Introduction

Welcome to the realm of CFDs (Contracts for Difference), a captivating world where you can trade a myriad of financial assets while leveraging market movements to maximize your potential gains. CFDs offer an exhilarating and potentially lucrative trading experience, but it is imperative to equip yourself with the necessary knowledge before venturing into this dynamic field.

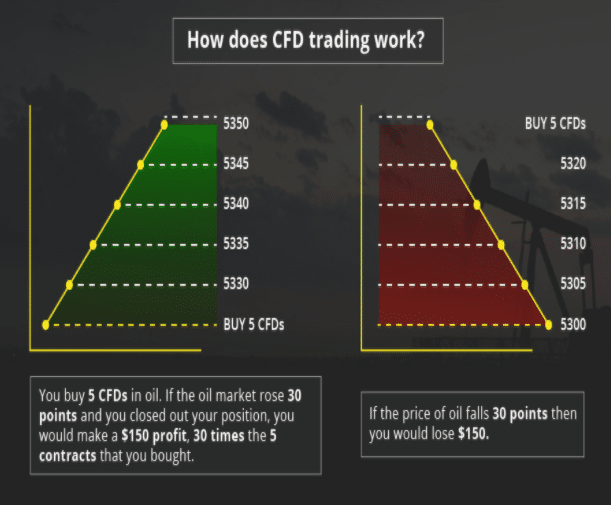

Image: jeangalea.com

In this comprehensive guide, we will delve into the fundamentals of CFD trading, guiding you through the intricate nuances of CFD accounts and empowering you with the know-how to navigate the markets with confidence. Whether you are a seasoned trader seeking to expand your horizons or a novice yearning to venture into the world of financial trading, this guide will provide you with an invaluable roadmap to success.

Understanding CFD Accounts

CFD accounts serve as gateways to the exhilarating world of CFD trading. These specialized accounts facilitate the exchange of CFD contracts, allowing traders to speculate on the future price movements of various underlying assets without actually owning them.

Unlike traditional trading, CFDs enable traders to benefit from both rising and falling prices, providing opportunities to capitalize on market fluctuations regardless of prevailing trends. This unique advantage, however, also carries inherent risks, making it crucial to understand the mechanics of CFD trading and manage risks effectively.

Benefits of Opening a CFD Account

Opting to open a CFD account unlocks a plethora of tantalizing benefits that can elevate your trading experience to new heights. Here are some of the key advantages that set CFD accounts apart:

- Leverage: CFDs offer generous leverage, enabling traders to amplify their trading positions and potentially increase their profits. Leverage magnifies both profits and losses, so it is crucial to employ it judiciously.

- Short Selling: Unlike traditional trading, CFD accounts empower traders to profit from falling prices by engaging in short selling. This versatility allows traders to capitalize on both bullish and bearish market conditions.

- Wide Range of Markets: CFDs encompass a vast array of underlying assets, including stocks, indices, currencies, and commodities. This diversity enables traders to diversify their portfolios and manage risk.

- Flexibility: CFDs provide remarkable flexibility, allowing traders to open and close positions swiftly. This agility enables traders to respond nimbly to changing market conditions and seize fleeting opportunities.

- Educational Resources: Reputable CFD brokers typically offer an abundance of educational materials, webinars, and tutorials to bolster traders’ knowledge and refine their trading strategies.

Choosing a CFD Broker

Selecting the right CFD broker is paramount to the success of your trading endeavors. Here are some key factors to consider when choosing a CFD broker:

- Regulation: Opt for brokers that are regulated by reputable financial authorities to ensure their adherence to ethical practices and industry standards.

- Fees and Spreads: Compare brokers’ fees and spreads to find the most competitive rates for your trading style and budget.

- Trading Platform: Evaluate the user-friendliness, features, and charting capabilities of the trading platform offered by different brokers. Choose a platform that aligns with your trading needs.

- Customer Support: Ensure that the broker provides responsive and helpful customer support to assist you with any queries or issues you may encounter.

- Research and Analysis Tools: Seek brokers that offer robust research and analysis tools to empower your trading decisions with valuable insights and market data.

Image: www.phillipcfd.com

Opening a CFD Account

Opening a CFD account is a relatively straightforward process. Here’s a step-by-step guide to get you started:

- Choose a Broker: Conduct thorough research and select a reputable CFD broker that meets your specific requirements.

- Visit the Broker’s Website: Navigate to the broker’s website and locate the section for opening an account.

- Fill Out the Application: Diligently complete the account opening application, providing personal and financial information as required.

- Verify Your Identity: Most brokers require traders to verify their identity by submitting government-issued identification documents.

- Deposit Funds: Choose your preferred funding method and transfer funds into your newly created CFD account.

Open Cfd Account

Trading CFDs Responsibly

CFD trading carries inherent risks, so it is crucial to approach this endeavor with prudent risk management strategies. Here are some tips to trade CFDs responsibly:

- Educate Yourself: Acquire a comprehensive understanding of CFD trading before venturing into live markets. Take advantage of the educational resources provided by your broker and supplement it with additional research.

- Start Small: As a beginner, start with small positions to limit potential losses. Gradually increase your position size as you gain experience and confidence.

- Manage Risk: Implement robust risk management strategies, such as stop-loss orders, to protect your capital against adverse market movements.

- Diversify Your Portfolio: Spread your investments across a