In forex trading, the risk-reward ratio is a crucial concept that determines the potential gain or loss in relation to the amount of risk taken on a trade. It is expressed using a colon :. For example, a risk-reward ratio of 1:2 indicates that for every unit of risk, a trader can potentially earn two units of profit. Here’s a comprehensive guide to risk-reward ratios in forex factory:

Image: myforexhelp.com

Understanding Risk-Reward Ratios

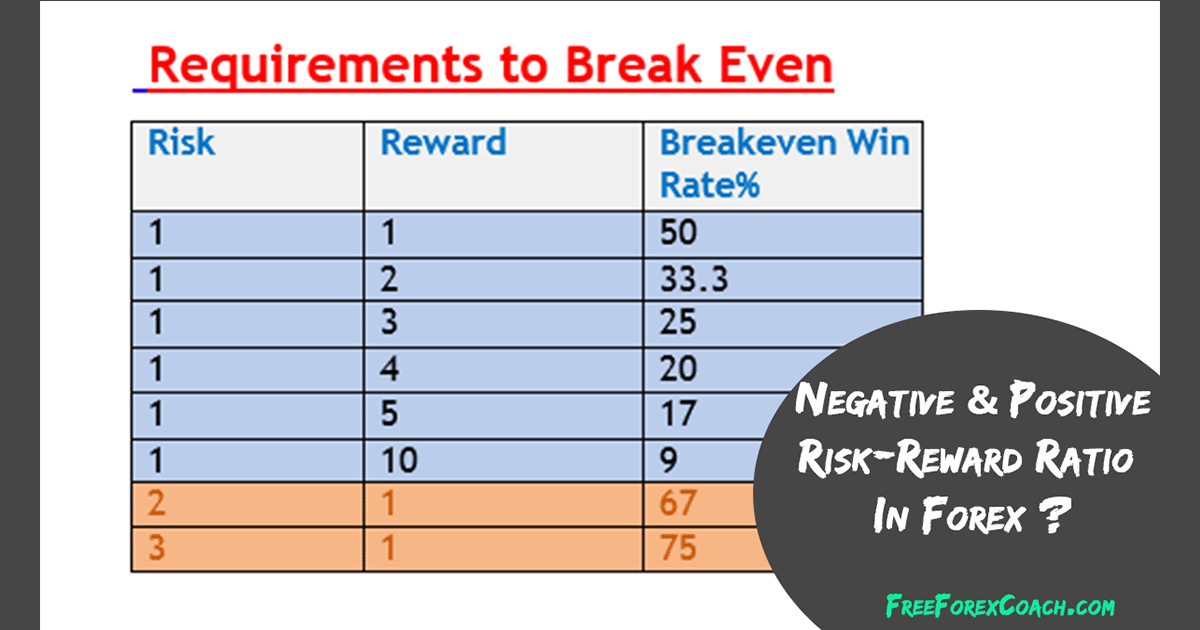

To calculate the risk-reward ratio, traders should first define the risk and reward levels associated with a trade. Risk is typically determined as the potential loss, while reward represents the potential profit. By dividing the reward by the risk, traders can establish the risk-reward ratio. A higher risk-reward ratio is generally considered more favorable, as it indicates a greater potential return for the risk being undertaken.

Factors Affecting Risk-Reward Ratios

Numerous factors can influence the risk-reward ratio, including:

- Trade setup: Different trading strategies and setups have varying risk-reward profiles.

- Market conditions: Market volatility and liquidity can impact the potential risk and reward of a trade.

- Trader’s risk tolerance: Traders should consider their personal risk appetite when setting risk-reward ratios.

- Position size: The size of a trade relative to a trader’s account balance can affect the risk-reward ratio.

Tips for Optimizing Risk-Reward Ratios

To enhance your trading performance, consider implementing the following tips:

- Trade with a plan: Develop clear entry and exit strategies before entering a trade, ensuring the risk-reward ratio aligns with your overall trading plan.

- Manage your risk: Use risk management tools such as stop-loss orders to limit potential losses and protect your capital.

- Set realistic expectations: Avoid chasing unrealistic returns. Aim for a balanced risk-reward ratio that aligns with your risk tolerance and trading goals.

- Review and adjust: Continuously monitor your risk-reward ratios and adjust them based on changing market conditions or as your trading skills and experience evolve.

Image: trademasterypro.com

FAQs on Risk-Reward Ratios

Q: What is an optimal risk-reward ratio?

A: There is no universally accepted optimal risk-reward ratio. It depends on individual circumstances, risk tolerance, and trading style.

Q: How can I improve my risk-reward ratios?

A: Implement risk management strategies, conduct thorough market analysis, and focus on setting realistic trading goals.

Q: What is the relationship between risk-reward ratios and position size?

A: Position size and risk-reward ratios are inversely related. A larger risking reward ratio allows for a smaller position size, while a smaller risk-losing reward ratios necessitates a larger position size.

Q: Is it possible to trade with no risk?

A: While risk cannot be completely eliminated in forex trading, it can be managed through proper risk management techniques.

What Is Your Risk Reward Ratio Forex Factory

Conclusion

In the dynamic world of forex trading, understanding and optimizing risk-reward ratios is paramount. By implementing the principles outlined above, traders can improve their risk management, enhance their trading performance, and increase their chances of achieving success in the forex market.

Are you ready to delve deeper into the fascinating realm of risk-reward ratios in forex trading? What are your thoughts and experiences with this concept? Share your insights and engage in the discussion below.