The Captivating World of Forex: A Realm of Currency Exchanges

In the ever-evolving financial landscape, foreign exchange (forex) trading has emerged as a sought-after endeavor, attracting investors seeking lucrative returns in the global currency market. As nations participate in international commerce and seek economic growth, forex trading has become an indispensable component of their financial systems. Let’s embark on a global journey to uncover the countries where the passion for forex trading burns brightest.

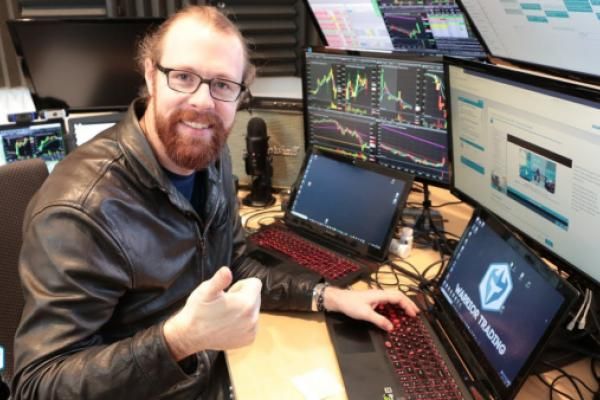

Image: forexpropreviews.com

The Top Forex Trading Hubs: Where Passion Meets Profit

Across the globe, various countries have established themselves as prominent forex trading hubs. These financial powerhouses account for a significant portion of the global forex market volume and attract traders seeking vibrant and sophisticated trading environments.

- United Kingdom: London, the heart of the United Kingdom’s financial industry, stands out as a global forex trading behemoth. Its legacy as a financial powerhouse, coupled with a favorable regulatory environment, makes London a magnet for forex traders worldwide.

- United States: New York City, the bustling financial capital of the United States, plays a pivotal role in the global forex market. Its proximity to major financial institutions and a highly developed infrastructure make it an ideal hub for forex trading activities.

- Japan: Tokyo, the economic epicenter of Japan, is renowned for its robust forex market. The country’s sophisticated financial system and technological advancements have contributed to its status as a major forex trading hub.

- Switzerland: Geneva, nestled amidst the picturesque Swiss Alps, is home to a thriving forex trading industry. Its political and economic stability, along with its robust financial infrastructure, have made Switzerland a haven for forex traders seeking a safe and reliable environment.

- Singapore: Singapore, a financial powerhouse in Southeast Asia, has emerged as a prominent forex trading hub in recent years. Its strategic location, coupled with a business-friendly environment, has attracted a surge of forex traders to its shores.

Exploring the Factors Fueling Forex Trading Growth

The burgeoning popularity of forex trading in these countries can be attributed to a multitude of factors. Let’s delve into the key drivers:

- Economic Growth: Forex trading thrives in nations experiencing robust economic growth, as businesses and individuals engage in international trade and investments.

- Political Stability: A stable political environment fosters confidence among forex traders, encouraging them to participate in the market without fear of sudden policy changes or economic upheaval.

- Regulatory Framework: A well-defined regulatory framework provides transparency and accountability in the forex market, assuring traders of fair and ethical practices.

- Technological Advancements: The advent of online trading platforms and mobile trading apps has democratized access to the forex market, making it accessible to a wider range of traders.

- Growing Awareness: Educational initiatives and media coverage have raised awareness about forex trading, attracting new participants to the market.

The Far-Reaching Impact of Forex Trading

Forex trading has a profound impact on national economies and the global financial system as a whole. Here’s how it contributes to economic growth and stability:

- Facilitation of International Trade: Forex trading enables businesses to exchange currencies seamlessly, facilitating international trade and fostering economic growth.

- Price Discovery: Forex markets play a crucial role in determining currency values, which influences pricing for goods and services traded globally.

- Risk Management: Forex trading allows individuals and institutions to manage currency risks associated with international transactions.

- Liquidity Provision: Forex markets provide liquidity to international financial transactions, ensuring smooth and efficient settlement of payments.

- Economic Stability: A stable forex market contributes to overall economic stability by preventing drastic fluctuations in currency values and safeguarding against financial crises.

Image: thetradable.com

A Call to Action: Unlocking the Potential of Forex Trading

If you’re intrigued by the world of forex trading and seek to leverage its potential benefits, consider these steps:

- Educate Yourself: Acquire a thorough understanding of forex trading concepts, market dynamics, and risk management techniques.

- Choose a Reliable Broker: Select a reputable and regulated forex broker that provides a secure trading platform, competitive spreads, and reliable customer support.

- Develop a Trading Strategy: Determine a trading strategy that aligns with your risk tolerance and financial goals, considering factors such as market analysis, technical indicators, and risk management tools.

- Practice with a Demo Account: Familiarize yourself with the trading platform and hone your trading skills in a risk-free environment using a demo account.

- Start Trading with Caution: Begin trading with a small amount of capital that you can afford to lose, and gradually increase your investment as your experience and confidence grow.

Which Country People Trade Forex Most

Conclusion: A Global Tapestry of Forex Trading

Forex trading has become an integral part of the financial landscape, with various countries emerging as prominent hubs for this dynamic and lucrative market. Understanding the factors driving forex trading’s growth and its far-reaching impact on economies provides valuable insights for individuals and nations alike. By embracing forex trading with knowledge, caution, and a sound strategy, you can unlock its potential to generate financial rewards and contribute to the stability of the global financial system. As the world’s currencies continue to intertwine, forex trading will remain a vital force shaping the economic destiny of nations and individuals across the globe.