Introduction

Navigating the ever-fluctuating Forex market requires a keen understanding of risk and reward. Using a risk-reward ratio Forex calculator can empower traders to make informed decisions, optimize their strategies, and mitigate potential losses. In this comprehensive guide, we will delve into the intricacies of this essential tool, exploring its benefits, usage, and its impact on trading profitability.

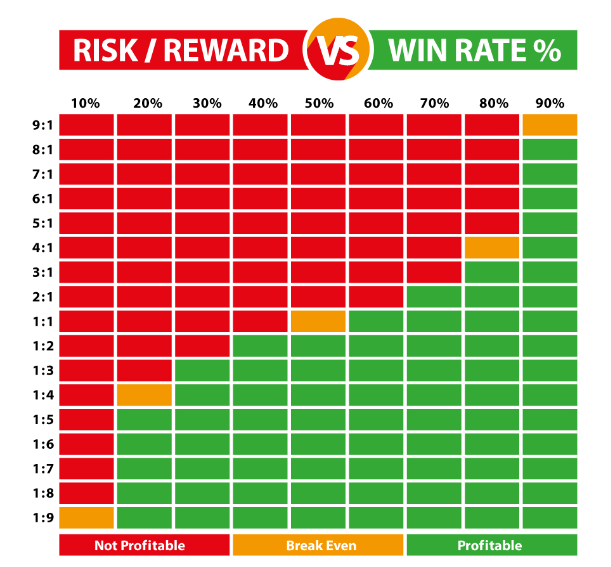

Image: medium.com

Understanding the Risk-Reward Ratio Forex Calculator

A risk-reward ratio Forex calculator is a powerful tool that allows traders to determine the potential profit or loss associated with a specific trade. By plugging in the trade’s entry and exit prices, stop-loss level, and target profit level, the calculator calculates the risk-to-reward ratio—a crucial metric that indicates the balance between potential gain and potential loss.

Significance of the Risk-Reward Ratio in Forex Trading

The risk-reward ratio is a fundamental concept in Forex trading. It serves as a yardstick for traders, enabling them to assess the suitability of a potential trade. By quantifying the risk-to-reward potential, traders can prioritize trades with higher profit expectations and minimize the impact of losses on their trading accounts. It promotes disciplined trading and prevents traders from venturing into trades with unfavorable risk-reward profiles.

Calculating Risk-Reward Ratio for Forex Trades

Calculating the risk-reward ratio for Forex trades is straightforward. The formula is:

Risk-Reward Ratio = (Target Profit) / (Stop Loss

To exemplify, suppose a trader enters a long EUR/USD trade at 1.1000, sets a stop-loss at 1.0950, and targets a profit of 1.1050. The risk-reward ratio would be:

Risk-Reward Ratio = (1.1050 – 1.1000) / (1.1000 – 1.0950)

= 0.50 / 0.0050

= 10:1

This ratio indicates that for every $1 risked, the trader has the potential to earn $10.

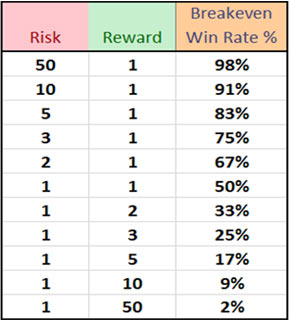

Image: darrenpabeye0191721.blogspot.com

Benefits of Using a Risk-Reward Ratio Forex Calculator

Leveraging a risk-reward ratio Forex calculator offers numerous benefits to traders:

-

Enhances Risk Management: By quantifying risk and reward, the calculator empowers traders to manage their risk appetite. It helps them determine the optimal trade size based on their account balance and risk tolerance.

-

Facilitates Informed Decision-Making: The calculator provides a clear and objective assessment of the risk-reward profile of a trade. It eliminates guesswork and supports data-driven decision-making, leading to more calculated trades.

-

Optimizes Trading Strategies: By analyzing risk-reward ratios, traders can refine their trading strategies. It enables them to identify trades with favorable risk-reward profiles and adjust their entry, stop-loss, and profit levels accordingly.

Factors Influencing Risk-Reward Ratios in Forex Trading

Several factors can impact risk-reward ratios in Forex trading:

-

Market Volatility: Highly volatile markets tend to produce higher risk-reward opportunities, but also carry greater risk. Traders should adjust their risk-reward ratios accordingly.

-

Trade Timeframe: Shorter-term trades typically offer lower risk-reward ratios, while longer-term trades may yield higher ratios.

-

Trading Instrument: Different currency pairs and Forex instruments have varying levels of volatility and risk-reward potential.

Risk Reward Ratio Forex Calculator

https://youtube.com/watch?v=abQEjbuCm4M

Conclusion

The risk-reward ratio Forex calculator is an indispensable tool for traders seeking to optimize their trading strategies. By quantifying the potential gain and loss associated with a trade, it empowers traders to make informed decisions, manage risk effectively, and maximize profit potential. By understanding the principles of risk-reward ratios and leveraging the calculator’s versatility, traders can gain a competitive edge in the dynamic and ever-evolving Forex market.