Introduction

In the ever-evolving forex market, effective trading strategies hold the key to success. Amidst the array of technical analysis tools, pivot points have emerged as a powerful indicator, offering traders a structured approach to identifying potential support and resistance levels. Understanding how to trade pivot points forex is crucial for traders seeking to navigate the volatile market with precision and confidence. This comprehensive guide unlocks the secrets of pivot point trading, empowering you with the knowledge and skills to leverage this invaluable tool and maximize your profits.

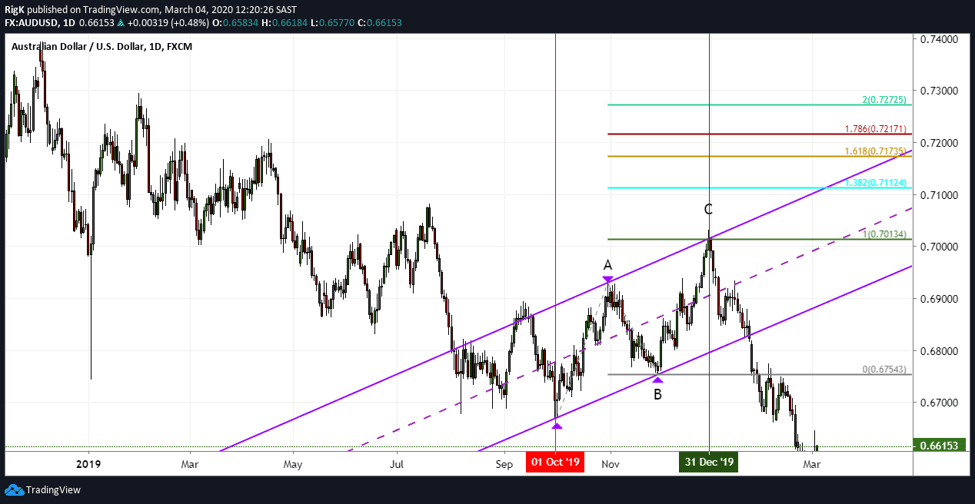

Image: forexrobotfreedownloadsoftware.blogspot.com

In essence, pivot points serve as dynamic reference points that serve as potential turning points in the market. Developed by floor traders, these levels represent areas where the market has previously found support or resistance, providing valuable insights into potential price movements. Harnessing the power of pivot points, forex traders can make informed decisions about entry and exit points, aiming to capture profitable trades while minimizing risk.

Understanding Pivot Point Calculations

The foundation of pivot point trading lies in their calculation. Several methods exist, each with its own interpretation and significance. The most common type of pivot point, known as the Classic Pivot Point, is calculated using the following formula:

Pivot Point (P) = (High + Low + Close) / 3

Based on this central pivot, additional support and resistance levels can be derived. These levels include:

- Support Levels: S1 = (P – (High – Low)), S2 = (P – 2(High – Low)), S3 = (P – 3(High – Low))

- Resistance Levels: R1 = (P + (High – Low)), R2 = (P + 2(High – Low)), R3 = (P + 3(High – Low))

Identifying Support and Resistance Levels

Pivot points serve as pivotal indicators, highlighting zones where the market may find support or resistance. Support levels signal potential areas where the downtrend may encounter a pause or reversal, inviting traders to consider buying positions. Conversely, resistance levels indicate areas where the uptrend may stall or reverse, prompting traders to explore selling opportunities. Recognizing these levels empowers traders to anticipate market movements, enabling them to execute informed trades.

Implementing Pivot Point Strategies

Armed with the knowledge of identifying pivot points, traders can strategize and implement profitable trading approaches tailored to their individual risk tolerance and trading style. Some common pivot point trading strategies include:

- Trading Breakouts: Identifying breakouts above resistance levels or below support levels can provide entry points for promising trades. These breakouts often signal the start of new market trends and offer opportunities for substantial gains.

- Retesting Pivot Levels: When the market price retests a broken pivot level, it can serve as a confluence signal, suggesting a high probability trade. If the market successfully retests a broken support level, it often signifies a reversal in bullish momentum, presenting a potential selling opportunity. Similarly, if the market retests a broken resistance level, it may indicate a reversal in bearish momentum, hinting at a potential buying opportunity.

- Conservative Approach: Conservative traders may prefer to enter trades only after a confirmed breakout and a subsequent retest of a pivot level, seeking higher probabilities of success.

Image: www.asktraders.com

Advanced Pivot Point Techniques

Seasoned traders may venture into advanced pivot point techniques to refine their strategies. These techniques include:

- Fibonacci Extensions: Integrating Fibonacci extensions with pivot points can enhance the accuracy of identifying potential target prices and profit-taking levels. Fibonacci extensions provide additional insights, helping traders determine where the market might extend after breaking a pivot level.

- Volume Analysis: Considering volume data alongside pivot points can provide valuable validation. Higher volume during a breakout or retest can increase the likelihood of a successful trade.

- Multiple Timeframes: Analyzing pivot points on multiple timeframes can offer a comprehensive perspective of market trends. Identifying pivot points on higher timeframes, such as the daily or weekly charts, can reveal significant support and resistance levels that are likely to have a strong influence on lower timeframes.

How To Trade Pivot Points Forex

https://youtube.com/watch?v=9gVgmfLsGTQ

Conclusion

Mastering the art of pivot point trading empowers forex traders with a valuable tool for analyzing market behavior and identifying potential trading opportunities. By understanding pivot point calculations, recognizing support and resistance levels, and implementing effective strategies, traders can gain a competitive edge in the ever-changing forex market. Employing advanced pivot point techniques and heuristics can further refine trading strategies, enhancing profit potential. Whether you are a seasoned trader or a novice seeking to enhance your trading skills, incorporating pivot points into your analysis and trading approach can unlock new avenues for success in the dynamic world of forex trading.