The world of Forex trading can be daunting, especially for beginners. One of the first things you’ll encounter is the term “pip,” which stands for “point in percentage.” But what exactly is a pip, and how much is it worth? Understanding pip value is crucial to determining your potential profits and losses, and it’s a fundamental concept for any Forex trader.

Image: monstersoundpro.com

Imagine you’re just starting your Forex journey, eager to make your first trades. You’ve learned about pips and how they relate to currency fluctuations, but you’re still unsure about their actual value. This article aims to guide you through the intricacies of pip value, empowering you to make informed trading decisions.

Understanding Pip Value

A pip is the smallest unit of change in an exchange rate. It’s typically the fourth decimal place in a currency pair, except for currencies like the Japanese yen, where it’s the second decimal place. For example, if the EUR/USD rate changes from 1.1200 to 1.1201, that 0.0001 change represents one pip.

However, the actual monetary value of a pip varies depending on several key factors, including:

- The currency pair being traded: Each currency pair has its own specific pip value, influenced by the exchange rate.

- The size of the trade: The larger the trade size (measured in units or lots), the higher the pip value.

- The broker’s spread: Spreads, which are the difference between the bid and ask prices, affect the actual profit or loss generated by each pip.

Calculating Pip Value

Calculating pip value can seem complex, but it’s actually quite straightforward. Here’s a simple formula to use:

Pip Value = (Pip Movement x Trade Size) / Exchange Rate

Let’s break down this formula with an example:

- Example: You’re trading EUR/USD, with a trade size of 10,000 units (1 standard lot). Suppose the EUR/USD exchange rate is 1.1200.

- Pip Movement: The pip movement is 0.0001, as it’s the smallest unit of change in this currency pair.

- Trade Size: Your trade size is 10,000 units.

- Exchange Rate: The EUR/USD exchange rate is 1.1200.

Putting it all together, the pip value would be:

Image: network-bussiness.com(0.0001 × 10,000) / 1.1200 = $0.89

This means that for every pip movement in the EUR/USD currency pair, you’d earn or lose $0.89 on a 10,000-unit trade.

Pip Value and Trading Strategies

Understanding pip value is essential for formulating effective trading strategies. Here’s how it plays a role:

- Risk Management: Knowing the pip value allows you to determine your potential risk per trade, helping you set appropriate stop-loss orders and position sizes.

- Profit Targets: Pip value enables you to establish realistic profit targets based on your expected price movements.

- Trading Psychology: Being aware of the financial value of each pip can help you manage your emotions and avoid impulsive trading decisions.

Latest Trends and Developments

The Forex market is constantly evolving, and pip value remains a crucial element for traders. Recent trends include:

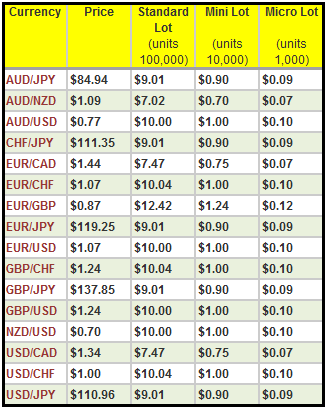

- Rise of Micro Lots: Micro lots, smaller trading units, allow traders to enter the market with less capital, impacting pip value calculations.

- Variations in Spreads: Brokers offer different trading conditions, including varying spreads, affecting the actual profit generated per pip.

- Automated Trading: Algorithms and robots are becoming increasingly popular, necessitating precise pip value calculations for automated strategy optimization.

Tips and Expert Advice

Here are some tips based on experience to help you navigate pip value effectively:

- Use Pip Value Calculators: There are many online tools that can quickly calculate pip value based on your trading parameters.

- Factor in Spreads: Always remember to account for the spread in your pip value calculations to get a realistic estimate of potential profits.

- Experiment with Different Account Types: Consider different account types, like mini accounts or micro accounts, to see how they impact pip values and trading strategies.

- Keep Up with Market Conditions: Stay informed about market volatility and economic events that can influence pip value.

Frequently Asked Questions

Q: How do I calculate pip value for exotic currency pairs?

Calculating pip value for exotic currency pairs follows the same formula, but you need to consider the specific decimal placement for that currency. For instance, the Japanese yen has a pip value in the second decimal place.

Q: Does the pip value change over time?

Yes, the pip value can change over time due to fluctuations in exchange rates. Therefore, it’s essential to calculate pip values based on the current exchange rate when initiating a trade.

Q: Are there any tools to help me visualize pip value?

Many trading platforms offer built-in pip value calculators or visual representations to help you understand the potential impact of pip movements on your trades.

How Much Is A Pip Worth

Conclusion

Understanding pip value is a cornerstone of successful Forex trading. This article has equipped you with the knowledge and resources to calculate and effectively use pip value. Keep in mind that market conditions and trading instruments can influence pip values, so it’s vital to stay informed and adapt your strategies accordingly.

Are you interested in learning more about Forex trading or its nuances? Share your thoughts and questions in the comments below. Let’s continue the discussion and explore the exciting world of Forex together!