Introduction

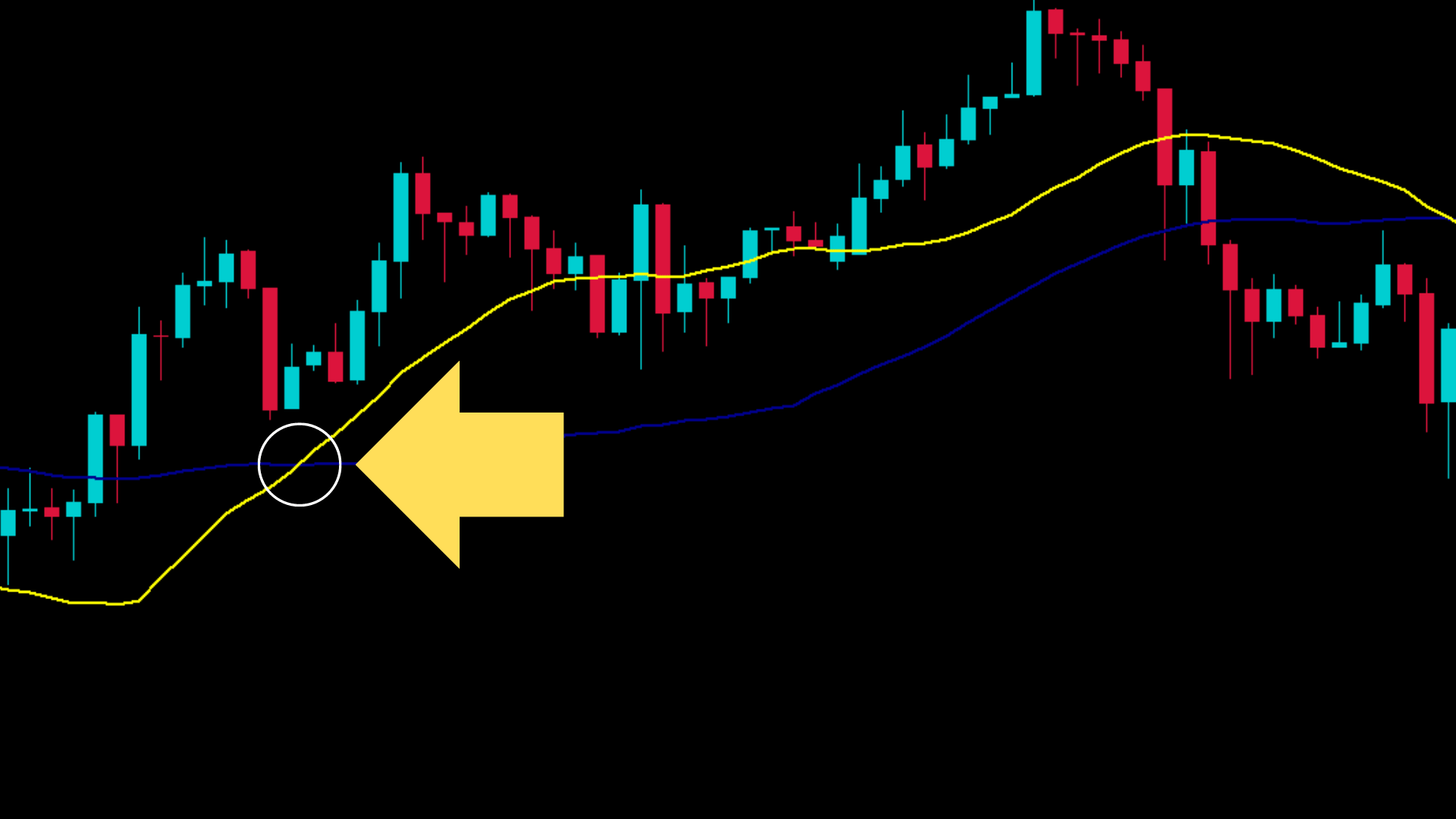

The foreign exchange market, a colossal arena where currencies are traded, presents a relentless pursuit for traders seeking profitable opportunities. Amidst the ceaseless ebb and flow of exchange rates, technical analysis emerges as a valuable tool, offering a structured approach to identifying potential trading signals. One such technique, the moving average (MA) crossover strategy, stands out for its simplicity and effectiveness, making it accessible to traders of all skill levels.

