Have you ever found yourself deep in the world of financial trading, struggling to decipher the ever-complex charts and market trends? If so, you’re not alone. As a seasoned trader myself, I’ve delved into a wide array of trading strategies, but one that stands out for its simplicity and effectiveness is the moving average commodity trading forex strategy. In this article, we’ll dive into the details of this powerful approach, helping you master the art of forecasting market movements and maximizing your trading potential.

Image: www.tradingwithrayner.com

Understanding Moving Averages in Forex Trading

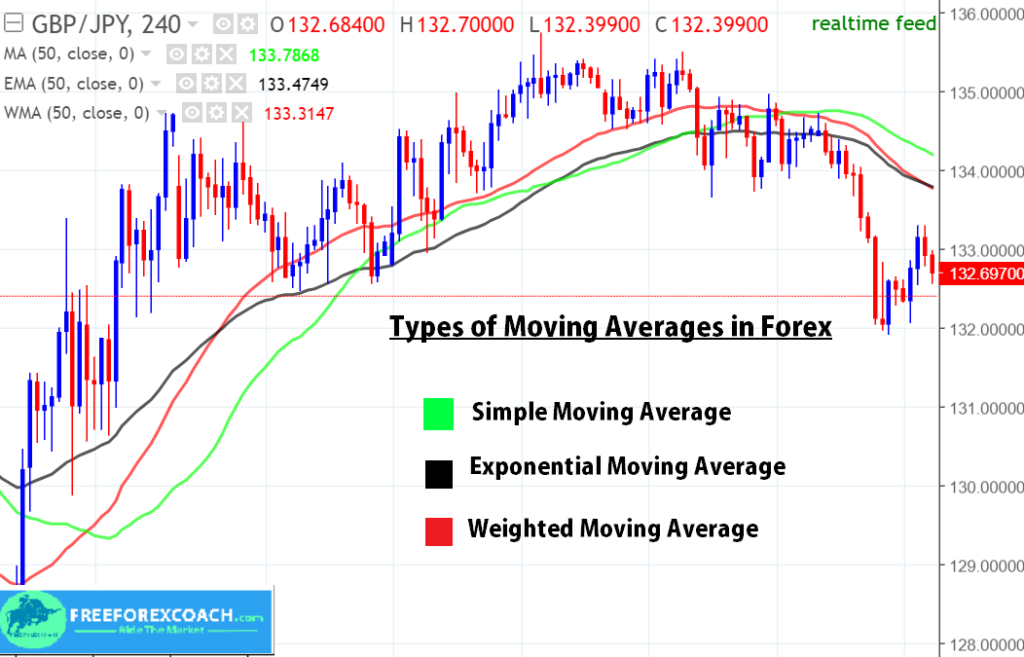

Moving averages are one of the most widely used technical indicators in financial markets, including forex trading. A moving average calculates the average price of a security over a specified period of time, smoothing out price fluctuations and highlighting the general trend. By considering different moving averages with varying time frames, traders gain valuable insights into the short-term, mid-term, and long-term market sentiment.

The Power of Simplicity

Moving averages are a remarkably accessible tool for traders of all levels of experience. Unlike more complex indicators that involve complex formulas and mathematical concepts, moving averages rely on straightforward calculations, making them easy to understand and implement. This simplicity allows traders to focus on market movements rather than getting bogged down in intricate calculations.

Spotting Trends, Identifying Opportunities

Moving averages serve as a guiding light in the unpredictable world of financial trading. By highlighting the general market trend, they assist traders in identifying potential trading opportunities and making informed decisions. When the price action is above the moving average, it indicates an uptrend, signaling potential buy opportunities. Conversely, prices below the moving average suggest a downtrend, presenting potential sell opportunities.

Image: freeforexcoach.com

Identifying Support and Resistance Levels

Moving averages play a crucial role in identifying support and resistance levels in forex trading. Support refers to price levels that historically act as barriers to a falling price, while resistance levels represent price points that restrain upward price movements. By studying multiple moving averages, traders can pinpoint these levels with greater accuracy, enhancing their understanding of market dynamics and enabling them to make strategic trading decisions.

Technical Tips from the Trenches

Over years of trading forex, I’ve discovered invaluable tips that can help you optimize your moving average strategy:

- Choose a moving average period that aligns with your trading style and the volatility of the asset being traded.

- Combine multiple moving averages with varying time frames for a comprehensive view of market trends.

- Use moving averages in conjunction with other technical indicators to confirm signals and minimize false breakouts.

Frequently Asked Questions (FAQs)

Q: What is the ideal moving average period for forex trading?

A: The optimal moving average period depends on your trading timeframe and the asset’s volatility. Common timeframes include 50-day, 100-day, and 200-day moving averages.

Q: How do I interpret moving average crossovers?

A: When a shorter-period moving average crosses above a longer-period moving average, it generally indicates a bullish signal, while a bearish signal is indicated when the shorter-period moving average crosses below the longer-period moving average.

Q: Can moving averages be used for all forex pairs?

A: Yes, moving averages can be applied to most major forex pairs, but their effectiveness may vary depending on the pair’s volatility and market conditions.

Moving Average Commodity Trading Forex

Conclusion

In the realm of forex trading, the moving average commodity trading strategy stands as a cornerstone technique, empowering traders to navigate the ebb and flow of financial markets. Through the utilization of moving averages, traders gain the ability to identify trends, pinpoint trading opportunities, and enhance their understanding of market dynamics. If you’re keen on elevating your forex trading game, embrace the simplicity of moving averages and unlock the doors to informed decision-making and increased profitability.

Would you like to learn more about this fascinating strategy? Join our vibrant community of traders and dive deeper into the world of moving average commodity trading forex.