In the realm of international finance, the concept of foreign exchange (forex) reserves holds immense importance. These reserves, meticulously accumulated by central banks, serve as a nation’s financial lifeline, ensuring economic stability and mitigating risks in times of adversity.

Image: economictimes.indiatimes.com

**Foreign Exchange Reserves: A Bridge to Global Markets**

Forex reserves, primarily comprising foreign currencies, gold, and other liquid assets, act as a buffer against external shocks, enabling countries to meet their international obligations and participate in global trade and financial markets.

**Significance of Forex Reserves**

A country’s forex reserves bear strategic importance, providing the following benefits:

- **Currency Stabilization:** Forex reserves help central banks manage exchange rate fluctuations, preventing extreme currency volatility that could harm the economy.

- **Trade Facilitation:** Adequate reserves ensure the smooth flow of imports and exports, supporting economic growth.

- **External Debt Repayment:** Forex reserves serve as a cushion for countries servicing external debts, reducing the risk of default.

- **Confidence Building:** Ample reserves foster investor confidence in a country’s economic stability, attracting foreign direct investment and boosting economic growth.

**India’s Forex Reserves: A Journey of Growth**

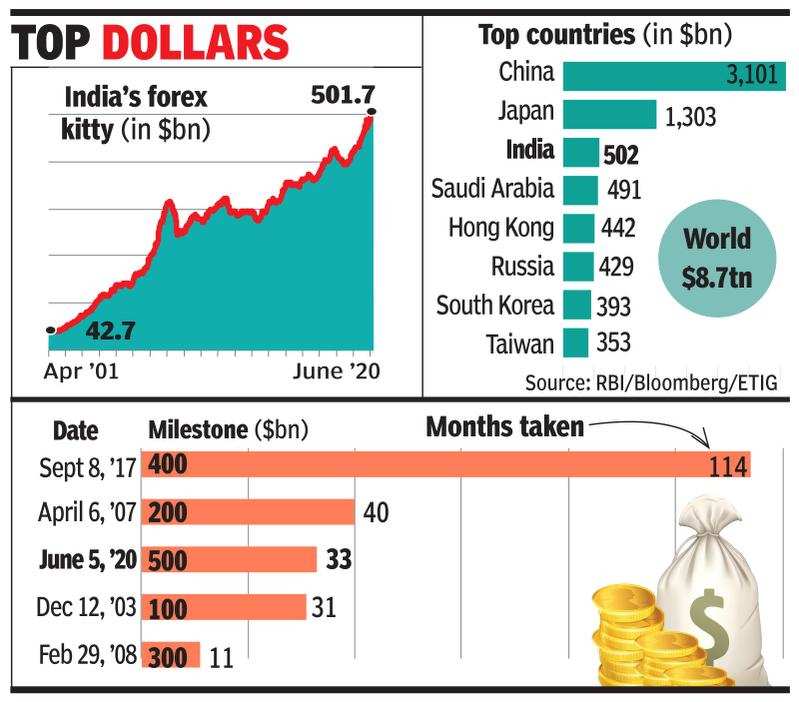

India’s forex reserves have witnessed a remarkable journey over the decades, mirroring the country’s growing economic strength. As of December 2023, India’s forex reserves stand at a record $603.4 billion, making it the world’s fourth-largest reserve holder.

Image: timesofindia.indiatimes.com

**Factors Driving Forex Reserve Growth:**

Several factors have contributed to India’s burgeoning forex reserves:

- Foreign Direct Investment (FDI): Inflows of foreign investment bolster India’s forex reserves.

- Inward Remittances:** Remittances sent home by Indian expatriates contribute significantly to forex reserves.

- Software Exports:** India’s thriving software industry generates substantial foreign exchange earnings.

- Foreign Currency Borrowings:** India’s government and businesses have borrowed foreign currencies, adding to forex reserves.

- Central Bank Intervention:** The Reserve Bank of India (RBI) intervenes in the foreign exchange market to stabilize the rupee and build reserves.

**Recent Trends and Developments**

The global economic landscape is constantly evolving, impacting forex reserves worldwide. Some notable trends and developments include:

- Global Economic Slowdown:** Slowing global economic growth and trade tensions can reduce the demand for exports, impacting forex reserves.

- Currency Volatility:** Fluctuations in major currencies like the US dollar can affect the value of forex reserves.

- Interest Rate Changes:** Central bank interest rate adjustments can influence the flow of foreign capital, impacting forex reserves.

- Technological Advancements:** The rise of fintech and digital currencies is transforming the foreign exchange landscape.

**Tips for Managing Forex Reserves**

Managing forex reserves effectively requires a prudent and balanced approach:

- Diversification:** Forex reserves should be diversified across multiple currencies and asset classes to mitigate risks.

- Liquidity:** Maintaining a healthy level of liquid assets ensures the availability of funds for immediate use.

- Investment Strategy:** Forex reserves can be invested in low-risk assets to generate returns.

- Monitoring and Evaluation:** Regular monitoring and evaluation of forex reserves enable policymakers to adjust strategies based on evolving market conditions.

**Additional Expert Advice**

For further insights, consider the following advice from experts:

“India should focus on increasing its exports to reduce dependence on foreign borrowing and boost forex reserves.” – Rajiv Kumar, Niti Aayog

“Diversification of forex reserves is crucial to manage risks and enhance returns.” – Urjit Patel, former RBI Governor

**Frequently Asked Questions (FAQs)**

Q: What is the primary purpose of forex reserves?

A: Forex reserves provide a buffer against external shocks and support economic growth by facilitating trade and mitigating currency risks.

Q: How do forex reserves affect a country’s economy?

A: Forex reserves promote economic stability by minimizing currency fluctuations, enabling trade and investment, and fostering investor confidence.

Q: What factors influence the level of forex reserves?

A: FDI, inward remittances, foreign currency borrowing, and central bank intervention all contribute to the size of forex reserves.

Q: Can forex reserves be used in emergencies?

A: Yes, forex reserves can be utilized to meet external obligations, stabilize exchange rates, and support the economy during crises.

What Is The Forex Reserve Of India

**Conclusion**

Forex reserves are an integral component of a nation’s financial resilience, providing a foundation for economic growth and stability. India’s substantial forex reserves reflect its growing economic power and the confidence of global investors. By understanding the significance, trends, and management strategies associated with forex reserves, we gain insights into the complexities of international finance and its impact on national economies.

Are you keen to learn more about forex reserves and their impact on global markets? Explore additional resources or connect with financial experts for further insights.