Forex trading, with its allure of lucrative profits, has captivated traders from all walks of life. Yet, navigating the complexities of this market can prove daunting, especially for beginners. Enter the realm of expert advisors (EAs), automated trading tools that can simplify decision-making and enhance profitability. With a vast array of EAs available, choosing the best one becomes paramount. This comprehensive guide aims to illuminate this decision-making process, providing invaluable insights into the world of Forex EAs.

Image: eaforexkiller.blogspot.com

Defining Forex EAs: A Glimpse into Automated Trading

Forex EAs are software programs designed to automate trading decisions based on predefined rules and algorithms. These automated systems can operate 24/7, tirelessly monitoring market fluctuations and executing trades as per the programmed criteria. EAs offer traders several advantages, including:

- Time Optimization: Freeing up valuable time typically spent on manual trading analysis and execution.

- Emotional Discipline: Eliminating emotional biases that often cloud human judgment, leading to rash decisions.

- Backtesting Capabilities: Allowing traders to test their EAs on historical market data, optimizing strategies before deploying them in live trading.

Delving into the Types of Forex EAs: Understanding Trading Styles

The Forex EA landscape encompasses a diverse array of systems, each catering to distinct trading styles. Some of the most common types include:

- Trend-Following EAs: Designed to capture momentum by identifying and trading in the direction of the prevailing trend.

- Range-Bound EAs: Seek to profit from market fluctuations within a defined range, capitalizing on price oscillations.

- Scalping EAs: Execute a flurry of short-term trades, aiming for small but consistent profits.

- News-Based EAs: Monitor economic news releases and automatically trade based on anticipated market reactions.

Choosing the best Forex EA entails aligning the EA’s trading style with your own preferences and risk tolerance. For risk-averse traders, trend-following EAs offer a more conservative approach, while aggressive traders may prefer the higher-frequency trading of scalping EAs.

Unveiling the Secrets of a Winning Forex EA: Essential Considerations

Identifying a winning Forex EA involves scrutinizing several key factors:

- Trading Strategy: Analyze the underlying trading strategy employed by the EA. Ensure it aligns with your market understanding and trading objectives.

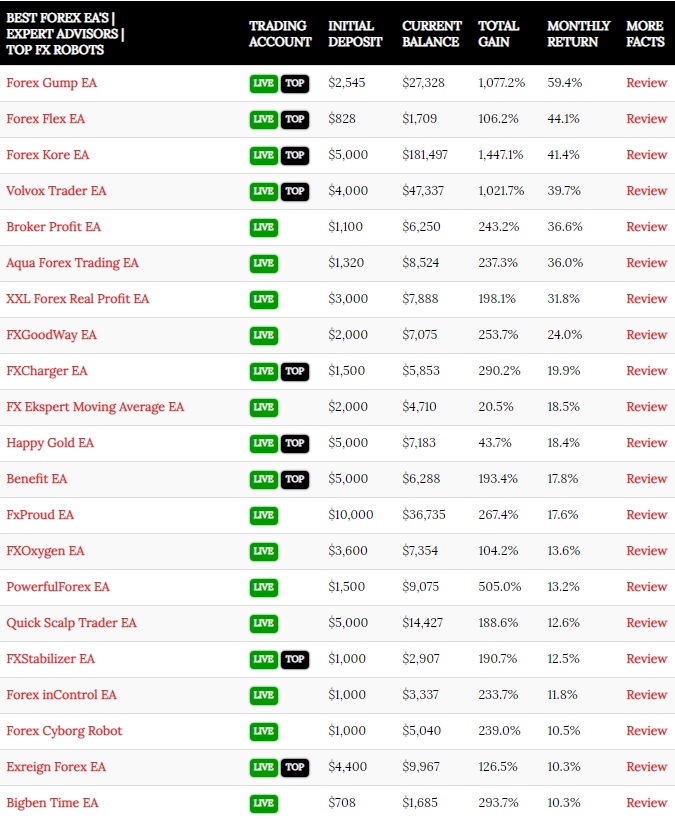

- Historical Performance: Request performance data from the EA’s developer, including backtesting and live trading results. Validate its profitability and consistency.

- Flexibility and Customization: Assess the EA’s ability to adapt to changing market conditions. Ideal EAs allow for parameter adjustments and customization to fine-tune performance.

- Reputation and Support: Choose EAs developed by reputable vendors with a track record of customer support and regular updates. Positive user reviews and testimonials further bolster credibility.

Diligent evaluation of these factors will lead you closer to selecting the Forex EA that best aligns with your trading needs and aspirations.

Image: www.mql5.com

Which Is The Best Forex Ea

Conclusion: Empowering Your Trading Journey with a Winning Forex EA

Navigating the Forex market with the aid of a well-chosen EA can significantly enhance your trading experience and propel your profitability to new heights. By embracing the insights and guidance provided in this comprehensive guide, you can confidently embark on your journey to identifying the best Forex EA for your individual needs. Remember, the quest for success in Forex trading is an ongoing process that demands continuous learning, adaptation, and the unwavering pursuit of knowledge. May this guide serve as your trusted companion on this exhilarating journey.