Have you ever dreamt of automating your forex trading, allowing you to sit back and watch your profits accumulate while you focus on other aspects of your life? The allure of hands-free trading is powerful, and Forex Advisor Generators offer a tempting solution. But are these powerful tools just a mirage, or can they truly empower traders to achieve consistent profitability?

Image: www.softpedia.com

In this comprehensive guide, we’ll delve deep into the world of Forex Advisor Generators, exploring their intricacies, potential benefits, and risks. We’ll examine how these automated trading systems work, analyze the different types available, and shed light on the crucial factors to consider before implementing them into your trading strategy. By understanding their capabilities and limitations, you can make informed decisions about whether Forex Advisor Generators are the right fit for your individual trading goals.

What are Forex Advisor Generators?

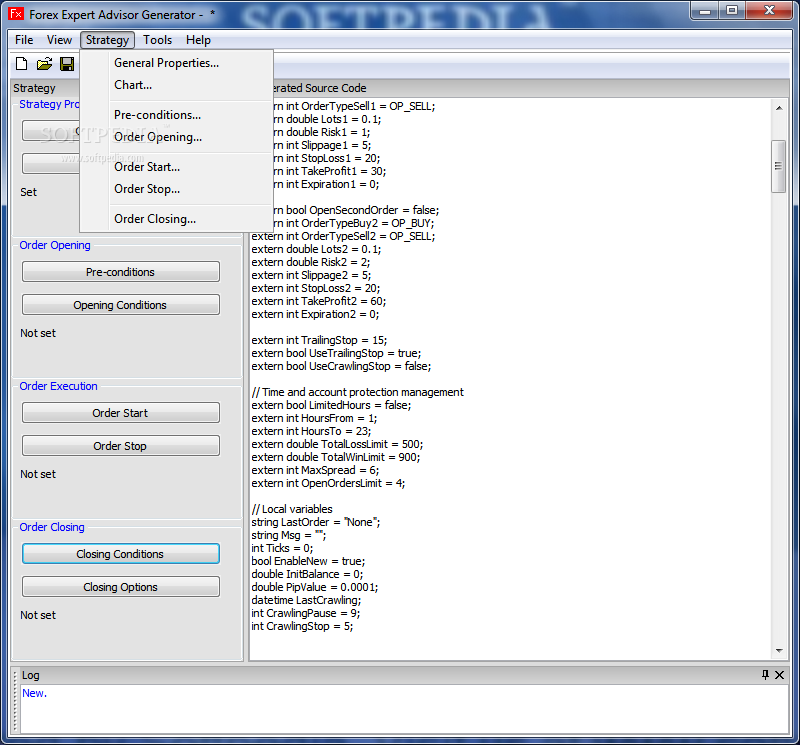

Forex Advisor Generators, also known as Expert Advisor (EA) Generators, are sophisticated software programs designed to automate forex trading strategies. They leverage complex algorithms and programming techniques to create custom Expert Advisors (EAs), which are automated trading robots that execute trades based on predefined rules and parameters.

Think of a Forex Advisor Generator as a blueprint maker for your trading strategy. You provide the building blocks—the specific rules you want your trading system to adhere to—and the generator assembles them into an automated program ready to execute trades on your behalf. This automation can free up your time, allowing you to focus on other aspects of your trading or your daily life, while your EA diligently monitors the market and acts based on your pre-determined criteria.

The Intriguing History of Forex Advisor Generators

The concept of automated trading has existed for decades, predating the rise of retail forex trading. In the early days, automated trading systems were primarily confined to institutional traders with substantial resources to develop complex proprietary algorithms. As forex trading became more accessible to the general public, the need for user-friendly automation tools became increasingly apparent.

The emergence of the internet and the rise of online forex brokers made it easier for individuals to participate in the forex market. This paved the way for the development of Forex Advisor Generators, democratizing automated trading and making it available to a wider audience. These generators offered traders a means to implement their trading strategies without requiring advanced coding skills.

Unveiling the Mechanics: How Forex Advisor Generators Work

Forex Advisor Generators leverage a combination of programming languages, technical analysis indicators, and trading strategies to create custom automated trading systems. To understand their inner workings, let’s break down the key elements:

- Programming Languages: Common programming languages used in Forex Advisor Generators include MQL4 (MetaQuotes Language 4) and MQL5 (MetaQuotes Language 5), developed by MetaQuotes Software Corp. (the company behind the popular MetaTrader trading platform). These languages enable developers to create complex algorithms for analyzing market data, executing trades, and managing risk.

- Technical Analysis Indicators: Forex Advisor Generators often incorporate a wide range of technical indicators to analyze market trends and identify potential trading opportunities. These indicators could include moving averages, oscillators, momentum indicators, and volatility indicators, among others. Users can choose the specific indicators they want to include in their trading strategy, allowing them to tailor the EA to their specific needs.

- Trading Strategies: The fundamental building block of any automated trading system is the trading strategy that guides its trading decisions. Forex Advisor Generators offer pre-programmed templates for popular strategies, such as trend-following, mean reversion, arbitrage, and scalping. They also allow users to create their own custom strategies by defining specific rules and entry/exit conditions.

Image: recursos.skilling.com

The Types of Forex Advisor Generators at Your Disposal

There’s a wide array of Forex Advisor Generators available, each with its own unique features, capabilities, and target audience. Understanding the different types can help you choose the right one for your needs:

1. Free Forex Advisor Generators

This category offers a tempting prospect: the ability to create custom EAs without paying a dime. While free generators can be a good starting point for beginners or those who want to experiment with automated trading, they often come with limitations. They may provide basic functionality, limited indicator support, and restricted customization options. It’s crucial to be aware of these limitations and understand that the “free” aspect often comes at the cost of features and flexibility.

