Introduction: Embark on a Journey of Currency Conquest

In the realm of forex trading, where the world’s currencies dance in a perpetual waltz, understanding the nuances of market positions is crucial for aspiring traders. Among the fundamental concepts lies the enigmatic term “going long,” a strategy that holds the potential to unlock lucrative gains. In this comprehensive guide, we will delve into the depths of “going long” in forex, unraveling its intricacies and empowering you with the knowledge to navigate the currency markets with confidence.

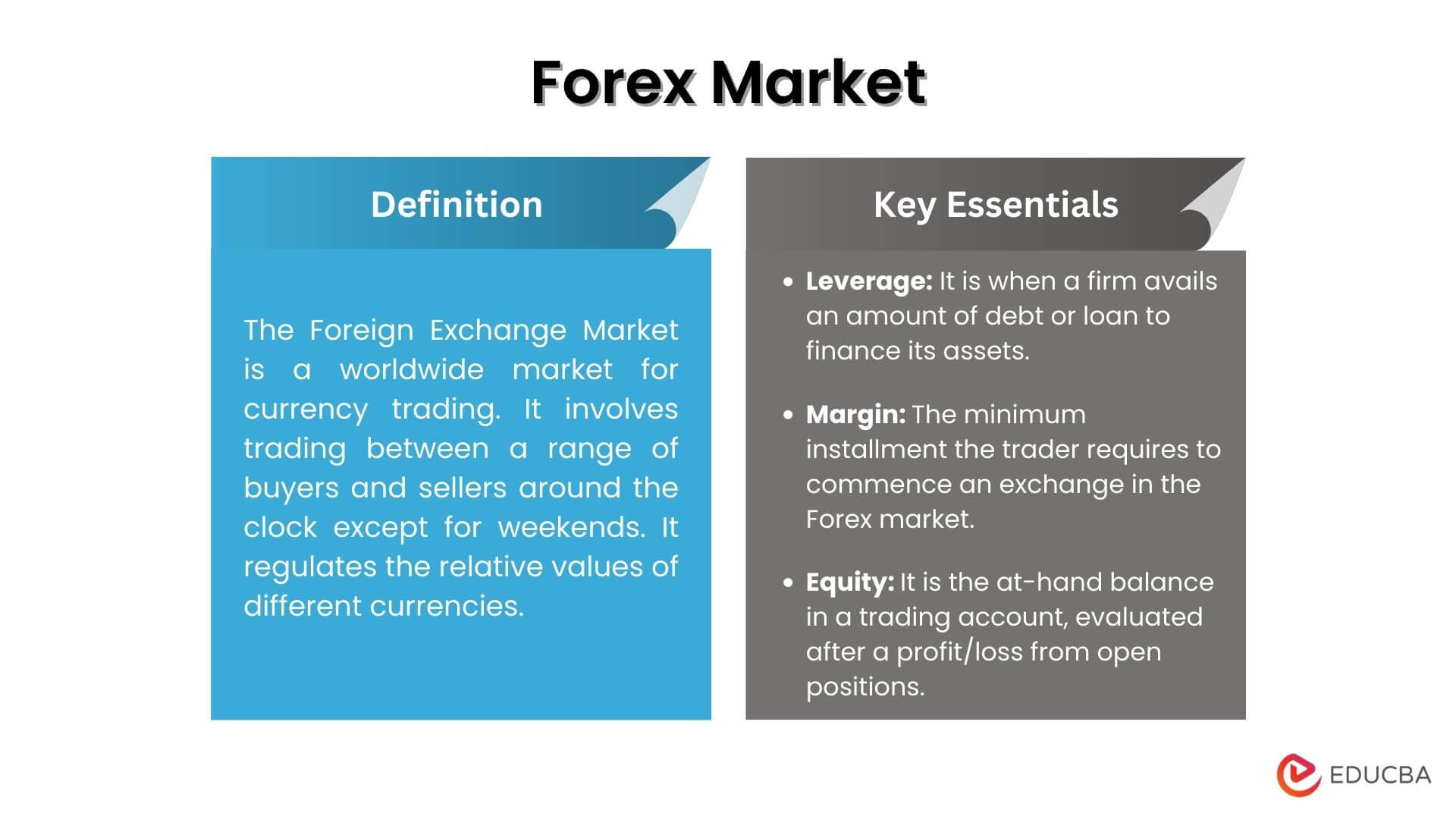

Image: www.educba.com

Deciphering “Going Long”: A Currency Odyssey

At its core, “going long” in forex entails entering into a transaction where a trader purchases a specific currency pair, anticipating an increase in its value. It is essentially a bet that the value of the base currency (the first currency listed in the pair) will rise against the value of the quote currency (the second currency). For instance, if you “go long” on EUR/USD, you are speculating that the euro will strengthen relative to the US dollar, potentially yielding a profit.

Understanding the Mechanics: A Tale of Two Positions

In the chessboard of forex trading, “going long” stands as the antithesis of “going short.” While “going short” involves selling a currency pair in anticipation of a decrease in its value, “going long” represents the unwavering belief in a currency pair’s upward trajectory. This duality of positions allows traders to harness market dynamics, profiting from both rising and falling currency values.

The Anatomy of a Long Position: A Blueprint for Success

Constructing a long position in forex involves selecting a currency pair, determining the desired amount to trade, and specifying the entry and exit points. The entry point represents the price at which you purchase the currency pair, while the exit point marks the price at which you plan to realize your gains (or potentially mitigate losses). Managing these parameters with precision is the cornerstone of successful forex trading.

Image: dongnaiart.edu.vn

Leveraging Long Positions: A Path to Profitability

Mastering the art of “going long” in forex can lead to substantial profits. By correctly predicting the direction of currency movements, traders can accumulate significant gains as their chosen currency pair ascends in value. The key lies in astute market analysis, risk management, and the ability to capitalize on favorable market conditions.

Managing the Risks: A Balancing Act

Like any form of financial trading, “going long” in forex carries inherent risks that aspiring traders must acknowledge and mitigate. Market volatility, unpredictable economic events, and geopolitical uncertainties can all impact currency values, potentially leading to losses. Effective risk management techniques, such as stop-loss orders and position sizing, are indispensable for safeguarding your capital and preserving your trading journey.

What Is The Meaning Of Going Long In Forex

Conclusion: A Gateway to Forex Mastery

Navigating the forex markets can be a daunting undertaking for aspiring traders, but comprehending the intricacies of “going long” is an essential step on the path to mastery. By embracing the knowledge and strategies outlined in this guide, you can unlock the potential of this dynamic financial arena, turning currency movements into opportunities for growth and prosperity. Remember, the mastery of forex trading is an ongoing pursuit, requiring continuous learning, adaptability, and a unwavering commitment to excellence.