Have you ever pondered the intriguing world of financial markets and wondered about the differences between the Indian stock market and Forex trading? From budding investors to seasoned traders, understanding the nuances of each market can pave the way for well-informed decisions and optimal returns.

Image: tradebrains.in

In this comprehensive article, we will embark on a comparative journey between the Indian stock market and Forex. Delve into the realm of the stock exchange, and witness the ebb and flow of company shares, while navigating the complexities of currency trading in the global Forex market. By the time you finish reading, you’ll have a deeper understanding of these financial arenas and be able to make more informed choices about your investments.

The Stock Market: A Hub of Listed Companies

Imagine a vibrant marketplace where companies from various industries showcase their shares, beckoning investors to partake in their growth. This is the essence of the stock market, a regulated platform that facilitates the buying and selling of company stocks. When you purchase a stock, you essentially become a partial owner of that company, sharing in its financial journey and potential profits.

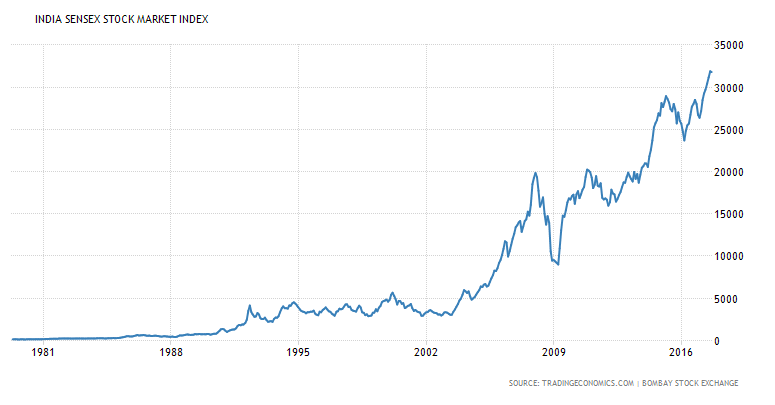

The Indian stock market, often referred to as Dalal Street, is a bustling hub of financial activity. It comprises two prominent stock exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These exchanges provide a transparent and efficient platform for investors to trade stocks from a wide spectrum of companies, including blue-chip giants, mid-caps, and small-caps.

Forex: The Realm of Currency Trading

Now, let’s shift our focus to the dynamic realm of Forex trading. This mesmerizing realm embodies the vast global market where currencies from different countries are exchanged. Unlike stock markets, Forex trading doesn’t involve purchasing shares of companies but rather entails the buying and selling of currencies in pairs, such as the Euro versus the US dollar (EUR/USD).

The Forex market is decentralized, operating 24 hours a day, 5 days a week, making it one of the most accessible and liquid financial markets globally. Traders in this market speculate on the fluctuations in currency exchange rates, aiming to profit from these movements. Forex trading demands a keen understanding of economic factors, geopolitical events, and risk management strategies.

Indian Stock Market vs Forex: A Tale of Two Worlds

To gain a clearer picture of the differences between the Indian stock market and Forex, let’s delve into a comparative analysis:

Image: ebidobyt.web.fc2.com

1. Underlying Assets:

– Stock Market: Trades in company stocks, representing ownership in businesses.

– Forex: Exchanges currencies from different countries, essentially a market for global currencies.

2. Market Structure:

– Stock Market: Organized, regulated exchanges (e.g., BSE, NSE) facilitate stock trading.

– Forex: Decentralized, over-the-counter (OTC) market, accessible through brokers.

3. Participants:

– Stock Market: Range of participants, including individual investors, mutual funds, and institutional investors.

– Forex: Broader spectrum of participants, incorporating banks, hedge funds, corporations, and retail traders.

4. Risk and Volatility:

– Stock Market: Company-specific factors and economic conditions influence stock prices, leading to varying degrees of risk.

– Forex: Highly volatile, influenced by a complex interplay of economic, political, and geopolitical factors.

5. Diversification Potential:

– Stock Market: Offers opportunities for diversification by investing in a variety of companies and industries.

– Forex: Limited diversification options compared to the stock market, as currencies tend to be correlated.

Tips for Success in the Indian Stock Market

Navigating the complexities of the Indian stock market requires a combination of knowledge, strategy, and discipline. Here are some tips for success:

1. Define Your Investment Goals:

Clearly outline your financial objectives, whether short-term gains or long-term wealth creation.

2. Conduct Thorough Research:

Study the companies in which you intend to invest, analyzing their financial performance, industry trends, and management team.

3. Build a Diversified Portfolio:

Spread your investments across different companies and sectors to mitigate risk and enhance returns.

4. Seek Professional Advice:

Consider consulting with a financial advisor or broker for personalized guidance and investment strategies.

5. Stay Informed:

Monitor market news, track company announcements, and stay abreast of economic and political developments that may impact your investments.

FAQs About Investing in India

To address any lingering queries, here are some frequently asked questions about investing in the Indian stock market:

Q: What are the tax implications of investing in the stock market?

A: Short-term capital gains (held for less than a year) are taxed at 15%, while long-term capital gains (held for over a year) are taxed at 10%. Dividends received from Indian companies are also taxable.

Q: Is it safe to invest in the Indian stock market?

A: The Indian stock market is generally considered safe and well-regulated by the Securities and Exchange Board of India (SEBI). However, all investments carry some level of risk, and it’s essential to conduct thorough research before investing.

Q: What are the best stocks to invest in India?

A: Identifying the best stocks to invest in requires extensive research and consideration of factors such as financial performance, industry outlook, and management strength. Consult with financial advisors or research analysts to make informed decisions.

Indian Stock Market Vs Forex

Conclusion

The Indian stock market and Forex present distinct investment opportunities with unique characteristics, risks, and rewards. Understanding the nuances of each market is paramount for making informed decisions that align with your financial goals and risk tolerance. By carefully considering the analysis and tips outlined in this article, you can enhance your investment journey and potentially reap the benefits of these dynamic financial arenas.

So, are you ready to embrace the thrilling world of financial markets? Dive into the depths of the Indian stock market or navigate the global currency exchange landscapes of Forex. The choice is yours. With knowledge as your compass and a strategic approach as your guide, you can confidently venture into these exciting realms and strive for financial success.