Prologue: Navigating the Labyrinthine World of Foreign Exchange

In the dynamic realm of global economics, foreign exchange (forex) reserves serve as a vital lifeline, bolstering nations’ financial resilience and underpinning international trade. These reserves, comprising currencies, gold, and other liquid assets, are the cornerstone of central bank strategies to stabilize their economies, weather financial storms, and exert influence in the global arena.

Image: howtotradeonforex.github.io

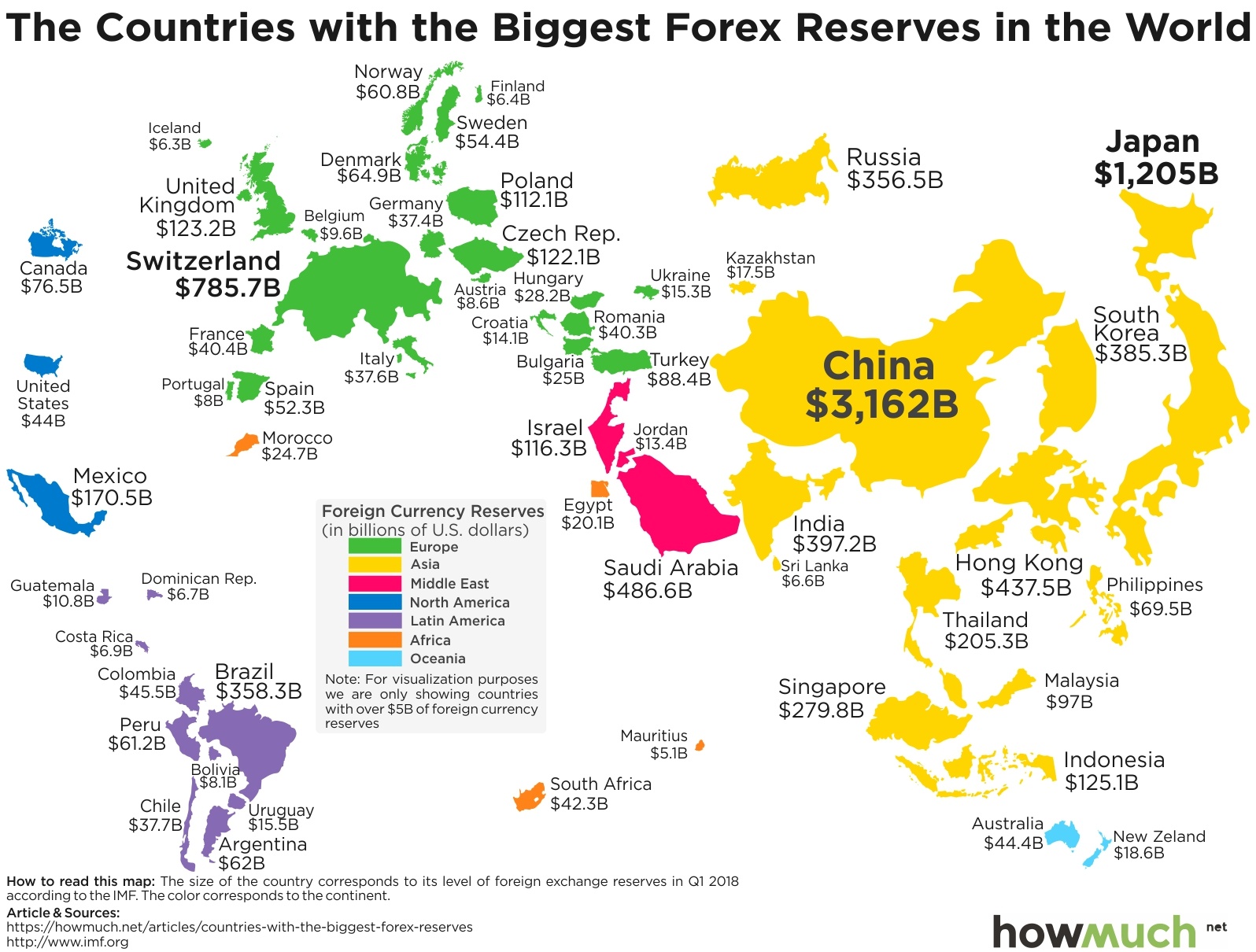

To gain a comprehensive understanding of the forex landscape, let us embark on a journey to uncover the countries that possess the mightiest forex war chests. This article will delve into the fascinating world of forex reserves, unraveling their importance and highlighting the strategies employed by the top 10 countries that hold the most significant reserves.

