Managing foreign exchange in international businesses often involves cross-border transactions, leading to fluctuations in receivables and payables denominated in foreign currencies. One effective strategy for mitigating currency risks is to offset foreign receivables with foreign exchange payables, which can have significant benefits for businesses.

Image: www.forexfactory.com

**The Art of Offsetting**

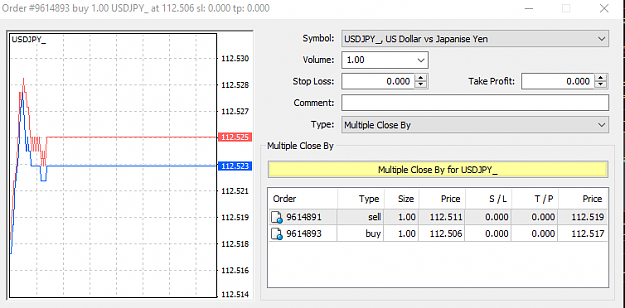

Setting off foreign receivables against forex payables involves matching foreign currency-denominated receivables, which are amounts owed to the business by foreign customers, with forex payables, which are amounts owed to foreign suppliers or creditors. Matching these opposing transactions allows businesses to reduce their exposure to foreign currency exchange rate fluctuations, potentially reducing losses and protecting profits.

**How Offsetting Works**

When a business has a foreign receivable, such as an invoice from a foreign customer, it typically records the receivable using the foreign currency exchange rate prevailing on the transaction date. If the foreign currency appreciates against the local currency, the business gains value when it eventually collects the receivable. However, if the foreign currency depreciates, the business faces a foreign exchange loss.

Conversely, when a business incurs a forex payable, such as an invoice from a foreign supplier, it typically records the payable using the foreign currency exchange rate prevailing on the transaction date. If the foreign currency depreciates against the local currency, the business gains value as the value of the payable decreases. However, if the foreign currency appreciates, the business faces a foreign exchange loss.

By offsetting foreign receivables against forex payables, businesses can reduce the net impact of foreign exchange fluctuations. For example, if a business has a foreign receivable of $100,000 and an equivalent forex payable of $100,000, any potential foreign exchange gains or losses realized from these transactions would essentially net each other out, reducing the business’s overall currency risk.

**Benefits of Offsetting**

- **Reduced Currency Risk:** Offsetting foreign receivables with forex payables helps mitigate the impact of foreign exchange fluctuations, providing stability to business operations.

- **Improved Cash Flow:** By eliminating the need to convert foreign currency balances into local currency, businesses can improve their cash flow position and reduce transaction costs.

- **Enhanced Financial Performance:** Reducing foreign exchange risks can improve financial performance, making the business more resilient during periods of currency volatility.

Image: www.youtube.com

**Expert Advice**

To effectively implement an offsetting strategy, businesses should consider the following expert advice:

- **Regular Monitoring:** Monitor foreign currency exchange rates closely and regularly adjust offsetting positions to maintain optimal risk mitigation.

- **Consider Hedging Tools:** Supplement offsetting with hedging tools, such as forward contracts or options, to further reduce currency risk exposure.

- **Account for Tax Implications:** Seek professional advice regarding the tax implications of offsetting transactions in different jurisdictions.

**FAQ**

**.Q: What is the key difference between an offsetting transaction and a netting transaction?**

**A:** An offsetting transaction pairs a receivable with a payable, while a netting transaction combines multiple receivables and payables into a single balance, usually at the end of a reporting period.

**.Q: Can businesses offset foreign receivables and forex payables denominated in different currencies?**

**A:** Yes, but it requires converting one currency into the other at the prevailing exchange rate.

**.Q: How can businesses benefit from offsetting cross-border transactions?**

**A:** Reducing foreign exchange risk, improving cash flow, enhancing financial performance, streamlining accounting, and consolidating reporting.

Setoff Foreign Receivable To Forex Payable

https://youtube.com/watch?v=TVzIbM5nzB4

**Conclusion**

Setting off foreign receivables against forex payables is a valuable strategy that can mitigate currency risks, enhance cash flow, and improve financial performance. By leveraging offsetting techniques and adhering to expert advice, businesses can optimize their foreign exchange management and navigate the complexities of international trade.

Are you interested in learning more about offsetting foreign receivables with forex payables? Share your questions or thoughts in the comments below.