Image: axlestreet.com

The moving average, a mainstay in technical analysis, measures the average price of a financial instrument over a specified period. By plotting multiple moving averages with varying timeframes, traders can discern patterns and trends in price action, helping them make informed trading decisions. The MA crossover strategy harnesses the convergence and divergence of these moving averages to identify potential trading opportunities.

Delving into the MA Crossover Strategy

The MA crossover strategy involves comparing the values of two or more moving averages to identify when they intersect. When a short-term moving average crosses above a long-term moving average, it signals a potential uptrend, prompting traders to consider buying. Conversely, when the short-term moving average crosses below the long-term moving average, it suggests a potential downtrend, indicating a selling opportunity.

The rationale behind the MA crossover strategy lies in the assumption that moving averages represent market momentum and trend direction. The crossing of a short-term moving average above a long-term moving average signifies a shift from short-term downward momentum to upward momentum, suggesting a potential uptrend. Conversely, a cross below indicates a shift from short-term upward momentum to downward momentum, hinting at a possible downtrend.

Customizing the MA Crossover Strategy

The MA crossover strategy can be tailored to suit individual trading styles and preferences. The choice of moving average types and timeframes depends on the time scales and volatility of the financial instrument being traded.

- Moving Average Types: Traders can employ simple moving averages (SMAs), exponential moving averages (EMAs), or weighted moving averages (WMAs), each with its unique characteristics and responsiveness to price changes.

- Timeframes: The choice of timeframes for the moving averages is crucial. Short-term moving averages, typically in the range of 5 to 30 periods, capture recent price movements, while long-term moving averages, ranging from 50 to 200 periods, track longer-term trends.

Enhancing Strategy Efficiency: Incorporating Additional Indicators

While the MA crossover strategy is powerful in its simplicity, combining it with other technical indicators can further enhance its accuracy and profitability.

- Volume Confirmation: Volume indicators, such as the volume-weighted moving average (VWMA), provide insights into trading volume and market sentiment. Incorporating volume confirmation can help traders assess whether a MA crossover is supported by significant buying or selling pressure.

- Trend Indicators: Trend indicators, such as the moving average convergence divergence (MACD) or the relative strength index (RSI), provide additional information about market momentum and trend direction. Integrating trend indicators can help traders confirm MA crossovers and identify potential trend reversals.

Image: www.youtube.com

Case Study: Applying the MA Crossover Strategy in Forex

To illustrate the practical application of the MA crossover strategy in the forex market, let’s consider the EUR/USD currency pair. Suppose we set up a 15-period EMA as the short-term moving average and a 50-period EMA as the long-term moving average.

A buy signal would be triggered when the 15-period EMA crosses above the 50-period EMA, indicating a potential uptrend. Conversely, a sell signal would occur when the 15-period EMA crosses below the 50-period EMA, suggesting a potential downtrend.

By integrating the MA crossover strategy with additional indicators, such as the RSI or the stochastics oscillator, traders can refine their analysis and enhance the probability of successful trades.

Working Ma Crossover Strategy Forex

Conclusion: Unlocking Profitable Forex Trades with the MA Crossover Strategy

The MA crossover strategy, with its simplicity and versatility, offers traders a powerful tool for identifying potential trading opportunities in the forex market. By utilizing multiple moving averages, traders can capture trend changes and make informed trading decisions.

Remember, mastering the MA crossover strategy requires practice, a thorough understanding of its mechanics, and careful customization to suit individual trading styles. By incorporating additional indicators and applying sound risk management practices, traders can harness the MA crossover strategy to unlock profitable forex trading opportunities.