In the ever-evolving global financial landscape, foreign exchange (forex) reserves play a pivotal role in stabilizing economies, facilitating international trade, and bolstering confidence in currencies. Forex reserves refer to the stockpile of foreign currencies, gold, and other liquid assets held by a country’s central bank or monetary authority. These reserves serve as a cushion against external shocks and provide the flexibility to intervene in currency markets to manage exchange rate fluctuations. Here’s an in-depth exploration of the top 10 countries with the largest forex reserves in the world.

Image: howtotradeonforex.github.io

The Significance of Ample Forex Reserves

Maintaining substantial forex reserves is crucial for several reasons. Firstly, it enables central banks to defend their currencies from speculative attacks or sudden outflows. In times of financial turmoil, countries with ample reserves have the firepower to intervene in currency markets, thereby calming market fears and preventing sharp depreciations. Secondly, sufficient forex reserves allow countries to settle international transactions and meet external debt obligations smoothly. This is particularly important for import-dependent economies that rely on foreign exchange to purchase essential commodities and services.

Moreover, robust foreign exchange reserves instill confidence among investors and businesses, indicating a country’s ability to withstand external risks. This, in turn, attracts foreign capital, fosters economic growth, and supports stable exchange rates. Thus, countries with large forex reserves enjoy a competitive advantage in global markets and are better equipped to navigate economic headwinds.

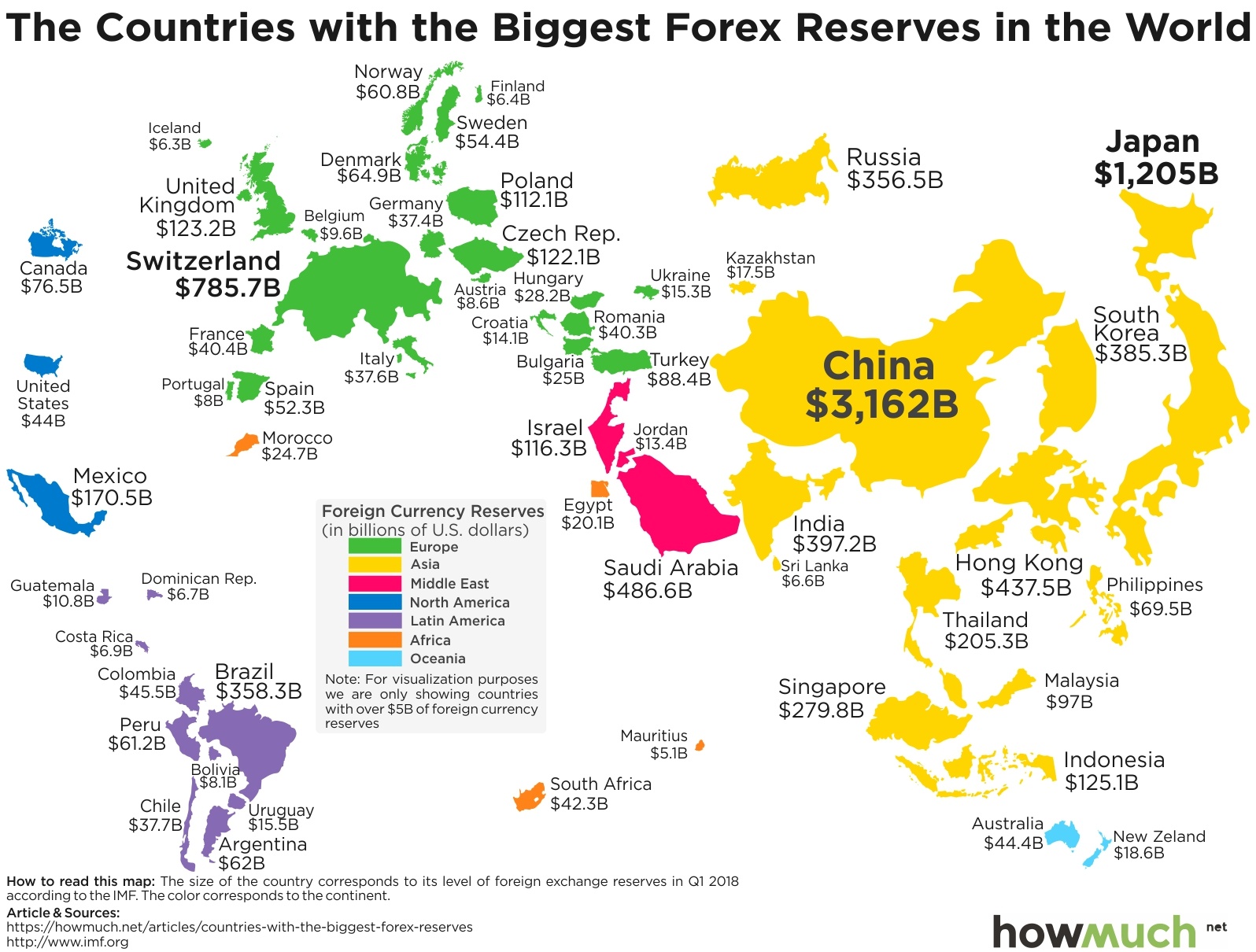

- China: With a staggering $3.3 trillion in foreign exchange reserves, China holds the top spot as the country with the largest stockpile. This vast reserve gives the People’s Bank of China immense control over the value of the yuan and provides a significant buffer against external risks.