2. Paid Forex Advisor Generators

Paid Forex Advisor Generators are often more feature-rich and offer greater flexibility. They may include a wider array of indicators, more advanced programming features, and better customization options. However, investing in a paid generator requires careful consideration of your budget and the value it offers. Ensure you thoroughly research the generator’s reputation, user reviews, and features before making a purchase.

3. Online Forex Advisor Generators

Online platforms allow users to create EAs through a graphical user interface (GUI) without requiring programming knowledge. These platforms often provide pre-built templates and wizards, simplifying the process of building a trading strategy and converting it into an automated EA. However, they may have limitations in terms of customization and control over core programming aspects, making them suitable for less experienced users.

Decoding the Benefits and Risks of Forex Advisor Generators

Forex Advisor Generators hold the promise of automating your trading and achieving consistent profits. While they can offer advantages, it’s crucial to acknowledge their potential downsides and approach them with a balanced perspective. Let’s weigh the benefits and risks:

Benefits

- Time Efficiency: Automation frees up your time, allowing you to focus on other aspects of your life or pursue other trading strategies. This can be particularly valuable for busy individuals or those with demanding jobs.

- Increased Discipline and Objectivity: Automated trading eliminates the influence of emotions, which can often lead to impulsive trading decisions. EAs follow pre-defined rules, ensuring consistency and discipline in your trading strategy.

- Improved Accuracy and Speed: EAs can execute trades faster and more accurately than humans, particularly in fast-paced market conditions. This can help you capitalize on short-term opportunities and maximize potential profits.

- Access to Advanced Strategies: Forex Advisor Generators can help you implement complex trading strategies that may be difficult or time-consuming to execute manually. This opens up new possibilities for exploring sophisticated trading techniques.

Risks

- Lack of Control: If you’re not familiar with the programming behind your EA, you may lack control over its decision-making process. This can make it challenging to adjust the strategy or adapt to changing market conditions.

- Risk of Overfitting: Overfitting occurs when an EA is designed to perform exceptionally well on past data, but it fails to adapt to live market conditions. This can lead to significant losses once the EA is deployed in the real world.

- Market Volatility and Unforeseen Events: Market conditions can change rapidly and unexpectedly, potentially rendering even the most carefully designed EA ineffective. It’s crucial to monitor your EA’s performance and make necessary adjustments to counter unforeseen events.

- Technical Malfunctions: As with any software, EAs can encounter technical issues, leading to unexpected errors or trading errors. This highlights the importance of choosing a reputable developer and testing your EA thoroughly before live trading.

Navigating the Road to Profitability: Tips for Success with Forex Advisor Generators

While Forex Advisor Generators can be a powerful tool, it’s crucial to understand that they’re not a magic bullet for guaranteed profits. Success with EAs requires careful planning, testing, and ongoing monitoring. Here are some key tips to enhance your chances of success:

- Start with a Sound Trading Strategy: A solid trading strategy is the foundation for any successful automated trading system. Before creating your EA, clearly define your trading goals, risk tolerance, and the specific rules that govern your trading decisions.

- Backtest Your Strategies Thoroughly: Backtesting your EA on historical data can provide insights into its potential performance and help identify areas for improvement. Backtesting should simulate real-world market conditions as closely as possible to ensure accurate results.

- Forward Test and Optimize: Once you’ve backtested your EA and made necessary adjustments, it’s crucial to conduct forward testing on live market data. Forward testing allows you to evaluate your EA’s performance in real-time before risking any significant capital.

- Monitor Performance Consistently: Continuously monitor your EA’s performance and make adjustments as needed. Market conditions change, and your EA may require fine-tuning to remain effective in the long run.

- Manage Risk Effectively: Implement robust risk management strategies to minimize potential losses. This may involve setting stop-loss orders, limiting your position size, and diversifying your trading portfolio.

- Choose a Reputable Developer: Select a Forex Advisor Generator developed by a reputable company with a history of providing reliable software and support. Read reviews and compare different generators before making a decision.

- Learn to Code (Optional): Understanding basic programming principles can give you greater control over your EA and allow you to make more sophisticated customization. This is a valuable investment for those who want to become more proficient in automated trading.

Embrace the Future: The Latest Trends in Forex Advisor Generator Technology

The world of Forex Advisor Generators is constantly evolving, driven by advancements in technology and changing market dynamics. Here are some key trends shaping the future of automated trading:

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are revolutionizing automated trading by automating complex tasks, analyzing large datasets, and making predictive models. EAs powered by AI can adapt to changing market conditions more effectively than traditional rule-based systems.

- Cloud-Based Trading Platforms: Cloud computing is allowing developers to create Forex Advisor Generators that are accessible from anywhere with an internet connection. This eliminates the need for physical installation and enables users to access their EAs from multiple devices.

- Increased Security and Transparency: Growing concerns about security and transparency in automated trading are driving developers to prioritize robust security measures and provide better access to their EAs’ algorithms. These advancements aim to build trust and accountability within the automated trading ecosystem.

Forex Advisor Generator

Final Thoughts: Your Journey to Automated Forex Trading

Forex Advisor Generators represent a powerful tool for both seasoned and budding forex traders. By understanding their capabilities, limitations, and risks, you can make informed decisions about whether these tools are right for you. Remember, automated trading is not a get-rich-quick scheme. It requires careful planning, testing, and dedication to succeed. As you embark on your journey with Forex Advisor Generators, be prepared to learn, adapt, and constantly improve your strategies for long-term success in the forex market.