In the ever-evolving realm of foreign exchange, traders seeking to navigate the turbulent waters of the currency market must possess a comprehensive understanding of its intricacies. Among the foundational pillars underpinning forex trading lies the concept of “structure level,” a crucial aspect that lays the groundwork for informed decision-making and potentially profitable trades.

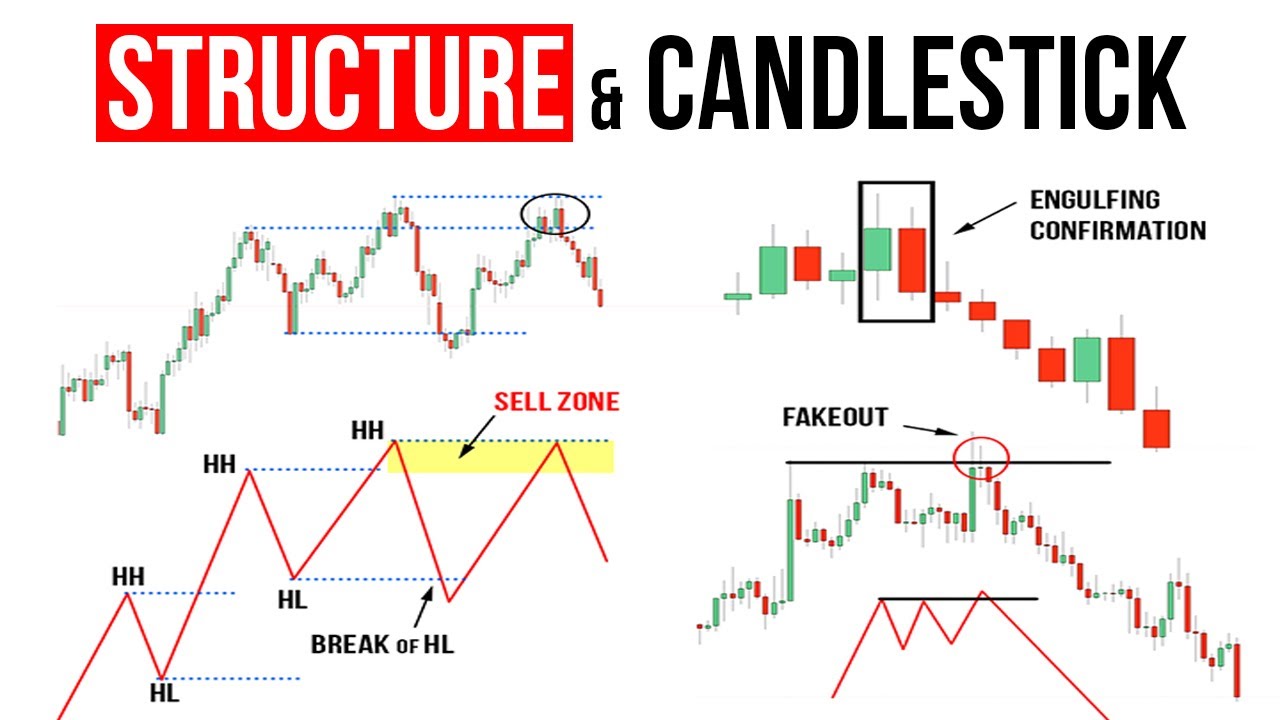

Image: www.youtube.com

Structure level denotes an area of the currency pair chart characterized by regions of consistent support and resistance, representing potential zones where price changes direction. Delineating these levels involves identifying pivot points, areas where the price action reverses direction, establishing levels of significance. These levels serve as crucial markers, guiding traders in predicting future price movements and adjusting their trading strategies accordingly.

The Anatomy of Structure Levels

Identifying structure levels requires a keen eye for price action analysis, examining candlestick patterns, and comprehending the forces shaping supply and demand. By deciphering these factors, traders uncover the structure of a currency pair’s price movements, unveiling areas where prices tend to pause, retrace, or reverse.

