Dive into the realm of foreign exchange trading with confidence, even if you have limited capital. This comprehensive guide will equip you with the knowledge and strategies to navigate the forex market effectively, starting with just $100.

Image: www.youtube.com

Why Forex Trading with $100?

Forex trading, the exchange of currencies worldwide, offers a plethora of opportunities for growth and profitability. However, many aspiring traders hesitate due to perceived financial constraints. Challenging this misconception, we’ll explore how $100 can pave the way for rewarding forex trading experiences.

1. Practice and Learn without Significant Financial Risk

Initiating your forex journey with a modest amount allows you to gain hands-on experience and refine your trading strategies without risking substantial capital. Consider it a low-stakes investment in your financial education.

2. Leverage the Power of Micro Accounts

Many forex brokers provide micro trading accounts designed specifically for traders with limited capital. These accounts enable you to trade with even smaller lot sizes, allowing you to maximize your potential returns while minimizing financial exposure.

Image: tradingstrategyguides.com

3. Focus on Technical Analysis and Price Action

Instead of relying heavily on fundamental analysis, concentrate on technical indicators and price action patterns. These methods empower you to understand market trends and make informed trading decisions, regardless of the amount of capital you have.

4. Trade Currency Pairs with High Liquidity

Prioritize trading major currency pairs like EUR/USD or GBP/USD, known for their high liquidity. This liquidity ensures tighter spreads, reducing transaction costs and increasing profit potential.

5. Leverage Stop-Loss and Take-Profit Orders

Implement strict risk management practices by setting stop-loss and take-profit orders. These safeguards protect your capital and ensure that potential losses are limited, minimizing the impact of adverse market movements.

6. Embrace Education and Practice

Success in forex trading requires continuous learning and practice. Dedicate time to studying market dynamics, trading strategies, and risk management techniques. Utilize available resources such as webinars, online courses, and demo accounts to hone your skills.

7. Build a Trading Plan

Before entering the market, formulate a comprehensive trading plan outlining your trading objectives, risk tolerance, and strategy. This plan serves as a roadmap, guiding your decision-making and keeping you disciplined.

8. Control Your Emotions

The forex market can be emotionally taxing. Maintain a level head and control your emotions to avoid impulsive trading decisions. Remember, discipline and patience are key elements of successful trading.

9. Explore Copy Trading or Social Trading

If you’re new to trading or lack confidence, consider exploring copy trading or social trading. These platforms allow you to follow and mimic the trades of experienced and successful traders, potentially enhancing your profitability.

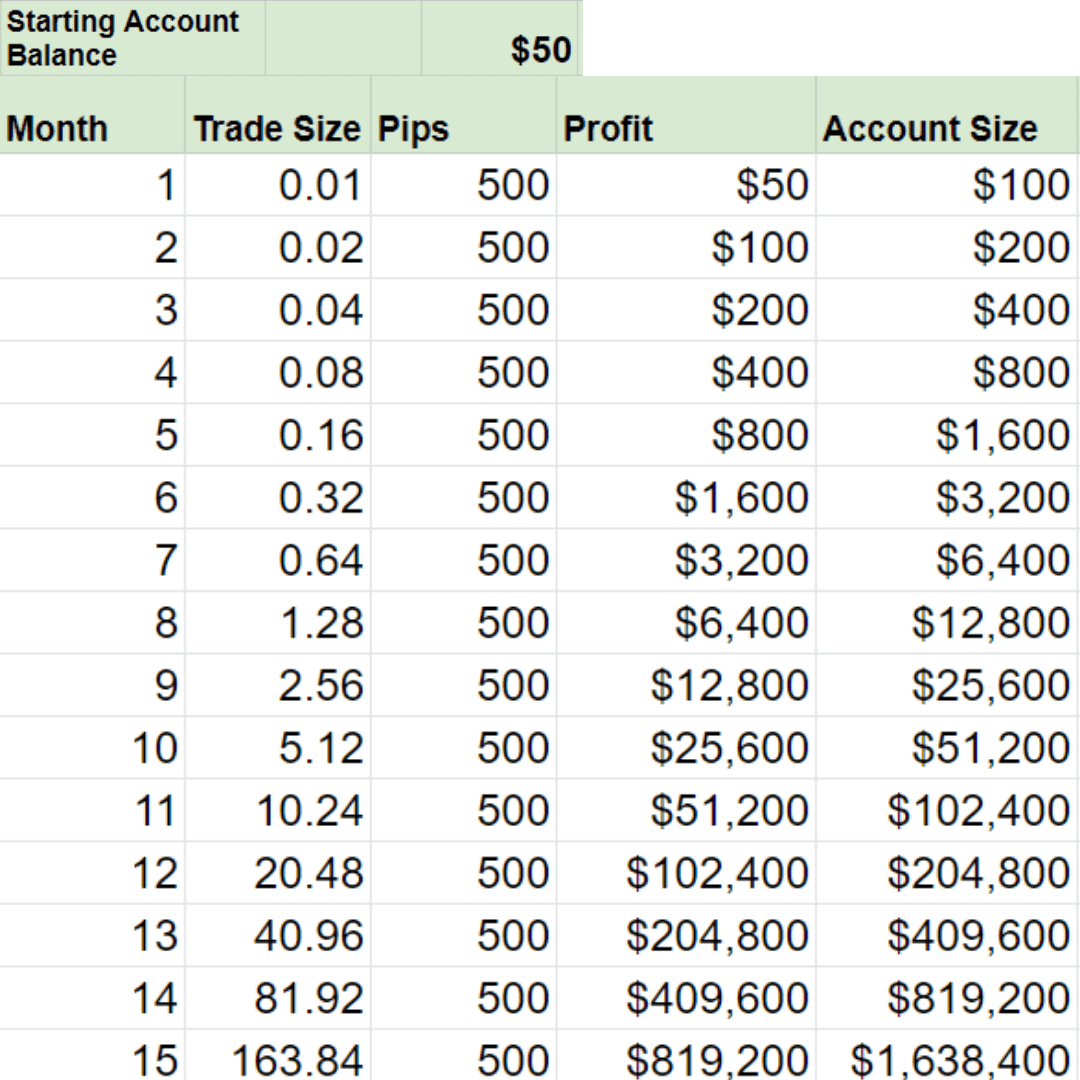

10. Start Small and Gradually Increase Your Capital

Begin with a modest amount, such as $100, and gradually increase your trading capital as you gain experience and confidence. This cautious approach allows you to test strategies and build your account responsibly.

Forex Trading With 100 Dollars

Conclusion

Embark on your forex trading journey with confidence, even if you have limited financial resources. By implementing the strategies outlined in this guide, you can unlock the potential of the forex market and pursue financial success. Remember, patience, discipline, and a commitment to learning are essential ingredients for thriving in the world of currency trading.