The allure of gold has captivated civilizations for millennia. Its enduring value and safe-haven status have made it a sought-after asset, particularly during times of economic uncertainty. But how can you tap into the potential of gold trading? The answer lies in choosing the right platform.

Image: www.forex.academy

Navigating the world of gold trading platforms can feel daunting at first. With a myriad of options available, selecting the platform that aligns with your needs and goals can be a challenge. This guide will equip you with the knowledge and understanding to make informed decisions, unlocking the golden opportunity presented by the global gold market.

Understanding the Landscape: Exploring Gold Trading Platforms

Gold trading platforms provide a virtual space for buying, selling, and investing in gold. These platforms act as intermediaries, connecting you to the global gold market and facilitating your transactions.

There are numerous types of gold trading platforms, each catering to different investment styles and risk tolerances. Let’s delve deeper into the key categories:

1. Spot Gold Trading Platforms

Spot gold trading platforms allow you to purchase physical gold at its current market price. Transactions are executed immediately, providing a quick and efficient way to access the gold market. These platforms are popular among traders seeking to capitalize on short-term price fluctuations.

Some well-known spot gold trading platforms include:

- TD Ameritrade: A reputable online brokerage offering access to a wide range of gold trading instruments.

- E*TRADE: Another popular online brokerage with user-friendly trading platforms and competitive commissions.

- Interactive Brokers: Known for its advanced trading tools and deep liquidity, catering to professional and institutional traders.

2. Futures Gold Trading Platforms

Futures gold trading platforms involve entering into contracts to buy or sell gold at a predetermined price and date in the future. This approach provides flexibility and potential for higher returns, but it also entails higher risks. Futures contracts are frequently used by larger institutions and experienced traders seeking to hedge against price volatility.

Examples of futures gold trading platforms:

- CME Group: The world’s leading futures exchange, offering a wide range of gold futures contracts.

- ICE Futures Europe: A prominent futures exchange based in London, providing access to gold futures contracts in various currencies.

Image: insidebitcoins.com

3. Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are investment funds traded on stock exchanges. Gold ETFs are designed to track the price of gold, providing a convenient and cost-effective way to diversify portfolios.

Popular gold ETFs include:

- SPDR Gold Shares (GLD): One of the largest and most widely traded gold ETFs, tracking the price of gold bullion.

- iShares Gold Trust (IAU): Another reputable gold ETF, providing exposure to the gold market with low expenses.

4. Gold Mining Stocks

Instead of directly investing in gold, some platforms allow trading shares of gold mining companies. This approach offers potential growth opportunities as gold prices rise, but it carries inherent risks associated with the mining industry and overall market performance.

Examples of platforms offering gold mining stocks:

- Robinhood: A commission-free online brokerage offering access to a wide range of stocks, including gold miners.

- Webull: Another commission-free platform with a user-friendly interface and advanced charting tools.

5. Online Physical Gold Dealers

For those seeking to own physical gold, online dealers provide a convenient way to purchase gold bars and coins. These platforms often specialize in sourcing high-quality gold from reputable refiners and offer secure storage options.

Notable online physical gold dealers include:

- APMEX: A leading dealer offering a wide selection of gold bullion and coins.

- JM Bullion: Another reputable dealer with competitive pricing and secure shipping.

Navigating the Gold Trading Landscape

Now that we’ve explored the different types of gold trading platforms, let’s discuss several key considerations to guide your decision:

1. Fees and Commissions

Fees and commissions play a significant role in your overall trading costs. Compare platforms for their trading fees, inactivity fees, and other charges to ensure they align with your budget and trading frequency.

2. Trading Platform Interface

The platform’s interface should be intuitive and user-friendly. Consider factors such as chart type options, order execution speeds, and available research tools to choose a platform that suits your trading style.

3. Security Measures

Security is paramount when trading gold or any financial asset. Look for platforms with robust security measures, including encryption, two-factor authentication, and regulatory compliance.

4. Customer Support

Reliable customer support is vital, especially when encountering issues with your trading account or facing complex transactions. Check the platform’s availability and response times to ensure you have access to assistance when you need it.

5. Regulatory Oversight

Choose platforms regulated by reputable financial authorities. Regulatory oversight provides added security and ensures adherence to financial industry standards.

Expert Tips for Gold Trading

While selecting the right platform is crucial, success in gold trading also depends on your knowledge, discipline, and strategy.

1. Diversification

Don’t put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk and potentially enhance returns.

2. Fundamental Analysis

Gain an understanding of the factors influencing gold prices, such as global economic conditions, inflation, and geopolitical events. This knowledge can help you make informed trading decisions.