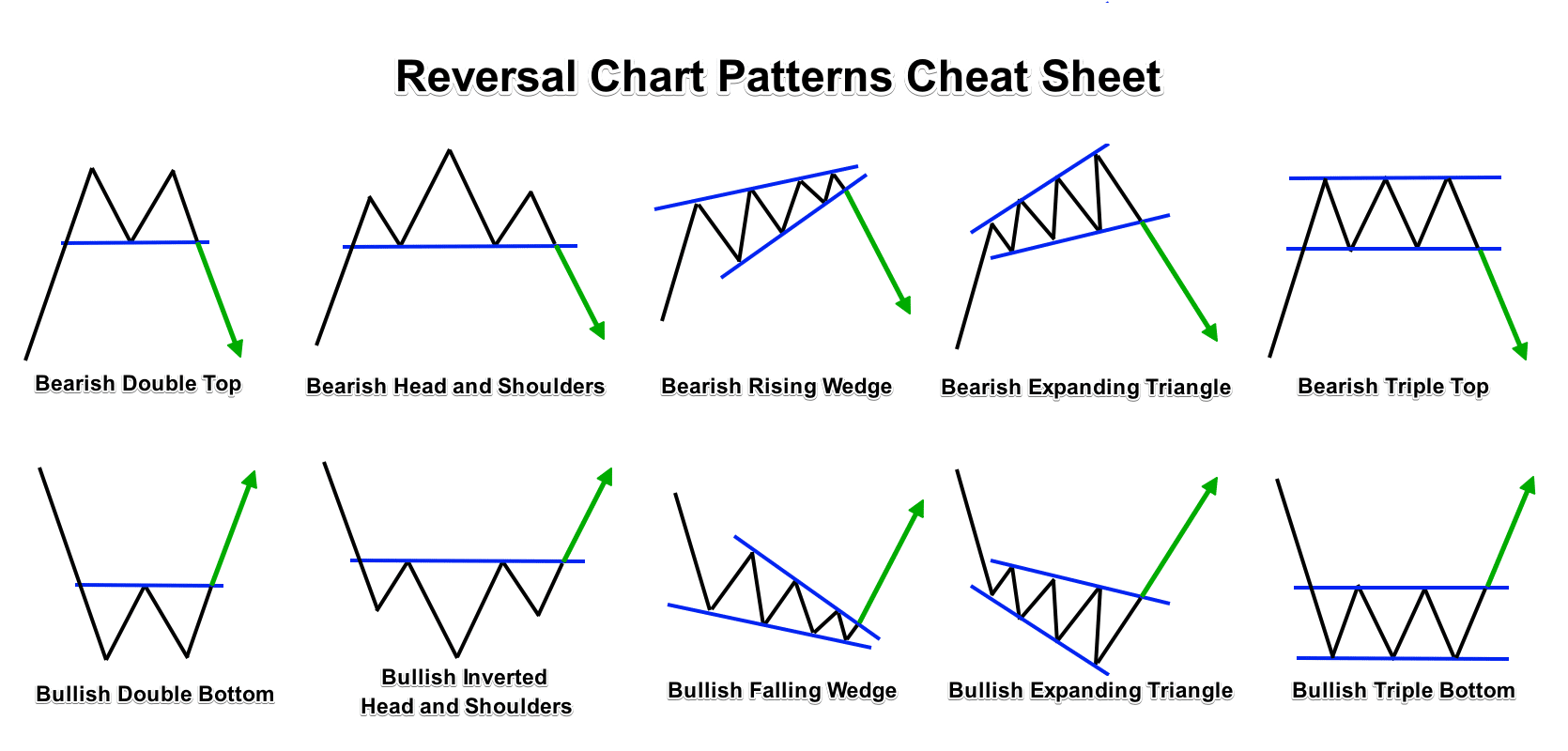

Support levels emerge when market participants demonstrate a willingness to buy at a specific price, preventing further declines. Resistance levels, on the other hand, denote areas where market participants exhibit a propensity to sell, thwarting further appreciation. These levels create boundaries within which price action fluctuates, providing essential references for traders.

Exploiting Structure Levels for Profitable Trades

Discerning structure levels empowers forex traders with a formidable advantage, allowing them to make informed decisions regarding entry and exit points. When price approaches a support level, traders can contemplate taking long positions, anticipating a reversal and subsequent price increase. Conversely, when price nears a resistance level, traders might consider going short, expecting a decline.

Identifying structure levels also aids in determining proper risk management strategies. Stop-loss orders can be strategically placed below support or above resistance levels, minimizing losses in the event of an unfavorable price movement. By incorporating structure levels into their trading arsenal, traders bolster their ability to mitigate risk and optimize their trading outcomes.

Evolving Structure Levels: Embracing Dynamic Markets

Forex markets are inherently dynamic, constantly influenced by geopolitical events, economic news, and market sentiment. As such, structure levels are not static but rather evolve in accordance with these evolving market conditions. Traders must remain vigilant in monitoring price action, adjusting their structure level assessments as necessary to stay abreast of the ever-changing market dynamics.

Image: howtotrade.biz

What Is Structure Level In Forex

Conclusion: Empowering Forex Traders with Structure Level Mastery

For forex traders seeking to harness the power of the market, comprehending and leveraging structure levels is an invaluable skill. By understanding the significance of these levels, traders can decipher the language of price action, identifying areas of potential price reversals and making educated decisions. This knowledge empowers traders to navigate the complexities of the forex market, increasing their chances of unlocking profitable trading opportunities. As the ever-evolving nature of the market dictates, staying abreast of dynamic structure levels will prove indispensable in their pursuit of trading success.