- Japan: Japan boasts $1.3 trillion in forex reserves, making it the second-largest holder globally. This reserve is managed by the Bank of Japan and serves as a tool to stabilize the value of the yen and support Japan’s export-oriented economy.

- Switzerland: Switzerland has long been known for its robust financial sector and holds $1.1 trillion in forex reserves. The Swiss National Bank uses these reserves to maintain the stability of the Swiss franc and counter any speculative pressures.

- India: India has emerged as a major economic power, with $612.7 billion in foreign exchange reserves. The Reserve Bank of India (RBI) actively manages these reserves to ensure exchange rate stability and support India’s growing international trade.

- Russia: Despite recent geopolitical tensions, Russia maintains $606.6 billion in forex reserves. These reserves provide the Central Bank of Russia with the flexibility to mitigate any potential financial sanctions and support the ruble’s value.

- Saudi Arabia: Saudi Arabia’s substantial oil exports have contributed to its $506.5 billion in foreign exchange reserves. The Saudi Arabian Monetary Authority (SAMA) uses these reserves to manage the Saudi riyal’s peg to the U.S. dollar and diversify the country’s economy.

- Hong Kong: Hong Kong, a key financial hub, holds $472.5 billion in forex reserves. The Hong Kong Monetary Authority (HKMA) operates a linked exchange rate system, pegging the Hong Kong dollar to the U.S. dollar. The ample reserves provide the HKMA with the necessary support to maintain this peg.

- Singapore: Singapore, another prominent financial center, has $458.1 billion in foreign exchange reserves. The Monetary Authority of Singapore (MAS) manages these reserves to stabilize the Singapore dollar and support the country’s export-driven economy.

- Taiwan: Taiwan’s central bank, the Central Bank of the Republic of China (Taiwan), holds $440.7 billion in forex reserves. These reserves play a crucial role in managing currency fluctuations, supporting Taiwan’s international trade, and fostering economic resilience.

- Brazil: Brazil, Latin America’s largest economy, has $336.1 billion in forex reserves. The Banco Central do Brasil (BCB) uses these reserves to stabilize the real, promote economic growth, and mitigate external risks.

It’s worth noting that the size of a country’s forex reserves is not solely determined by its economic size or trade volume. Factors such as the exchange rate regime, monetary policy, and geopolitical considerations also influence the level of reserves held. Nevertheless, the countries with the largest forex reserves enjoy significant advantages in terms of financial stability, currency management, and international trade.

Expert Tips for Countries with Low Forex Reserves

Countries with low forex reserves should consider the following expert tips to enhance their financial resilience and foster economic growth:

- Pursue prudent fiscal and monetary policies to maintain price stability, contain inflation, and manage external debt.

- Promote economic diversification by encouraging exports and attracting foreign direct investment to reduce dependence on a few primary sectors or export markets.

- Implement sound financial regulations to prevent excessive risk-taking by financial institutions and maintain the stability of the banking system.

- Foster a favorable investment climate that attracts domestic and international capital inflows, thereby bolstering the national currency and increasing foreign exchange reserves.

By following these recommendations, countries with limited forex reserves can gradually strengthen their financial foundation, attract foreign investment, and create the conditions for sustained economic growth.

FAQs on Top Forex Reserve Holders

- Why does China have such a large amount of foreign exchange reserves? China’s foreign exchange reserves are largely a result of its export-oriented economy, coupled with interventionist currency management policies by the People’s Bank of China.

- What is the best way to utilize foreign exchange reserves? Forex reserves should be managed prudently to maximize their benefits, including stabilizing currencies, supporting economic growth, and minimizing financial risks.

- How can a country increase its foreign exchange reserves? Countries can boost their forex reserves by maintaining a favorable trade balance, attracting foreign investment, and pursuing sound economic policies.

- What are the risks associated with having too little or too much foreign exchange reserves? Inadequate reserves can leave a country vulnerable to economic shocks, while excessive reserves can indicate inefficient use of financial resources.

- Which countries are projected to have the largest foreign exchange reserves in the future? China, Japan, and the United States are expected to remain among the top holders of forex reserves in the years to come.

Image: www.businesstoday.in

Top 10 Forex Reserve In World

Conclusion

Foreign exchange reserves are an indispensable tool for central banks and monetary authorities worldwide. They provide a safety net against external economic shocks, facilitate international trade, and enhance currency stability. The top 10 countries with the largest forex reserves wield significant influence in global financial markets and enjoy the benefits of financial resilience and economic flexibility. By understanding the intricacies of forex reserves and implementing prudent financial policies, countries can unlock the potential of these reserves to drive economic growth and prosperity.

Are you interested in learning more about foreign exchange reserves and their implications for global economies? Share your questions and insights in the comments section below, and let’s continue the conversation.