Embarking on a Voyage into the World of Financial Fluctuations

Exchange rates, oil prices, and interest rates are omnipotent forces that dance together in a transformative waltz, shaping the destiny of countless companies worldwide. These financial indicators have the power to reshape balance sheets, dictate profitability, and even influence the course of entire industries. To navigate this labyrinthine landscape, businesses must develop a keen understanding of these dynamic forces and their profound impact.

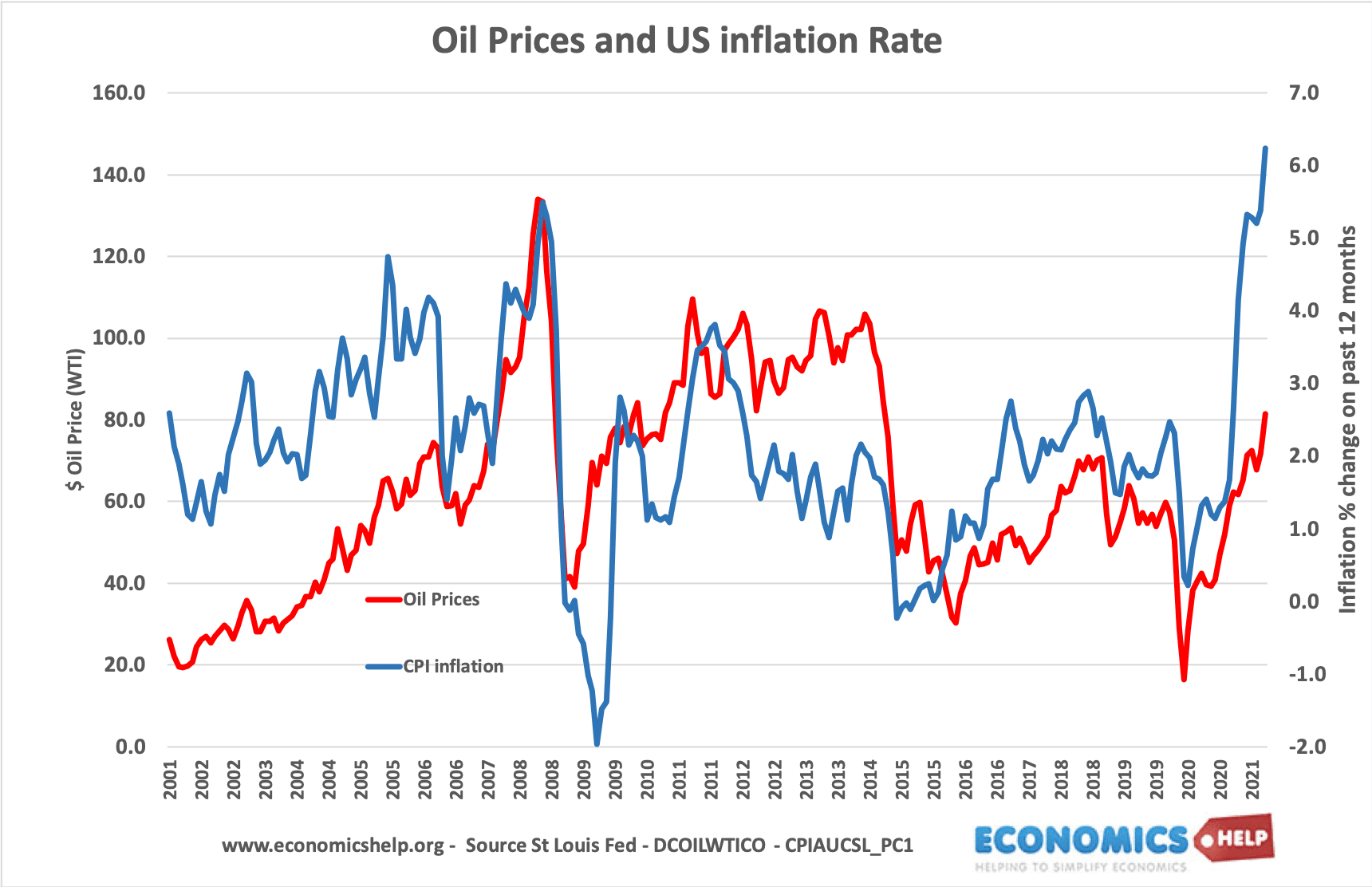

Image: www.economicshelp.org

Unraveling the Currency Conundrum: Forex’s Impact

Foreign exchange rates play a pivotal role in determining the value of a company’s exports, imports, and investments abroad. When the value of a company’s home currency depreciates, its exports become cheaper, offering a competitive edge in global markets. Conversely, a stronger home currency can make imports more expensive, potentially eroding profitability. The ups and downs of forex rates can also significantly impact the translation of foreign subsidiaries’ earnings, creating both opportunities and challenges.

