In the dynamic world of foreign exchange (forex) trading, managing risk is paramount. One effective strategy for mitigating potential losses and enhancing overall profitability is margin hedging. This technique involves employing multiple positions on different currency pairs that are inversely correlated, effectively offsetting risk and safeguarding capital.

Image: homecare24.id

Understanding Margin Hedging: A Balancing Act

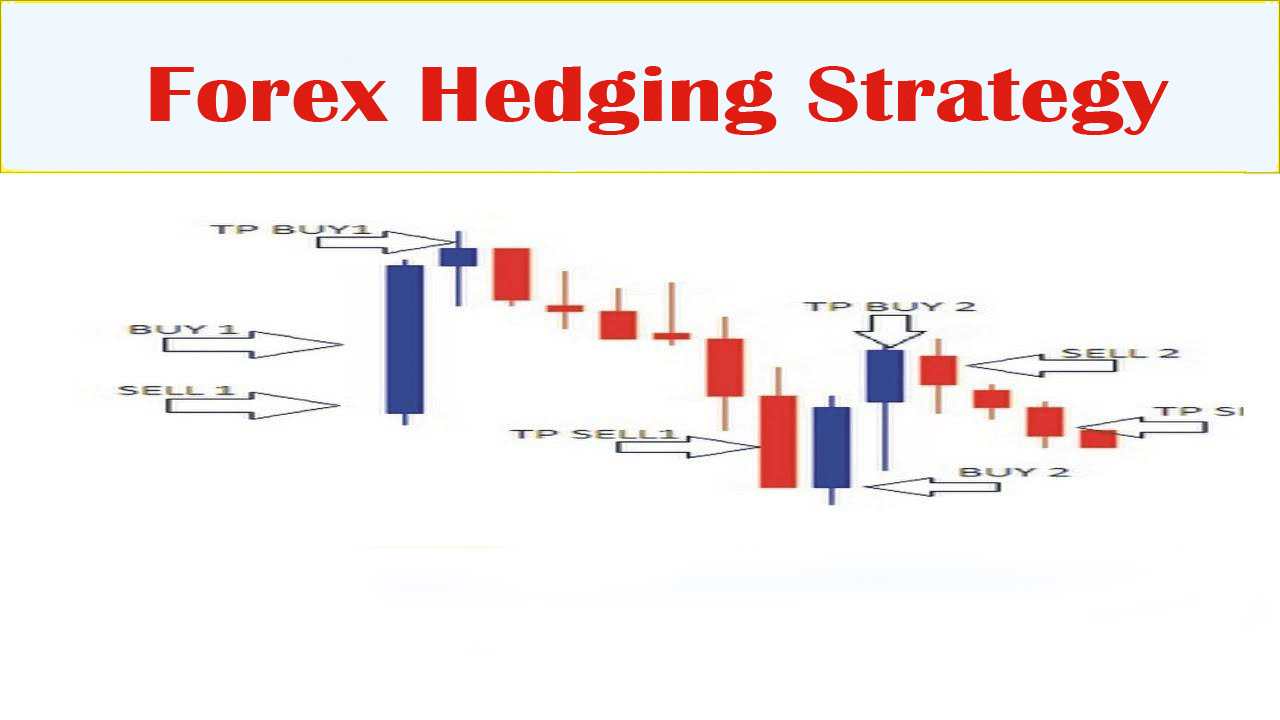

Margin hedging in forex is akin to striking a balance on a see-saw. By establishing opposing positions, one can counter the fluctuations of the market, minimizing the impact of adverse price movements on individual trades. Margin hedging strategies allow traders to maintain exposure to the forex market while mitigating the risk associated with any individual trade.

Elements of Margin Hedging

-

Selection of Inversely Correlated Pairs

The cornerstone of margin hedging lies in the careful selection of currency pairs that exhibit inverse correlation. For instance, if the EUR/USD pair is rising, it’s likely that the USD/JPY pair will be falling. By combining these two opposing positions, a trader can neutralize the fluctuations and limit overall risk.

-

Image: howtotradeonforex.github.ioHedging Ratio

Determining the appropriate hedging ratio is critical for successful margin hedging. This ratio represents the proportion of one position to the other. The ideal ratio depends on the correlation between the chosen pairs and the trader’s tolerance for risk.

-

Monitoring and Adjustments

Margin hedging is a dynamic process that requires ongoing monitoring and periodic adjustments. As market conditions evolve, the correlation between currency pairs can fluctuate, necessitating revisions to the hedging ratio to maintain the desired level of risk mitigation.

Advantages of Margin Hedging

-

Risk Mitigation

The primary advantage of margin hedging is its ability to reduce risk substantially. By offsetting the gains and losses of opposing trades, traders can limit their exposure to market volatility and safeguard their capital.

-

Capital Preservation

Margin hedging enables traders to preserve their capital for future trading opportunities. By mitigating risk, they minimize the likelihood of incurring significant losses that could disrupt their trading strategy.

-

Enhanced ROI

While margin hedging primarily focuses on risk management, it can also contribute to enhanced ROI in stable market conditions. By eliminating the impact of short-term market fluctuations, it allows traders to hold positions longer, potentially capturing greater profits over time.

Pitfalls to Avoid

-

Incorrect Pair Selection

Selecting currency pairs that are not truly inversely correlated can undermine the effectiveness of margin hedging, exposing traders to unnecessary risk.

-

Over-Hedging

Excessively hedging positions can limit profit potential and reduce overall returns. Traders should carefully consider the appropriate hedging ratio to avoid over-mitigating risk.

-

Commission Costs

Executing multiple hedging trades can accumulate commissions over time, impacting profitability. Traders need to factor in these costs when evaluating their hedging strategy.

What Is Margin Hedge Forex

https://youtube.com/watch?v=8LZ8UrboyWU

Conclusion

Margin hedging is a valuable tool for skilled forex traders, providing a means to mitigate risk and enhance capital protection. By carefully selecting and monitoring inversely correlated currency pairs, maintaining an appropriate hedging ratio, and avoiding common pitfalls, traders can implement margin hedging strategies that complement their trading approach, bolster their risk management capabilities, and ultimately increase their likelihood of long-term success in the dynamic forex markets.