In the dynamic world of forex trading, there are two primary strategies: going long and going short. While going long involves buying a currency with the expectation of its appreciation, going short, or short-selling, entails selling a currency with the anticipation of its depreciation. This article delves into the intricacies of shorting in forex, providing a comprehensive guide to selling currencies for profit.

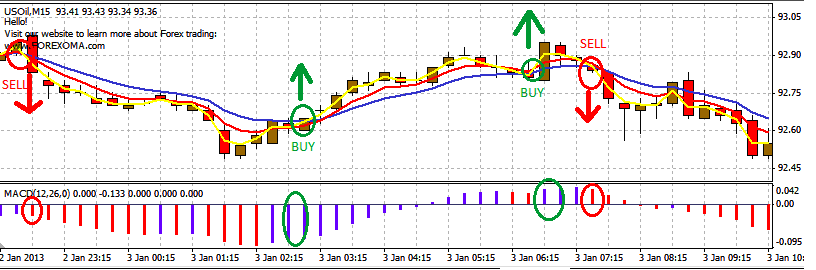

Image: forex-strategies-revealed.com

Understanding Shorting in Forex

Shorting in forex involves borrowing a certain amount of a currency pair from a broker and immediately selling it on the market. The trader expects the value of the currency to decrease in the future, allowing them to buy it back at a lower price and return it to the broker. The difference between the selling price and the buying price, minus any associated costs or fees, constitutes the trader’s profit.

For instance, if a trader believes that the Eurozone economy is weakening and the Euro is likely to depreciate against the US Dollar, they can initiate a short position. They borrow 100,000 Euros from their broker and sell them for US Dollars, receiving $110,000. If their prediction is correct and the Euro falls to €0.95 against the Dollar, they can buy back the 100,000 Euros for $95,000, returning them to the broker. The profit in this transaction would be $15,000, excluding any fees.

Benefits of Shorting in Forex

Shorting in forex offers several potential benefits:

- Profiting from falling currency values: Shorting allows traders to profit from currencies that are expected to depreciate.

- Hedging against risk: Traders can short currencies that are negatively correlated to their other investments, reducing overall portfolio risk.

- Leverage: Brokers often offer leverage in forex trading, allowing traders to control larger positions with relatively smaller capital.

Risks of Shorting in Forex

While shorting in forex can be lucrative, it also involves significant risks:

- Unlimited loss potential: Unlike going long, where losses are capped at the amount invested, shorting in forex poses the risk of unlimited losses. If the currency’s value increases instead of decreasing, the trader will continue to incur losses.

- Margin calls: Brokers may issue margin calls if the trader’s account balance falls below a certain level, requiring them to deposit additional funds or close their position.

- Overnight funding charges: Holding a short position overnight incurs financing costs, known as overnight funding charges or swaps.

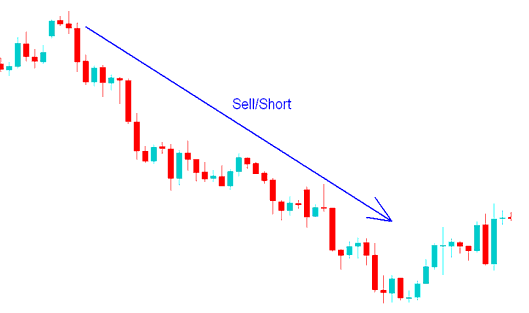

Image: www.tradeforextrading.com

Expert Tips for Successful Shorting

Experienced forex traders offer the following tips for successful shorting:

- Thorough research: Before shorting any currency, conduct thorough research to understand the economic and political factors affecting its value.

- Use technical analysis: Utilize technical analysis tools such as charts and indicators to identify potential shorting opportunities.

- Manage risk: Employ risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Patience: Shorting is a patience game. Allow sufficient time for the trade to play out, avoiding premature exits.

Frequently Asked Questions about Shorting in Forex

Answers to some common questions regarding shorting in forex:

- Q: How do I know when to short a currency?

A: Look for currencies that have been experiencing weakness in economic indicators and technical analysis suggests a downward trend. - Q: What is a margin call in shorting?

A: A margin call occurs when your account balance dips below a certain level, requiring you to add funds or close your position. - Q: Can I short any currency pair?

A: Most forex brokers offer a wide range of currency pairs for shorting, but liquidity and availability may vary.

What Is Short In Forex

https://youtube.com/watch?v=9avR3OJ-b9Q

Conclusion

Shorting in forex offers the potential for profit by selling currencies anticipated to depreciate. While it can be a lucrative strategy, it also involves substantial risks. Thorough research, expert advice, and diligent risk management are essential for successful shorting in forex. If you are considering shorting currencies, ensure you fully comprehend the risks and implement appropriate strategies to mitigate losses.

Are you interested in learning more about shorting in forex? Join our community of traders and immerse yourself in the world of currency trading. With our wealth of resources and expert guidance, you’ll gain the knowledge and tools to navigate the complexities of shorting in forex effectively.