Oil: The Unpredictable Fuel of Fortune

Oil prices, intricately intertwined with global economic activity, serve as a double-edged sword for companies. Fluctuations in oil prices can significantly influence production costs for energy-intensive industries, such as manufacturing and transportation. Rising oil prices can lift the profits of oil producers but simultaneously raise costs for oil-consuming companies. Conversely, falling oil prices can reduce costs for consumers and businesses, spurring economic growth and boosting profits for companies that depend on transportation and logistics.

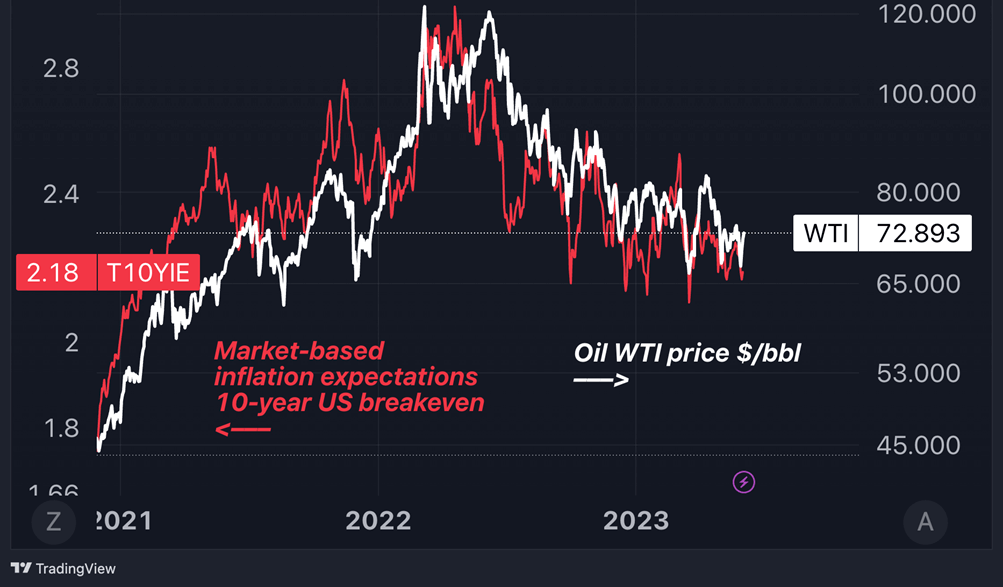

Interest Rates: Balancing Growth and Stability

Interest rates, orchestrated by central banks, play a crucial role in managing economic growth and inflation. Low interest rates encourage borrowing, potentially supporting business investment and economic expansion. However, excessively low interest rates can fuel asset bubbles and financial imbalances. Conversely, high interest rates dampen borrowing and investment, potentially slowing economic growth but stabilizing inflation. Finding the optimal balance between growth and stability is a constant balancing act for central banks, affecting companies’ financing costs, borrowing capacity, and overall financial health.

Image: www.flowbank.com

Case Studies: Real-World Examples of Forex, Oil, and Interest Rate Impact

Currency Impact Case Study:

- Toyota’s Global Advantage: The Japanese automaker Toyota benefited immensely from the depreciation of the yen against the dollar in 2013. The cheaper yen made Toyota’s exports more competitive, boosting its global sales and profitability.

Oil Impact Case Study:

- Boeing’s Headwind: In contrast, aviation giant Boeing faced headwinds when oil prices surged in 2018. The increased fuel costs significantly escalated Boeing’s operating expenses, squeezing its margins and eroding profits.

Interest Rate Impact Case Study:

- Tech Boom and Bust: Low interest rates fueled a surge in investment in technology companies during the late 1990s, leading to the tech boom. However, when the Federal Reserve raised interest rates in 2000, borrowing became more expensive, leading to a bust in tech valuations and a severe market downturn.

Navigating the Dynamic Forces: Strategies for Companies

In the ever-changing landscape of forex, oil, and interest rates, companies must adopt proactive strategies to mitigate risks and seize opportunities:

-

Currency Risk Management: Implementing hedging strategies, such as forward contracts or currency options, can minimize exposure to exchange rate fluctuations.

-

Fuel Portfolio Optimization: Diversifying fuel sources and exploring alternative fuels can reduce dependence on volatile oil prices.

-

Flexible Financing Mechanisms: Using a mix of debt and equity financing can help companies navigate fluctuations in interest rates by spreading their financing risk.

Impact Of Forex Oil And Interest Rate On Companies

Conclusion: Mastering Financial Tides

Forex, oil, and interest rates are forces that every company must reckon with. By understanding their interplay and adopting proactive strategies, businesses can reshape their vulnerability into a competitive advantage. Embracing the dynamic trio means expertly navigating financial tides, maximizing opportunities, and steering a course toward sustained growth and resilience.