Headline: Unveiling the Secrets of Pivot Point Analysis: A Game-Changing Guide to Forex Success**

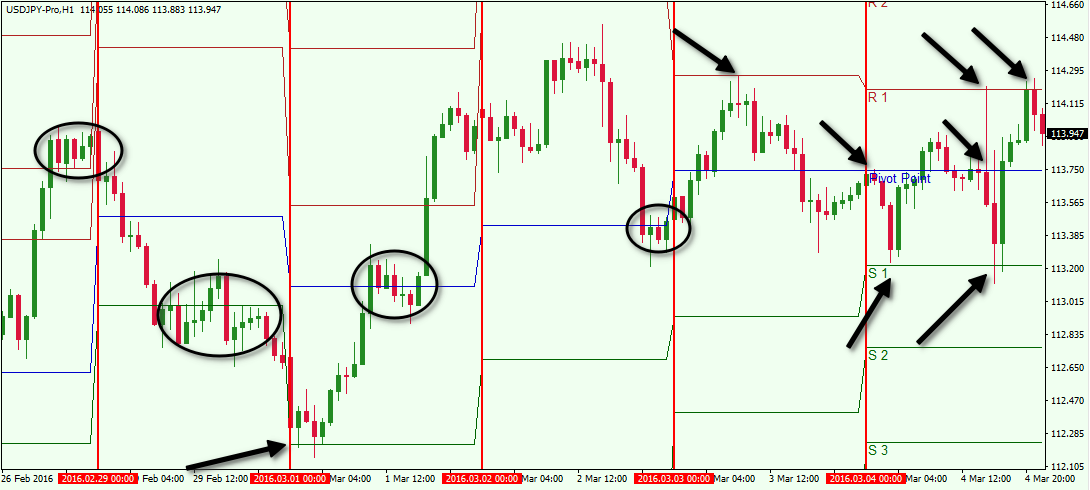

Image: faqogumypoze.web.fc2.com

Introduction:

In the ever-evolving landscape of forex trading, unlocking reliable and profitable strategies is akin to finding a hidden treasure. One such gem is pivot point analysis, a powerful technical tool that can transform your trading experience. It empowers traders with valuable insights into support and resistance levels, enabling them to pinpoint potential turning points in the market.

Delving into the Essence of Pivot Points

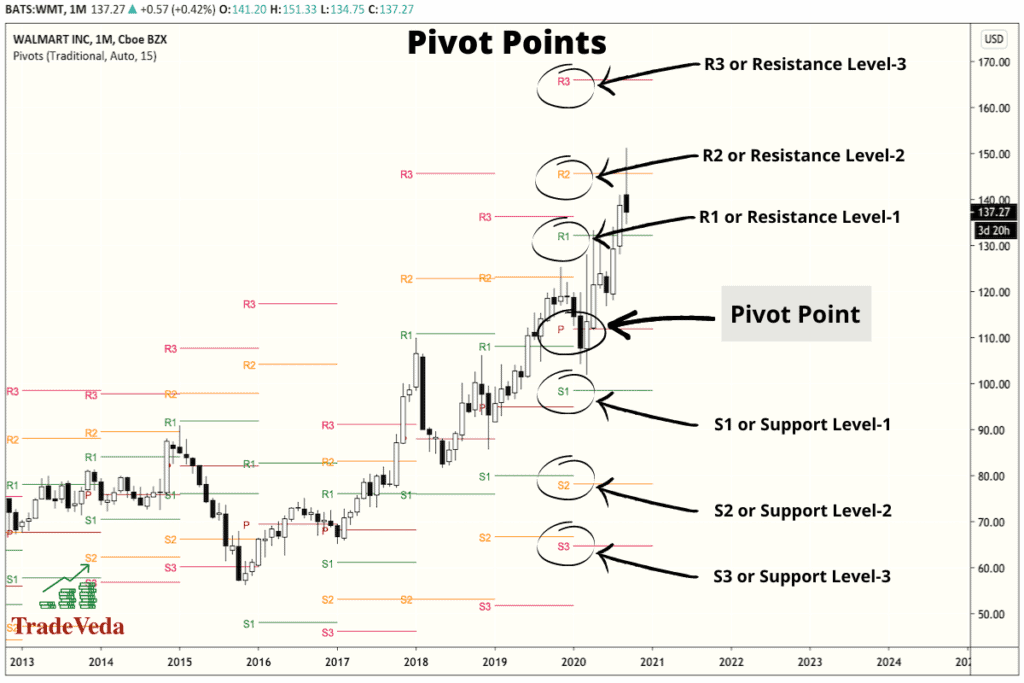

Pivot points are mathematical calculations derived from a security’s previous trading range. They serve as magnets that attract price and can predict future market movements. By understanding how to identify and utilize pivot points, traders can gain an edge over market fluctuations and optimize their trading decisions.

The Power of Psychological Levels:

Pivot points aren’t merely numerical values; they also represent psychological levels where traders tend to place orders. Market participants subconsciously gravitate towards these levels, forming areas of support and resistance. By recognizing these crucial areas, traders can anticipate price behavior and make informed trading decisions.

Step-by-Step Guide to Calculating Pivot Points

Calculating pivot points is a straightforward process, requiring only a few simple formulas. The Classic Pivot Point formula serves as the foundation:

Pivot Point = (High Price + Low Price + Close Price) / 3

Support and Resistance Levels:

From the pivot point, traders can derive support and resistance levels that guide price movements. Support levels are areas where buyers step in and prevent further price declines, while resistance levels are areas where sellers take control, restricting price increases. These levels provide traders with precise targets and risk management strategies.

Trading with Pivot Points

Armed with the knowledge of pivot points, traders can implement various trading strategies. One common approach involves buying above the pivot point and selling below it. Traders can also fine-tune their strategies by identifying multiple pivot points and combining them with other technical indicators for enhanced confirmation.

Expert Insights

“Pivot point analysis is an invaluable tool that provides an objective framework for analyzing market behavior,” says renowned forex trader and author, Mark Fisher. “Its simplicity and effectiveness make it accessible to both novice and experienced traders alike.”

Actionable Tips

- Leverage pivot points to identify potential buy and sell zones.

- Combine pivot point analysis with other technical indicators to enhance accuracy.

- Practice using pivot points in a demo account before implementing them in your live trading.

Conclusion:

Mastering pivot point analysis empowers traders with valuable insights into market behavior, allowing them to navigate forex trading with increased confidence and success. By utilizing the concepts discussed in this article, traders can unlock the door to a world of potential profits and enhance their trading skills. Remember, the financial markets are dynamic and constantly evolving, so it’s crucial to stay abreast of the latest trends and strategies to remain competitive.

Image: tradeveda.com

Pivot Point Analysis In Forex Trading