In the dynamic world of foreign exchange (forex), interest rate differentials play a crucial role, influencing currency values and shaping trading opportunities. Understanding the impact of interest rate differentials is paramount for any forex trader seeking success.

Image: www.slideserve.com

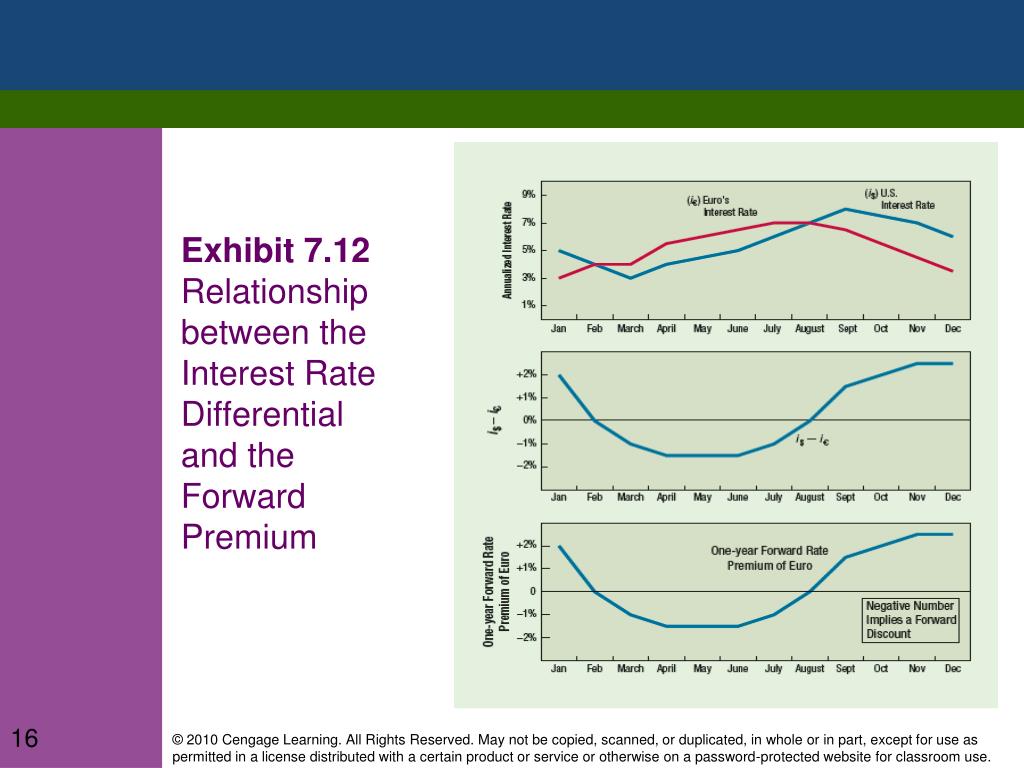

An interest rate differential refers to the difference in interest rates between two countries or economic zones. When the interest rate in one country is higher than another, investors are drawn to the higher-yielding country. This demand for the currency of the high-yielding country strengthens its value against the currency of the low-yielding country.

Mechanism of Interest Rate Differentials

Central banks set interest rates to control inflation, stimulate economic growth, and maintain financial stability. When a country embarks on a path of raising interest rates, it becomes more attractive to investors seeking higher returns. This inflow of capital creates a demand for the country’s currency, leading to its appreciation in value.

Conversely, when interest rates in a country are low, investors may be less inclined to park their funds in that country. This reduced demand for the currency can lead to its devaluation against stronger currencies.

Implications for Forex Trading

Interest rate differentials offer forex traders with both opportunities and challenges:

-

Carry Trade: Carry trade is a strategy involving borrowing a currency with low interest rates and investing it in a currency with higher interest rates. The trader profits from the interest rate differential, minus any transaction costs or currency fluctuations. Countries like Japan and Switzerland have low interest rates, making their currencies popular for carry trades.

-

Arbitrage: Interest rate differentials can create arbitrage opportunities for traders who buy a currency in one market and simultaneously sell it in another at a higher price, exploiting the interest rate difference and turning a profit.

-

Currency Correlation: Countries with similar interest rate differentials tend to have their currencies move in unison. This correlation can help traders identify trading pairs that are more likely to move together, reducing risk and enhancing trading efficiency.

Real-World Applications

In 2022, the United States Federal Reserve embarked on a series of aggressive interest rate hikes to combat rising inflation. This widening interest rate differential between the US and its trading partners led to a surge in the value of the US dollar relative to other major currencies. The euro, for instance, fell by over 10% against the US dollar from January to July 2022, as investors sought the higher returns offered by US bonds.

On the other hand, countries like Japan and Switzerland have maintained extraordinarily low interest rates for extended periods. This has made their currencies attractive for carry trades, leading to an appreciation in their value against major currencies like the US dollar and the euro.

Image: www.slideshare.net

Interest Rate Differential In Forex

Conclusion

Understanding interest rate differentials is fundamental for forex traders seeking to make well-informed decisions. By monitoring interest rate changes and their impact on currency values, traders can uncover potential trading opportunities, capitalize on carry trades, and mitigate risk. As the global economy continues to evolve, interest rate differentials will remain a driving force in forex markets, offering both opportunities and challenges for traders. Embracing a thorough understanding of these differentials empowers traders to navigate the complexities of the forex market with increased profitability and reduced uncertainty.