In the dynamic realm of global finance, foreign exchange markets play a pivotal role. A vast network where currencies are bought, sold, and traded, Forex is a complex and fascinating world. For seasoned traders and currency enthusiasts alike, a thorough understanding of the major currency pairs is essential for navigating this intricate arena successfully. Join us as we delve into the details of 28 key Forex pairs, unlocking the secrets of their significance and market dominance.

Image: pakshinaviol.blogspot.com

**Unlocking the Currency Landscape**

Forex pairs are the foundational elements of the foreign exchange market, each representing the exchange rate between two currencies. They are denoted by a three-letter abbreviation, with the first letter indicating the base currency and the second, the quote currency. These pairs offer traders opportunities to speculate on currency value fluctuations, driven by a multitude of factors such as economic performance, geopolitical events, and interest rate differentials.

Image: forexeabest2.blogspot.com

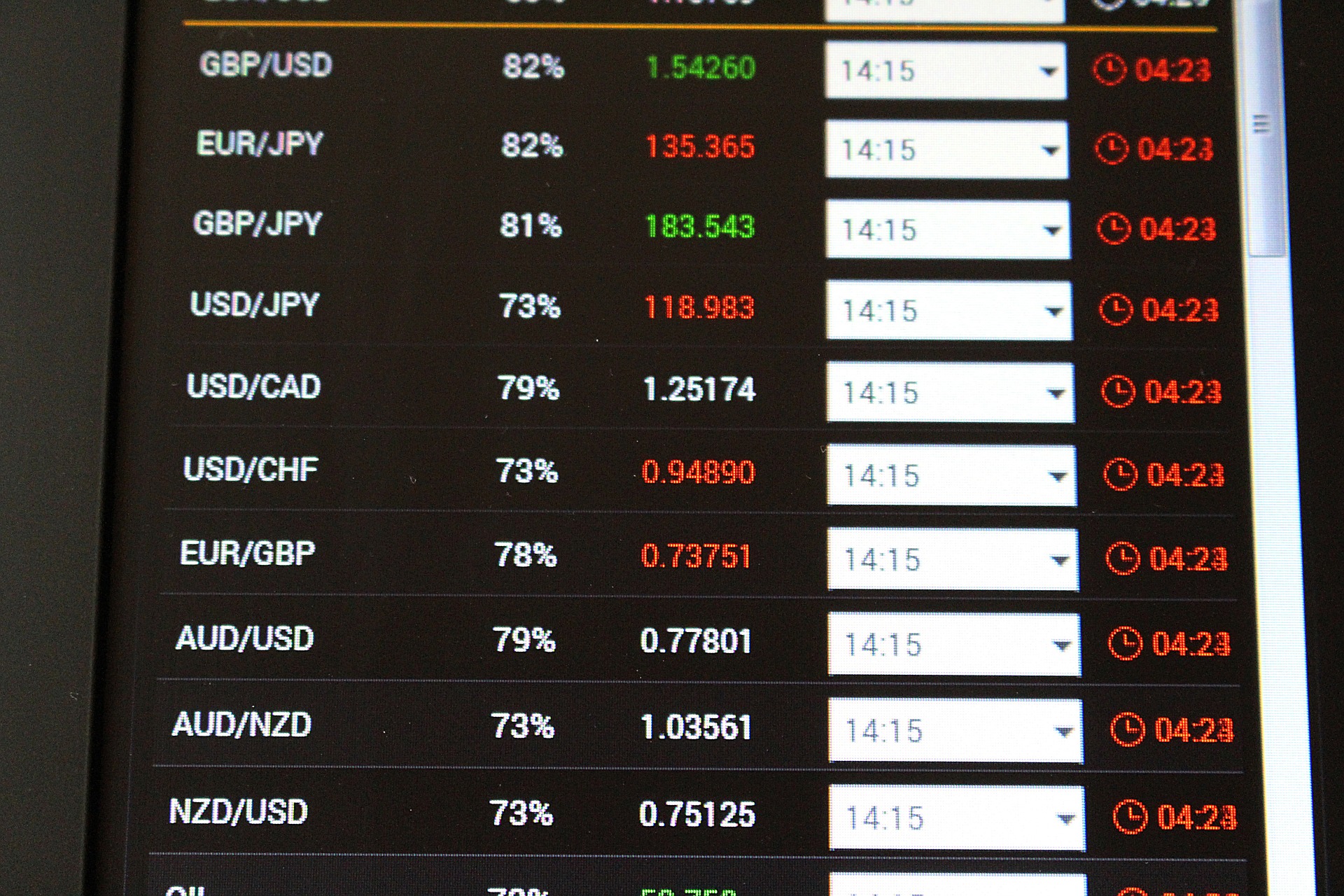

28 Major Forex Pairs List

Delving into the Forex Arena

The Forex market’s popularity can be attributed to its unmatched size and liquidity, with trading volumes far exceeding those of stock exchanges. This liquidity ensures that even large orders can be filled with minimal slippage, providing traders with increased confidence and execution efficiency. Additionally, the Forex market operates 24 hours a day, five days a week, catering to traders across various time zones, enhancing accessibility and global reach.

**Identifying the Major Currency Pairs**

Amidst the vast array of Forex pairs, a select group stands out due to their dominance in market share and trading volume:

- EUR/USD: Euro versus US Dollar

- USD/JPY: US Dollar versus Japanese Yen

- GBP/USD: British Pound versus US Dollar

- USD/CHF: US Dollar versus Swiss Franc

- AUD/USD: Australian Dollar versus US Dollar

These major pairs account for over 80% of the total Forex market volume, making them a focal point for traders seeking stability and liquidity. Their movements are closely watched and analyzed by market participants, influencing currency valuations worldwide.

**Beyond the Big Five: Exploring the Wider Currency Universe**

Beyond the prominent major pairs, a multitude of other pairings contribute to the vibrant Forex landscape, reflecting the economic prowess and trade dynamics of various nations. Here are some notable examples:

- NZD/USD: New Zealand Dollar versus US Dollar

- USD/CAD: US Dollar versus Canadian Dollar

- EUR/CHF: Euro versus Swiss Franc

- EUR/GBP: Euro versus British Pound

- USD/NOK: US Dollar versus Norwegian Krone

These additional pairs, often referred to as “minor pairs,” offer traders opportunities to diversify their portfolios, speculate on emerging markets, and potentially capitalize on unique market dynamics.

