“In the world of international business, foreign exchange (forex) fluctuations are like the tides—unpredictable, yet inevitable,” says Emily, a seasoned entrepreneur who has witnessed the rollercoaster ride of forex markets firsthand. “Managing these fluctuations can be tricky, especially when it comes to unrealized forex losses and their impact on income tax.”

Image: skilling.com

Emily’s experience reflects the growing importance of understanding unrealised forex losses and their tax implications in today’s globalized economy. As businesses venture beyond borders, they navigate the complexities of multiple currencies and the fluctuations that come with them.

Unrealised Forex Losses: A Definition

Unrealised forex losses arise when the value of a currency you hold decreases relative to another currency.

For example, if you have a receivables balance denominated in US dollars (USD) and the USD weakens against the Indian Rupee (INR), you will have an unrealized loss on paper. However, this loss is only recognized on your books and does not impact your cash position until the receivable is settled.

In the context of income tax, unrealized forex losses are typically not tax-deductible. This means that you cannot reduce your taxable income by the amount of the unrealized loss. However, there are some exceptions to this rule, which we will discuss later.

Tax Treatment of Unrealized Forex Losses

The tax treatment of unrealized forex losses depends on your specific situation and the jurisdiction in which you operate. In general, unrealised forex losses are not deductible from your taxable income unless:

- The loss is incurred in the ordinary course of your business;

- You have a reasonable expectation of being able to recover the loss in the future;

- You have documentation to support the loss.

If you meet these criteria, you may be able to claim a deduction for your unrealized forex loss. You will need to file an amended tax return to claim the deduction.

Tips for Managing Unrealised Forex Losses

While unrealized forex losses can’t be directly deducted, there are steps you can take to manage their impact on your taxes:

- Hedge your forex exposure by using forward contracts or options. This can help you lock in a future exchange rate and mitigate the risk of losses.

- Invoice in your own currency whenever possible. This will help you avoid the risk of forex losses on receivables.

- Monitor your forex exposure regularly and take steps to manage your risk.

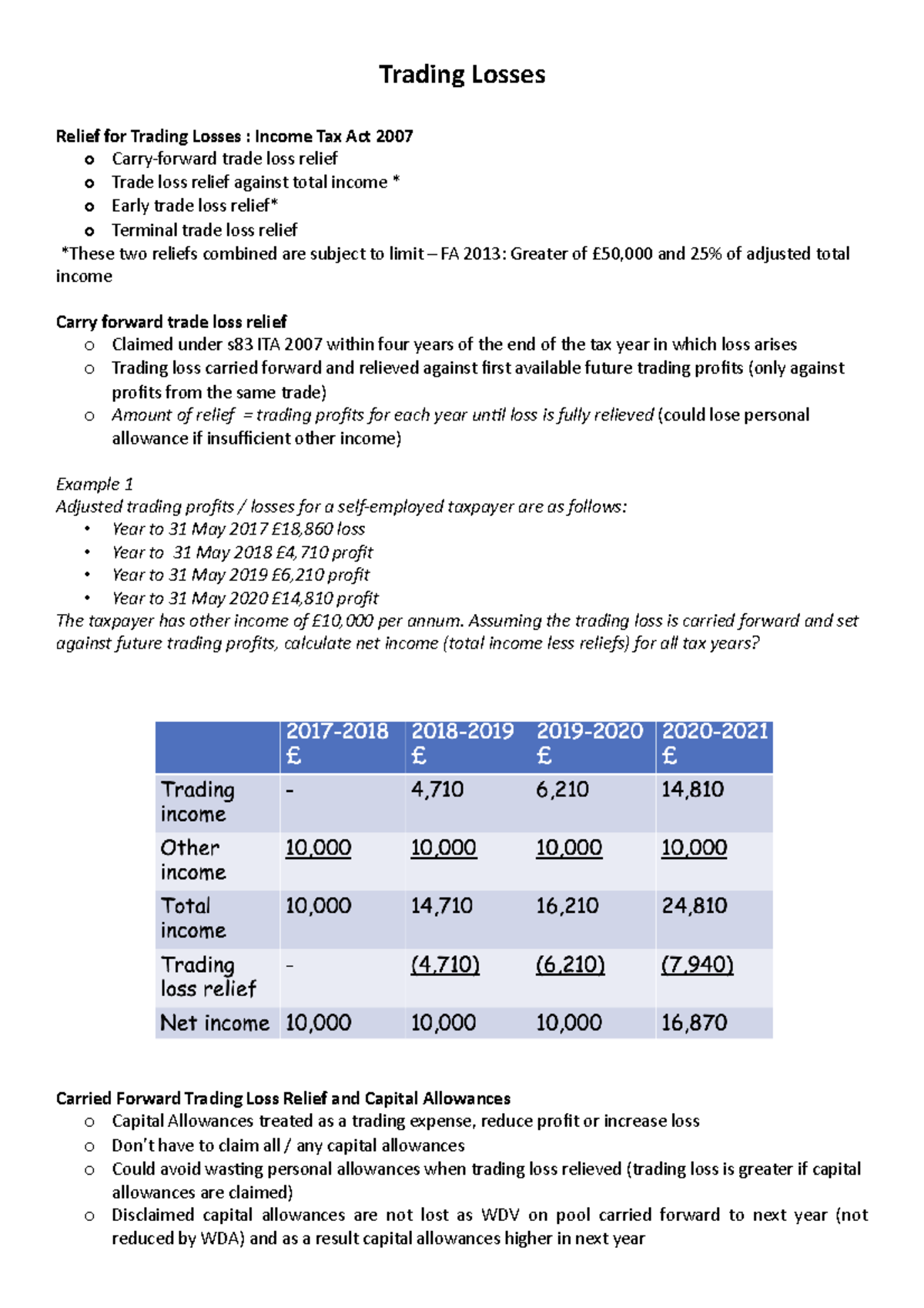

Image: www.studocu.com

Frequently Asked Questions

Q: What is an unrealized forex loss?

A: An unrealized forex loss occurs when the value of a currency you hold decreases relative to another currency.

Q: Are unrealized forex losses tax-deductible?

A: Generally, unrealized forex losses are not tax-deductible. However, there are some exceptions to this rule.

Q: How can I manage my unrealized forex losses?

A: You can hedge your forex exposure, invoice in your own currency, and monitor your forex exposure regularly.

Unrealised Forex Loss Treatment On Income Tax

Conclusion

Understanding the tax treatment of unrealized forex losses is essential for businesses operating in the global marketplace. By carefully managing your forex exposure and following the tips outlined above, you can mitigate the impact of forex losses on your taxes while continuing to expand your business internationally.

Are you interested in learning more about the tax implications of foreign exchange transactions? Let me know in the comments below and I’ll be happy to answer your questions and provide additional insights.