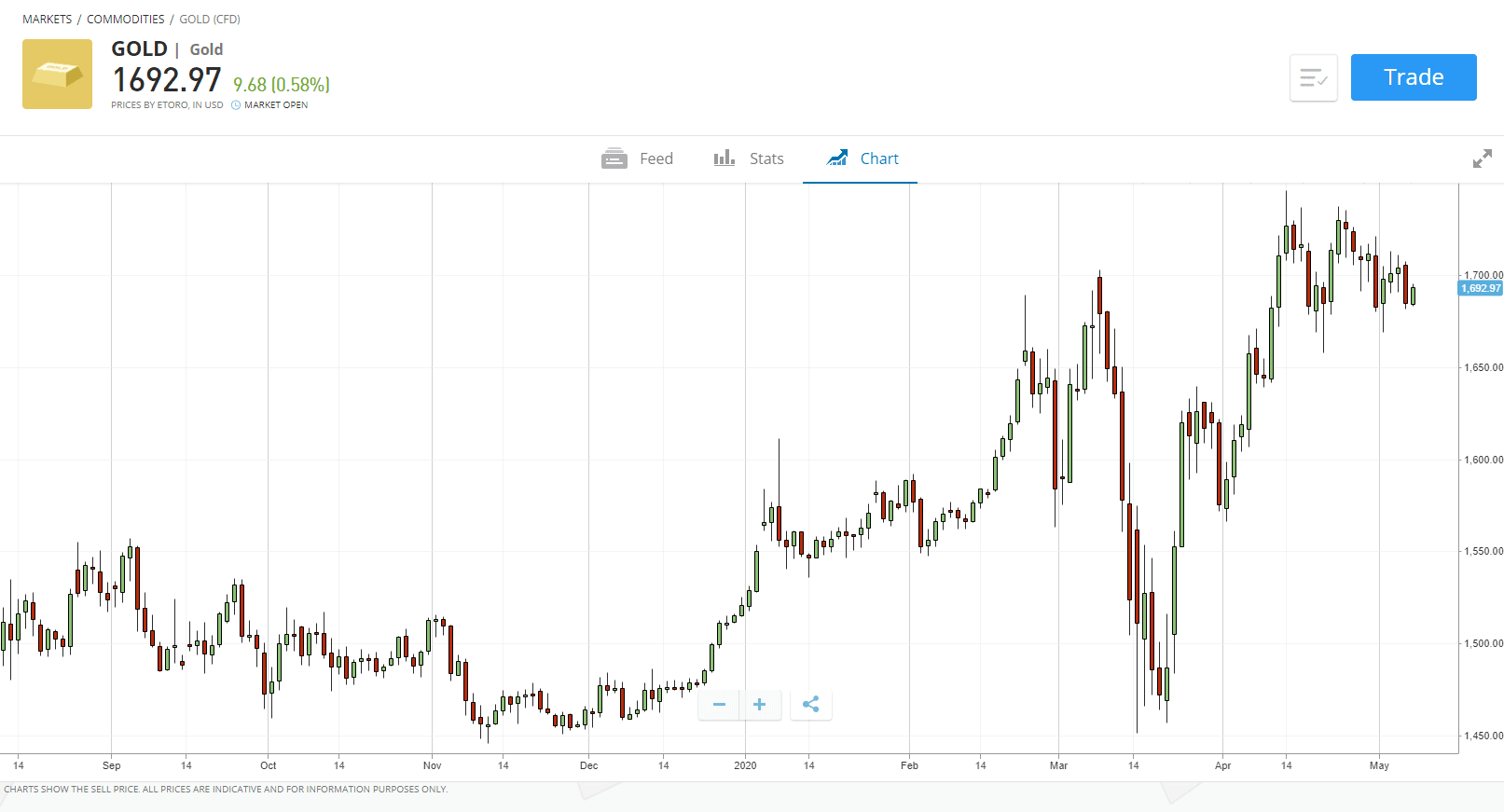

3. Technical Analysis

Utilize technical indicators and charts to identify potential price patterns and trends. Technical analysis can help you anticipate market movements and make timely trades.

4. Patience and Discipline

The gold market can be volatile. Avoid impulsive trades and stick to your trading plan and risk management strategies.

5. Continuous Learning

The gold market is constantly evolving. Stay updated on market news, economic data, and new trading technologies to gain an edge.

FAQ About Gold Trading Platforms

What are the benefits of trading gold?

Gold offers several benefits as an investment asset, including:

- Safe-haven asset: Gold tends to hold its value or even increase in value during times of economic uncertainty or market volatility.

- Inflation hedge: As inflation rises, the purchasing power of fiat currencies declines, while the value of gold tends to go up.

- Diversification: Gold can serve as a diversifier in a portfolio, reducing overall risk and potentially enhancing returns.

What are the risks of trading gold?

Gold trading also comes with risks:

- Price volatility: Gold prices can fluctuate significantly, leading to potential losses.

- Storage costs: Storing physical gold can involve costs, such as insurance and security.

- Counterparty risk: When trading through a platform, there is a risk that the platform may not be able to fulfill its obligations.

What are the best gold trading platforms?

The best gold trading platform for you depends on your individual needs and preferences. Consider factors such as fees, security, trading interface, and customer support.

How do I choose the right gold trading platform?

Follow the guidelines and tips discussed in this guide to make an informed decision based on your specific trading objectives, risk tolerance, and financial resources.

Gold Trading Platforms

Conclusion

The world of gold trading offers both opportunity and challenge. Choosing the right platform is essential to unlock the potential of this valuable asset. By understanding the different types of platforms, considering key factors like fees and security, and following expert tips for trading, you can navigate the gold market with confidence.

Are you interested in exploring gold trading opportunities? Share your thoughts and questions in the comments below!