In the fast-paced world of finance, the foreign exchange (forex) market offers a lucrative opportunity for traders to generate substantial profits. Forex trading, involving the exchange of currencies, presents a unique blend of risk and reward. For those seeking to maximize their returns, understanding forex trading profit per day is crucial. This comprehensive guide will delve into the intricacies of forex profit generation, guiding you towards a more profitable trading journey.

Image: www.forex.academy

The Concept of Forex Trading Profit

Forex trading profit refers to the financial gain realized when buying and selling currencies within the foreign exchange market. This profit is calculated as the difference between the buying and selling prices of a currency pair, adjusted for any commission or spread fees incurred during the trade. Effective forex trading strategies aim to exploit price fluctuations in currency pairs to generate profitable opportunities.

Factors Influencing Forex Trading Profit

A multitude of factors influence the profitability of forex trading. These include:

- Market Volatility: Higher market volatility typically presents more trading opportunities, allowing traders to capitalize on larger price movements.

- Currency Pair Selection: Different currency pairs exhibit varying levels of volatility and liquidity, impacting profit potential.

- Trading Strategy: The chosen trading strategy significantly affects profit generation. Scalping, day trading, and swing trading each have distinct profit objectives and risk profiles.

- Account Leverage: Leverage, by amplifying gains and losses, can enhance profit potential but also increase risk.

- Risk Management: Robust risk management practices, such as using stop-loss orders, limit potential losses and preserve capital.

Strategies for Maximizing Forex Trading Profit

Harnessing the potential of forex trading profit requires a structured approach to trading. Here are some effective strategies:

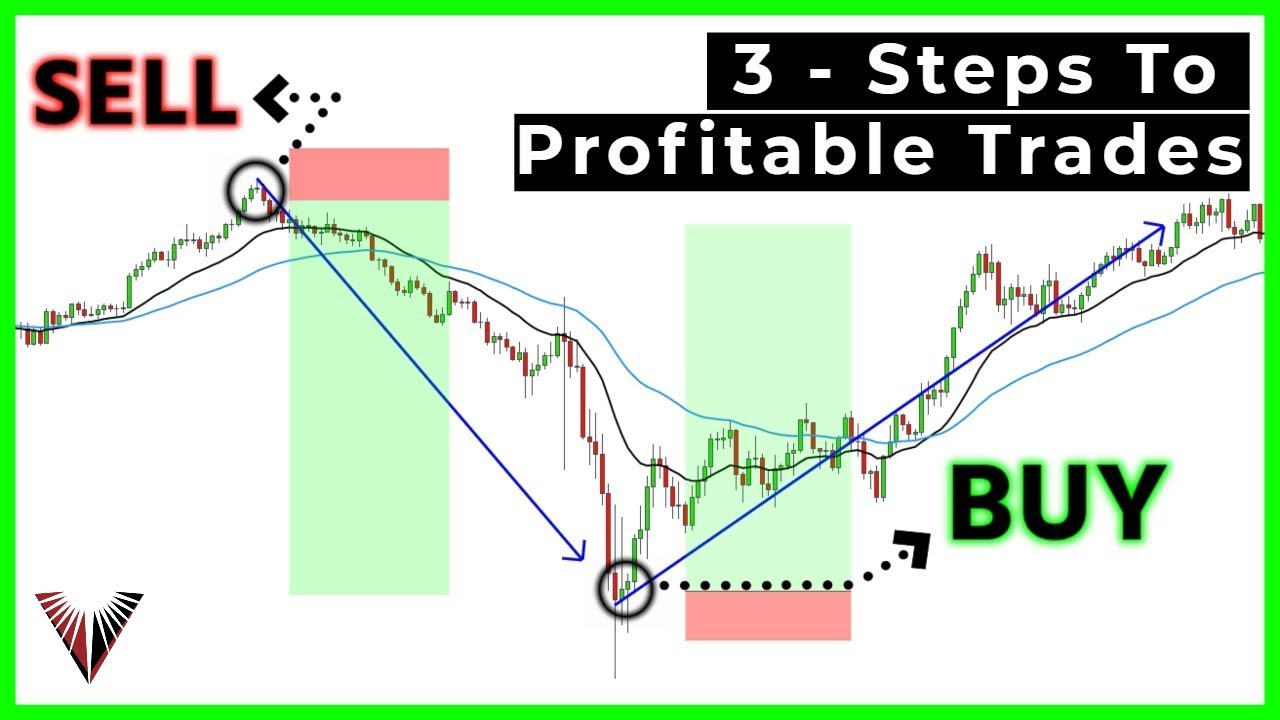

- Trend Trading: Identifying and trading in the direction of a prevailing trend can yield significant profits over time.

- Technical Analysis: Using technical indicators and price action analysis to identify trading opportunities can improve profit potential.

- Fundamental Analysis: Monitoring economic news and geopolitical events that influence currency markets provides insights for profitable trades.

- Copy Trading: Following the trades of experienced traders can provide a starting point for novice traders.

- Automated Trading: Employing trading bots or expert advisors allows for around-the-clock trading, potentially maximizing profits.

Image: www.youtube.com

Calculating Forex Trading Profit

Determining forex trading profit involves understanding the principles of profit calculation. The formula for profit calculation is:

Profit = (Selling Price – Buying Price) x Number of Units (Lots) – Commissions and Fees

The difference between the selling and buying prices constitutes the gross profit. Deducting commissions and fees incurred during the trade yields the net profit.

Tips for Consistent Profitability

Achieving consistent profitability in forex trading requires dedication and discipline. Consider these tips:

- Develop a Trading Plan: Outline a comprehensive trading plan, including trading strategies, risk management rules, and profit targets.

- Practice and Discipline: Consistent practice in a demo account or micro-trading helps refine trading skills and maintain discipline.

- Manage Emotions: Control emotions and avoid impulsive trading decisions that could lead to substantial losses.

- Seek Continuous Education: Forex trading is an evolving field. Continuously seek education to enhance trading skills and knowledge.

- Choose a Reputable Broker: Partner with a regulated and reputable broker to ensure transparency, security, and fair trading conditions.

Forex Trading Profit Per Day

Conclusion

Navigating the forex market to generate consistent profits requires a multifaceted approach. Understanding the factors influencing profit, adopting effective trading strategies, and implementing sound risk management principles is paramount. By embracing a disciplined and knowledgeable approach, traders can equip themselves to maximize their profit potential and achieve financial success in the dynamic world of forex trading. Remember, the journey to profitability demands patience, perseverance, and a commitment to continuous learning.