Foreign exchange (forex) trading, the global marketplace where currencies are exchanged, has captivated traders with its allure of potential profits. However, behind the glittering facade lies a burning question: what is the true success rate in forex trading? This article embarks on a comprehensive journey to dissect this enigmatic statistic, examining the factors that influence it and offering invaluable insights into the intricacies of forex trading.

Image: forexrobotnation.com

Before delving into the elusive success rate, it is imperative to acknowledge the inherent nature of forex trading. Unlike traditional stock market investments, where companies’ financial performance provides a tangible basis for analysis, currency values in forex are influenced by a myriad of factors, including geopolitical events, economic data releases, and central bank policy decisions. This dynamic and unpredictable environment adds an element of uncertainty, making it challenging to establish a precise success rate.

The Anatomy of Forex Trading Success

Unveiling the success rate in forex trading is akin to deciphering a complex equation, where multiple variables interact to determine the outcome. These variables can be categorized into three primary spheres:

1. Trading Strategies and Knowledge

The foundation of successful forex trading lies in developing a robust trading strategy tailored to your risk tolerance and financial objectives. Whether it’s fundamental analysis, technical analysis, or a combination thereof, a well-defined strategy serves as a roadmap, guiding your trading decisions. In-depth knowledge of currency markets, macroeconomic factors, and technical indicators empowers traders to make informed and calculated trades.

2. Risk Management and Discipline

Forex trading, while exhilarating, carries inherent risks. Effective risk management practices are paramount to safeguard your capital. This entails setting clear stop-loss orders to limit potential losses, maintaining an appropriate level of leverage, and adhering to a well-defined trading plan. Discipline plays a crucial role in resisting emotional impulses and executing trades based on sound analysis.

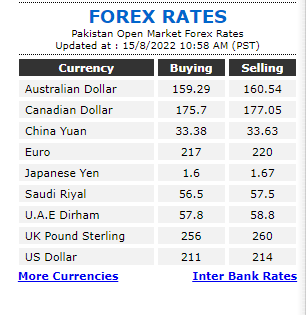

Image: dailytimes.com.pk

3. Emotional Intelligence and Mindset

The psychological aspect of forex trading cannot be overstated. Emotional biases can lead to impulsive decisions and costly mistakes. Developing emotional intelligence enables traders to manage stress, stay focused during market volatility, and avoid the pitfalls of overtrading. A positive and resilient mindset is essential for navigating the ups and downs of the forex market.

The Elusive Success Rate: Unveiling the Reality

Despite the meticulous examination of influencing factors, pinpointing an exact success rate in forex trading remains an elusive task. Studies and surveys offer estimations ranging from 10% to 30%, but these numbers should be interpreted with caution. The success rate can vary significantly depending on individual trading strategies, risk tolerance, market conditions, and the time frame considered.

It is crucial to recognize that forex trading is not a get-rich-quick scheme. Achieving consistent profitability requires dedication, continuous learning, and the ability to adapt to evolving market dynamics. Success in forex trading is a marathon, not a sprint.

Strategies to Enhance Your Success Rate

While the success rate in forex trading may be elusive, there are proven strategies to maximize your chances of achieving profitability:

- Develop a robust trading strategy: Conduct thorough research, backtest your strategies, and refine them based on market performance.

- Practice risk management: Set appropriate stop-loss levels, manage leverage wisely, and maintain a healthy risk-to-reward ratio.

- Enhance emotional intelligence: Recognize and manage your emotions, avoid impulsive trading, and maintain a positive mindset.

- Seek continuous education: Stay abreast of market developments, attend educational webinars, and read industry publications to improve your trading knowledge.

- Be patient and persistent: Forex trading requires patience and persistence. Learn from your mistakes, adjust your strategies, and stay committed to your trading goals.

What Issuccess Rate In Forex Trading

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion

The success rate in forex trading is a multifaceted concept influenced by a myriad of factors. While an exact figure remains elusive, understanding the contributing variables, adopting effective trading strategies, and cultivating emotional intelligence can significantly enhance your chances of achieving profitability. Remember, forex trading is a journey of continuous learning and self-improvement. By embracing knowledge, discipline, and a positive mental attitude, you can navigate the complexities of the forex market and unlock its potential rewards.