Introduction: Unveiling the Forex Frontier

As a keen Forex trader, I’ve witnessed firsthand the remarkable potential of interest rates carry trades. These strategies involve exploiting interest rate differentials between currencies to generate consistent returns. Join me as I delve into the world of carry trades, unravel their mechanics, and provide insightful tips to maximize your profitability.

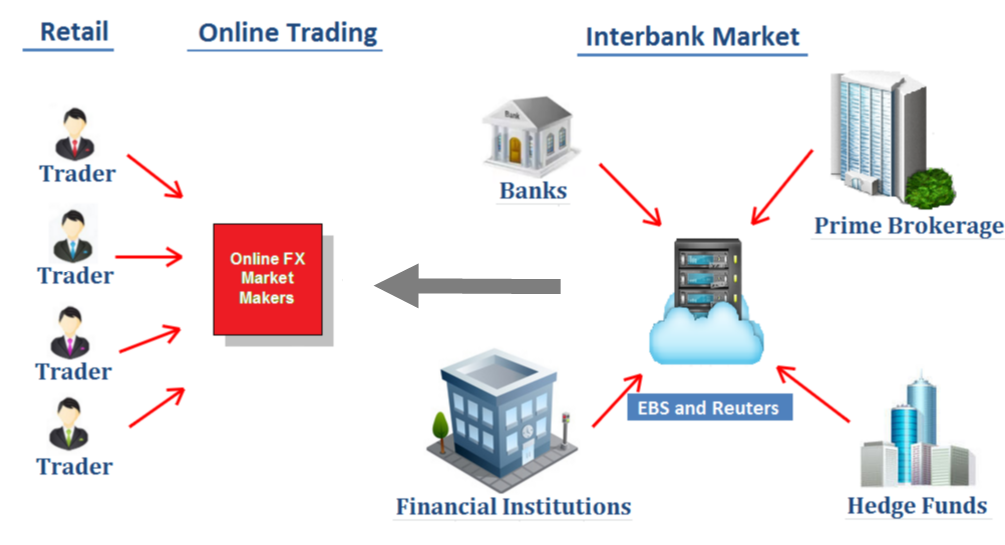

Image: myforexlearn.com

Unveiling Carry Trades: A Strategic Advantage

A carry trade in Forex involves borrowing a currency with a low interest rate and simultaneously investing the borrowed funds in a currency with a higher interest rate. This interest rate differential creates a positive carry, potentially generating substantial returns over time.

Comprehensive Overview: Exploring Carry Trades

Carry trades have been an integral part of the Forex market for decades. Central banks set different interest rates to manage their economies. These differences provide carry traders with opportunities to capitalize on the interest rate disparities. Interest rates fluctuate continuously, influenced by economic conditions, central bank policies, and market sentiment.

Identifying Profitable Carry Trades

Identifying profitable carry trades requires careful analysis. Traders must assess economic indicators, examine interest rate forecasts, and monitor market news to determine which currency pairs offer the most favorable carry opportunities. Economic growth, inflation, and central bank decisions impact interest rates and, consequently, carry trade profitability.

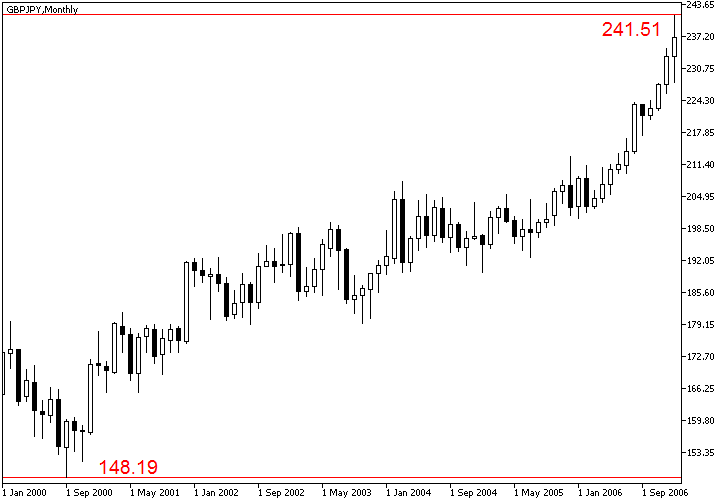

Image: ddfxforextradingsystemreview.blogspot.com

Tips for Maximizing Profits

- Research and Analysis: Thorough research and analysis are crucial. Identify currency pairs with significant interest rate differentials and assess their economic fundamentals.

- Risk Management: Manage risk by calculating the carry trade’s potential return and risk. Use stop-loss orders to mitigate potential losses.

- Monitor Market Conditions: Continuously monitor market conditions and economic indicators. Adjust your carry trade positions based on changes in the underlying factors.

- Seek Expert Advice: Consult with experienced Forex traders or financial advisors to gain insights and enhance your strategy. Market knowledge is invaluable for maximizing profits.

FAQs on Forex Interest Rates Carry Trades

Q: What are the risks associated with carry trades?

A: Carry trades involve the risk of exchange rate fluctuations and interest rate changes. Adverse market movements can lead to losses.

Q: How do I calculate the potential return on a carry trade?

A: The potential return is the difference between the interest rates of the two currencies multiplied by the amount borrowed.

Forex Interest Rates Carry Trades

Conclusion: A Call to Action

Forex interest rates carry trades offer a compelling opportunity for traders seeking consistent returns. By understanding the mechanics, identifying profitable trades, and implementing risk management principles, traders can strive for success in this dynamic and potentially lucrative market. Are you ready to explore the world of carry trades and unlock the full potential of the Forex market?