Introduction

In the dynamic landscape of forex trading, understanding the forces that drive market movements is paramount for successful trading decisions. Order flow, which captures the collective buying and selling orders in the market, and supply and demand, which represent the economic forces of buyers and sellers, are two fundamental concepts that provide invaluable insights into market dynamics. This article delves into the intricacies of order flow versus supply and demand in forex trading and provides traders with practical strategies to leverage these concepts for profitable execution.

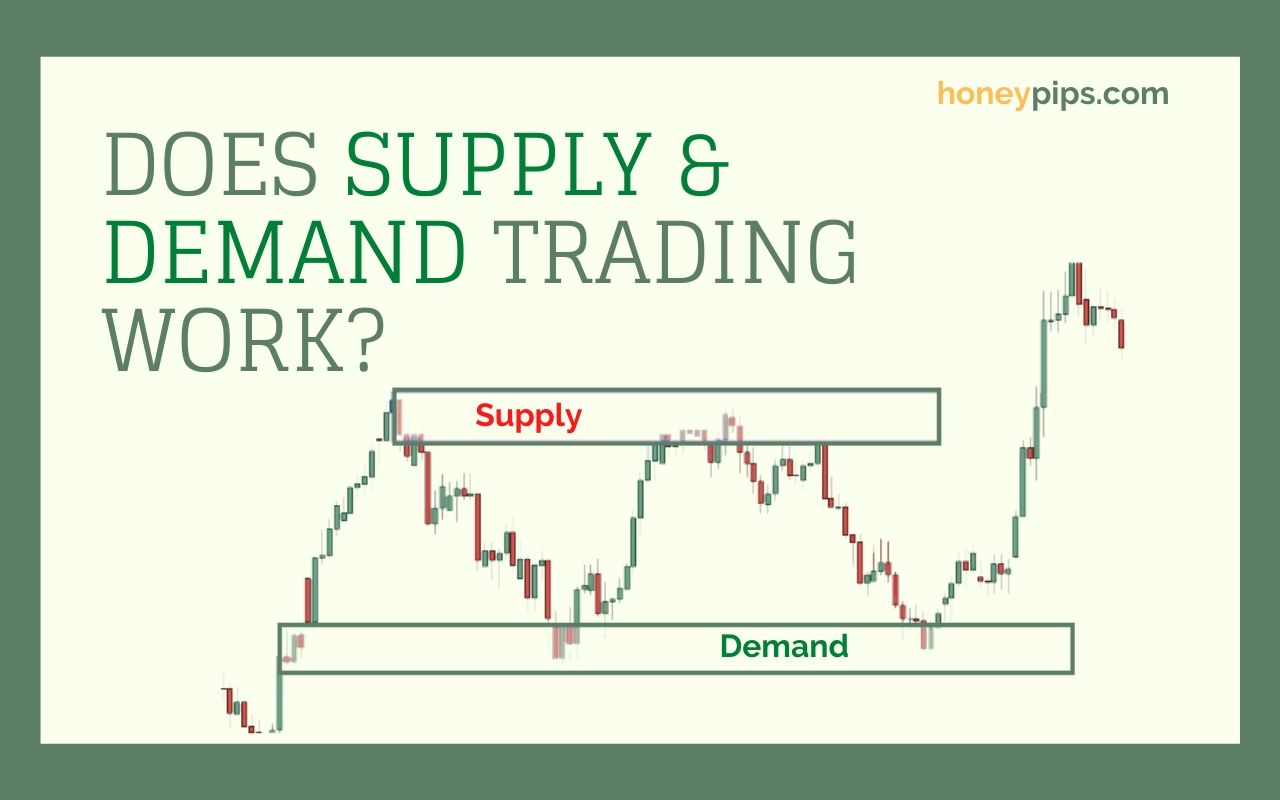

Image: honeypips.com

Understanding Order Flow

Order flow, at its core, is a real-time representation of the buy and sell orders placed in a market. By analyzing order flow data, traders can identify areas of interest, potential trend reversals, and areas of liquidity and volatility. These orders can come from various participants, including institutional investors, hedge funds, and retail traders. Order flow analysis helps traders gauge the intentions and behavior of these market participants, which can provide valuable insights into the direction of market momentum.

Supply and Demand

Supply and demand, a cornerstone of economics, is the fundamental force that drives market prices. In forex trading, supply represents the number of traders willing to sell a currency pair, while demand represents the number of traders willing to buy it. When supply exceeds demand, a surplus occurs, leading to downward price pressure. Conversely, when demand exceeds supply, a shortage occurs, resulting in upward price movement. Understanding supply and demand zones allows traders to identify potential trading opportunities and set target profit levels.

Interactive Dynamics between Order Flow and Supply and Demand

Order flow and supply and demand interact synergistically, with each concept influencing the other. Order flow reveals imbalances in supply and demand, which in turn can lead to shifts in price. For example, a sudden surge in buy orders can push prices higher, indicating increased demand and a potential shortage of the currency pair. Conversely, a cluster of sell orders may suggest excess supply and downward price movement. Traders can leverage this interplay by interpreting order flow signals in conjunction with supply and demand zones to fine-tune their trading strategies.

Image: tradersunion.com

Leveraging Order Flow and Supply and Demand for Profit

By incorporating order flow and supply and demand concepts into trading strategies, traders can enhance their market analysis and execution precision. Here are some practical tactics:

1. Identifying Trend Reversals:

Order flow analysis can provide early indications of potential trend reversals. When buy orders dominate in a downtrend or sell orders surge during an uptrend, traders can anticipate a shift in market momentum.

2. Liquidity Identification:

Order flow data reveals areas of high and low liquidity, enabling traders to target trades where execution slippage is minimal.

3. Volatility Assessment:

Extreme order flow imbalances can indicate periods of increased price volatility, which can be exploited by traders with appropriate risk management strategies.

4. Confirmation of Supply and Demand Zones:

Order flow analysis can confirm or invalidate supply and demand zones, providing traders with additional confidence in their trade entries and exits.

Order Flow Vs Supply Demand Forex

Conclusion

Order flow and supply and demand are powerful tools in the arsenal of astute forex traders. By leveraging these concepts together, traders can unravel the complexities of market movements, identify trading opportunities, and maximize their profitability. In this era of data-driven trading, mastery of order flow and supply and demand is a key differentiator for traders aspiring to success in the dynamic world of forex.