**Navigating the Dynamic Forex Market**

Successful Forex trading requires a comprehensive understanding of market dynamics, currency valuations, and technical analysis techniques. To unravel the complexities of this market, traders rely on a diverse toolbox of indicators, including:

- Technical analysis patterns

- Moving averages

- Support and resistance levels

- Relative Strength Index (RSI)

- Stochastic Oscillator

By harnessing the insights gleaned from these tools, traders can enhance their decision-making process, identify potential trading opportunities, and manage risk more effectively.

**Tips for Triumph in the Forex Arena**

Embarking on a successful Forex trading journey requires discipline, strategy, and a commitment to continuous learning. Here are some expert tips to help you navigate the market with confidence:

- Educate yourself thoroughly on Forex fundamentals and trading strategies

- Start with small positions and gradually increase trade size as you gain experience

- Implement comprehensive risk management measures to minimize losses

- Stay informed about global economic news and geopolitical events that could impact currency valuations

- Utilize reputable and reliable trading platforms that offer advanced tools and support

By embracing these principles and honing your skills, you can equip yourself to conquer the complexities of the Forex market and potentially achieve your trading objectives.

**Frequently Asked Questions**

To resolve lingering queries, let’s delve into frequently asked questions regarding Forex currency pairs:

- Q: What factors influence currency pair valuations?

A: Economic growth, interest rates, inflation, political stability, and global events all play a role in shaping currency values. - Q: How do I choose the right currency pairs to trade?

A: Consider your risk tolerance, trading strategy, and market experience when selecting currency pairs. - Q: What is the importance of liquidity in Forex trading?

A: Liquidity ensures that orders can be filled quickly and efficiently, reducing slippage and enhancing trading execution.

**Embracing the Forex Frontier**

With its vast opportunities and potential rewards, the Forex market beckons traders from all corners of the globe. By delving into the world of currency pairs, you can unlock a gateway to global financial arenas, engage in captivating market speculation, and potentially harness the power of currency dynamics to achieve your trading aspirations.

We invite you to embark on this captivating journey, exploring the vibrant world of Forex and its ever-evolving landscape. Whether you are a seasoned veteran or a budding currency enthusiast, we encourage you to embrace the challenges and seize the opportunities that this dynamic market has to offer.

Are you ready to dive into the thrilling realm of Forex currency pairs? Let the trading adventure begin!