In the dynamic and ever-evolving world of forex trading, the ability to time your trades effectively holds the key to unlocking exceptional profits. If you’re ready to elevate your trading game and gain a competitive edge, this comprehensive guide will provide you with invaluable strategies and insights on how to time your forex trades with precision. Embark on this educational journey and discover the secrets to optimizing your trades and maximizing your financial gains.

Image: aaronrodgersamazingathletimmediately.blogspot.com

Understanding Forex Market Timing

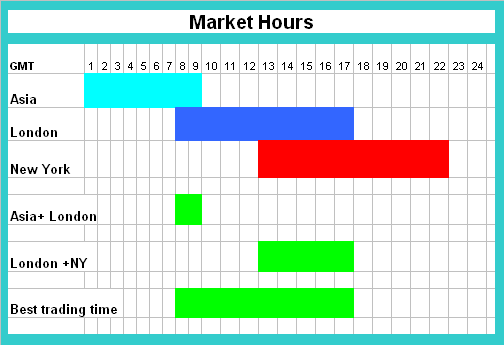

Forex market timing refers to the art of identifying the optimal entry and exit points for your trades. By choosing the right time to buy and sell, you increase your chances of profiting from market fluctuations. Unlike many other financial markets, the forex market operates 24 hours a day, offering traders ample opportunities to enter and exit trades at the most opportune moments.

Benefits of Timing Your Forex Trades

Timing your forex trades can significantly enhance your profitability. Here’s how:

-

Maximized Gains: By entering trades when market conditions are favorable, you increase your potential for substantial profits.

-

Reduced Losses: Exiting trades at the right time helps you mitigate losses and preserve your capital.

-

Increased Confidence: Successful trade timing builds confidence and allows you to make more informed and strategic decisions.

-

Emotional Control: When you have a clear understanding of the market’s direction, you’re less likely to make impulsive decisions based on fear or greed.

Fundamental Techniques for Forex Market Timing

-

Trend Analysis: Identifying and following market trends can guide your trading decisions. Trends can be identified using technical indicators such as moving averages and trendlines.

-

Support and Resistance Levels: These levels represent areas where the market has previously faced difficulty breaking through. They offer potential entry and exit points.

-

Economic Calendars: Monitoring economic events and releases can help you anticipate market movements and adjust your trades accordingly.

-

News Events: Major news events can significantly impact currency pairs. Stay informed and factor these events into your trading decisions.

-

Technical Analysis: Technical indicators and chart patterns can provide valuable insights into market momentum, overbought/oversold conditions, and potential reversals.

-

Risk Management: Proper risk management techniques, such as stop-loss orders, ensure you control your potential losses and protect your trading account.

Image: www.tradeforextrading.com

Advanced Techniques for Enhanced Results

-

Market Sentiment Analysis: Gauging market sentiment through sentiment indicators or social media analysis can provide insights into market biases and potential turning points.

-

High-Frequency Trading: Employing automated or semi-automated systems to execute trades based on specific criteria can increase trade frequency and reduce emotional interference.

-

Machine Learning and AI: Leveraging machine learning algorithms and artificial intelligence can enhance trade timing accuracy and identify patterns that are difficult to detect manually.

-

Custom Indicators: Designing and utilizing custom technical indicators tailored to your individual trading strategy can provide a competitive advantage.

Tips for Refinement

-

Learn from Experts: Study the strategies of successful traders and seek mentorship to accelerate your learning curve.

-

Practice Discipline: Consistent trade execution based on your timing strategies ensures optimal results.

-

Test Your Strategies: Backtest or forward test your timing techniques to assess their effectiveness before deploying them live.

-

Control Your Emotions: Avoid letting emotions cloud your judgment and stick to your pre-determined trading plan.

-

Seek Continuous Improvement: The forex market is constantly evolving, so stay engaged with market news and research to enhance your timing skills.

Time Your Trade In Forex Markets

Conclusion

Mastering the art of timing your forex trades is a journey that requires dedication, knowledge, and a continual pursuit of improvement. By embracing the strategies and techniques outlined in this comprehensive guide, you equip yourself with the tools and insights needed to outmaneuver market fluctuations with precision. Remember, a well-timed entry or exit can make all the difference in achieving consistent profitability.