Embark on an exhilarating journey into the world of forex trading as we delve into the intricacies of the moving average crossover strategy. Join us as we unlock its secrets, empower you with actionable insights, and elevate your trading game.

Image: forexlifestyleea.blogspot.com

Unveiling the Moving Average Crossover Strategy

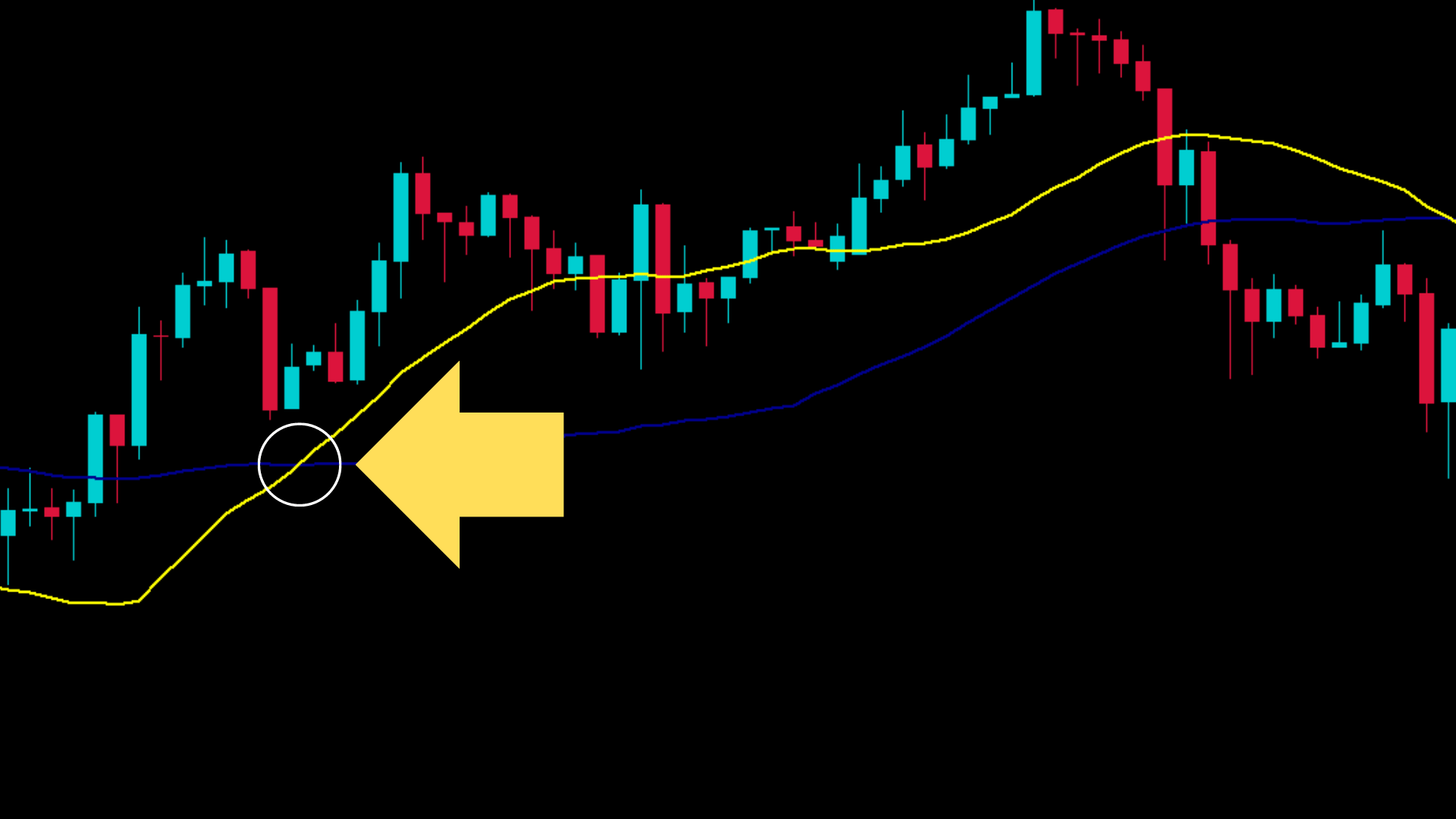

In the labyrinth of technical analysis, moving averages stand as indispensable tools for discerning market trends and uncovering trading opportunities. The moving average crossover strategy harnesses the power of two or more moving averages to identify potential turning points, arming traders with a potent edge in the ever-shifting forex market.

Unveiling the Moving Average Crossover Strategy

Like a beacon in the darkness, the moving average crossover strategy illuminates the path to potential profits. Its core principle lies in tracking the intersection of two moving averages of different time frames. When the shorter-term moving average crosses above the longer-term one, it signals a bullish trend; conversely, when it crosses below, bears take control.

Exploring the Power of Customization

The beauty of the moving average crossover strategy lies in its adaptability. By experimenting with different moving average periods, traders can tailor the strategy to suit their risk tolerance and trading style. The most common combination is the 50-day and 200-day moving averages, but numerous variations exist, offering a personalized trading experience.

Image: axlestreet.com

Harnessing Expert Insights

To elevate your trading prowess, seek wisdom from renowned experts in the field. Legendary forex trader John Bollinger advocates for using a 20-day moving average to identify overbought and oversold conditions. Meanwhile, Mark Fisher of Fisher Investments emphasizes the importance of using moving averages in conjunction with other technical indicators for a more comprehensive analysis.

Applying the Moving Average Crossover Strategy

Armed with the knowledge of the moving average crossover strategy, it’s time to put theory into practice. When the shorter-term moving average crosses above the longer-term one, consider entering a long position. Conversely, when the shorter-term moving average crosses below the longer-term one, consider exiting or entering a short position.

Risks and Considerations

Like any trading strategy, the moving average crossover strategy is not infallible. False signals can occur, especially during periods of market volatility. Risk management strategies, such as setting stop-loss orders and carefully calculating position size, are paramount to mitigate potential losses.

Forex Moving Average Crossover Strategy

https://youtube.com/watch?v=235nioN_8gE

Conclusion

The moving average crossover strategy is a powerful tool that can enhance your forex trading endeavors. Its simplicity and versatility make it accessible to both novice and experienced traders alike. By embracing the insights shared by experts, customizing the strategy to suit your unique needs, and adhering to sound risk management principles, you can unlock the potential of the moving average crossover strategy and elevate your trading mastery.