1. China: The Leviathan of Forex Reserves

Towering over all other nations, China reigns supreme with an astounding $3.34 trillion in forex reserves. This colossal reserve is a testament to China’s economic prowess, its export-oriented economy, and its prudent monetary management. China’s central bank, the People’s Bank of China (PBOC), has meticulously accumulated these reserves over decades, utilizing them to stabilize the Chinese yuan (CNY) and mitigate external economic shocks.

2. Japan: A Bastion of Stability and Economic Resilience

Japan, a bastion of financial stability, ranks second with forex reserves of $1.27 trillion. This impressive accumulation is a reflection of Japan’s long-term economic strength, its conservative fiscal policies, and its substantial trade surplus. The Bank of Japan (BOJ) astutely manages these reserves to maintain the stability of the Japanese yen (JPY) and bolster its financial system against global headwinds.

3. Switzerland: A Haven of Wealth and Neutrality

Nestled in the heart of Europe, Switzerland boasts $921 billion in forex reserves. This substantial war chest reinforces Switzerland’s reputation as a safe haven for investors and a sanctuary for wealth management. The Swiss National Bank (SNB) diligently manages these reserves to prevent excessive appreciation of the Swiss franc (CHF) and maintain the country’s monetary independence.

Image: www.investmentwatchblog.com

4. Saudi Arabia: An Oil-Backed Economic Powerhouse

Buoyed by its abundant oil resources, Saudi Arabia commands $485 billion in forex reserves. These reserves provide a substantial cushion for the kingdom’s economy, enabling it to weather fluctuations in global oil prices. The Saudi Arabian Monetary Authority (SAMA) prudently invests these reserves to generate additional revenue and diversify the country’s financial portfolio.

5. India: A Rising Economic Star with Ambitious Goals

India, a rising economic star, has accumulated $562 billion in forex reserves. This impressive sum reflects India’s robust economic growth, its burgeoning IT sector, and its aspirations to become a global economic powerhouse. The Reserve Bank of India (RBI) meticulously manages these reserves to stabilize the Indian rupee (INR), manage inflation, and promote economic development.

6. Hong Kong: A Financial Hub with a Sound Monetary Framework

Hong Kong, a vibrant financial hub, holds $482 billion in forex reserves. These reserves are a testament to Hong Kong’s sound monetary framework, its role as a global financial center, and its peg to the US dollar (USD). The Hong Kong Monetary Authority (HKMA) skillfully manages these reserves to maintain the stability of the Hong Kong dollar (HKD) and facilitate international trade.

7. Russia: A Resource-Rich Nation with Geopolitical Influence

Russia, a resource-rich nation, possesses $478 billion in forex reserves. These reserves play a crucial role in mitigating external economic risks, managing the volatility of the Russian ruble (RUB), and asserting Russia’s geopolitical influence. The Central Bank of Russia (CBR) strategically deploys these reserves to support domestic financial stability and bolster the country’s international standing.

8. Brazil: A Rising Economic Force with Abundant Natural Resources

Brazil, a rising economic force, commands $424 billion in forex reserves. These reserves are a reflection of Brazil’s strong economic fundamentals, its abundant natural resources, and its commitment to maintaining financial stability. The Central Bank of Brazil (BCB) cautiously manages these reserves to support the Brazilian real (BRL) and promote economic growth.

9. Taiwan: A Technological Powerhouse with Prudent Monetary Policies

Taiwan, a technological powerhouse, holds $422 billion in forex reserves. These reserves are a manifestation of Taiwan’s export-oriented economy, its strong financial sector, and its prudent monetary policies. The Central Bank of the Republic of China (Taiwan) skillfully utilizes these reserves to maintain the stability of the New Taiwan dollar (TWD) and foster economic development.

10. United Arab Emirates: A Dynamic Financial Center with a Vision for the Future

The United Arab Emirates (UAE), a dynamic financial center, has amassed $407 billion in forex reserves. These reserves underscore the UAE’s strong economic diversification, its thriving tourism industry, and its ambitious vision for the future. The Central Bank of the UAE (CBUAE) diligently manages these reserves to maintain the stability of the dirham (AED) and support the country’s long-term economic growth.

World Top 10 Country Forex Reserve

Conclusion: The Strategic Significance of Forex Reserves

In the ever-changing landscape of global economics, forex reserves stand as a beacon of financial stability and economic resilience. The top