Unlock the Secrets of Profitable Trading with Real-Time Market Guidance

In the fast-paced world of foreign exchange trading, quick and decisive action separates success from failure. Forex indicator buy sell signals provide an invaluable advantage to traders, offering real-time insights into market movements and pinpointing potential profit opportunities. This guide will delve into the depths of forex indicator buy sell signals, arming you with the knowledge and strategies to unlock consistent profits.

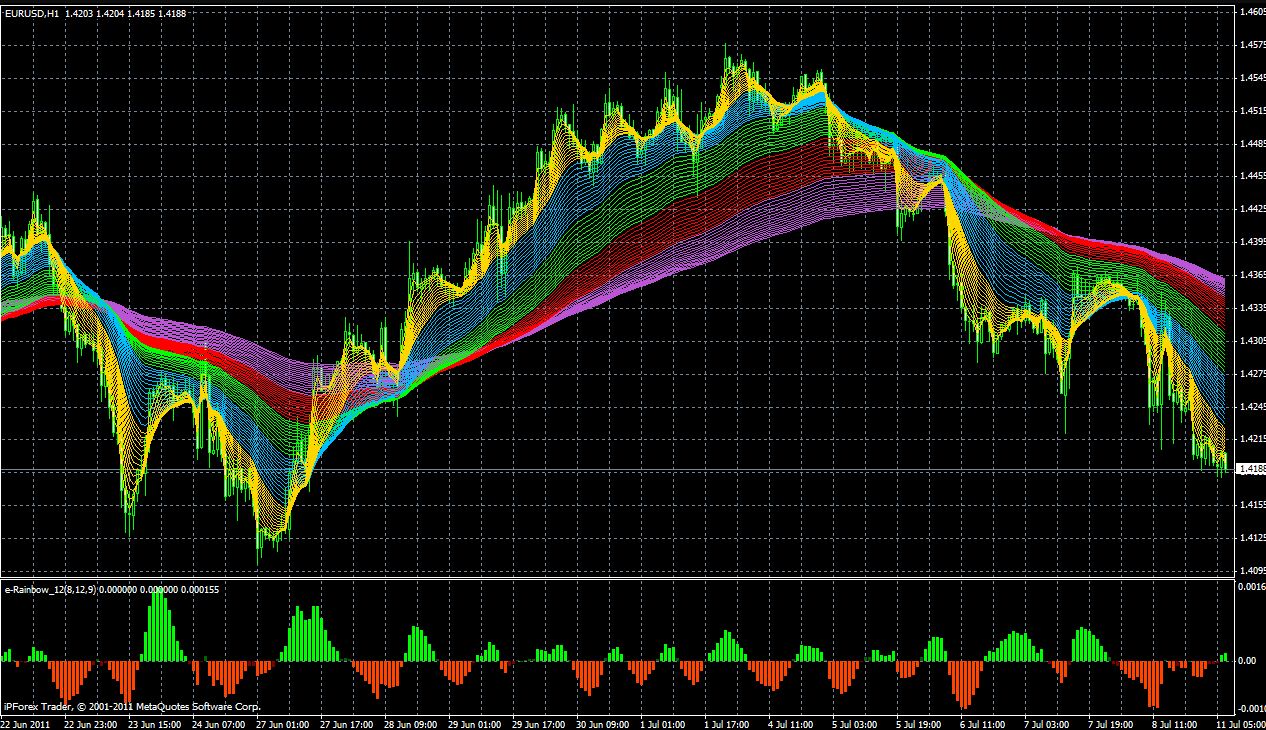

Image: www.ivtcapital.com

What are Forex Indicator Buy Sell Signals?

Forex indicator buy sell signals are automated or manual alerts that suggest when to enter or exit a trade based on specific technical indicators. These indicators analyze historical price data and market patterns to identify favorable trading conditions, such as overbought or oversold levels, potential price reversals, and breakouts. By relying on objective data, forex indicators can remove the guesswork from trading and increase the likelihood of profitable outcomes.

The Power of Forex Buy Sell Signals

- Increased Profitability: Forex indicator buy sell signals provide guidance on optimal entry and exit points, maximizing profit potential and reducing losses.

- Enhanced Confidence: When backed by real-time market analysis, traders can approach trades with increased confidence, knowing they are supported by objective data.

- Time Efficiency: Forex indicators automate the technical analysis process, saving traders valuable time that can be dedicated to other market-related tasks.

- Improved Risk Management: By identifying overbought or oversold levels, forex indicator buy sell signals help traders manage risk effectively and avoid potentially hazardous trades.

Types of Forex Indicator Buy Sell Signals

Forex indicator buy sell signals can be classified into two main categories:

- Technical indicators: Rely on historical price data and market patterns to generate signals, including moving averages, Bollinger Bands, and Relative Strength Index (RSI).

- Fundamental indicators: Consider economic data and news events that may impact market movements, such as Gross Domestic Product (GDP), interest rates, and unemployment.

Each type of forex indicator buy sell signal has its strengths and weaknesses. By understanding how they work and combining them effectively, traders can increase their chances of success.

Image: forexpops.com

Strategies for Using Forex Indicator Buy Sell Signals

To harness the full power of forex indicator buy sell signals, it is essential to develop sound trading strategies. Two prevalent approaches are:

- Trend following: Buy sell signals generated by trend indicators, such as moving averages and Ichimoku clouds, point to potential trade entries or exits in established market trends.

- Counter-trend trading: Oscillator indicators, such as RSI and Stochastic Oscillator, identify market overbought or oversold conditions, signaling opportunities to enter trades against the prevailing trend.

Forex Indicator Buy Sell Signals

https://youtube.com/watch?v=99LcmuZKr-k

Conclusion:

Equipped with the knowledge of forex indicator buy sell signals, you have unlocked a potent weapon in the pursuit of profitable trading. By leveraging real-time market analysis, you can enhance your accuracy, boost your returns, and manage your risks with confidence. Remember to approach trading with a sound strategy, diligent research, and unwavering discipline. The Forex markets beckon, embrace the guidance of forex indicator buy sell signals, and seize the profit-making opportunities that await you.