutional supply and demand can provide valuable market insights, it’s important to note that these players can alter their strategies and positions based on evolving market conditions.

Institutional Supply And Demand Forex

Conclusion

The intricate dance of institutional supply and demand is a cornerstone of the foreign exchange market, shaping price movements and influencing currency valuations. By harnessing the knowledge and insights presented in this article, traders can enhance their understanding of this dynamic market and make more informed trading decisions. We encourage readers to delve deeper into this topic and explore the fascinating world of institutional supply and demand in the forex market.

Are you interested in delving further into the intricacies of institutional supply and demand in the forex market? Let us know in the comments below, and we will be happy to provide additional resources and insights.