In the ever-evolving tapestry of global finance, the ripple effects generated by the Federal Reserve (Fed) decisions and policy shifts reverberate throughout the currency markets. Understanding the intricacies of what the Fed says and does is fundamental for those seeking to navigate the dynamic arena of forex trading. It’s akin to decoding a secret language, a language pregnant with potential profits or losses.

Image: seekingalpha.com

A pivotal player in the global economy, the Fed wields significant power over the world’s most dominant currency, the US dollar. The stewardship of the US dollar’s value and the direction of the US economy are entrusted to this esteemed institution, making its every word and action the subject of intense scrutiny within and beyond the financial community.

Unraveling the Fed’s Impact on Forex Markets

The Fed’s sphere of influence stretches far and wide, exerting a profound impact on currency valuations and forex market patterns. Join us as we embark on a journey to demystify the Fed’s modus operandi and its ramifications for forex traders:

Interest Rate Decisions: The Heartbeat of Currency Markets

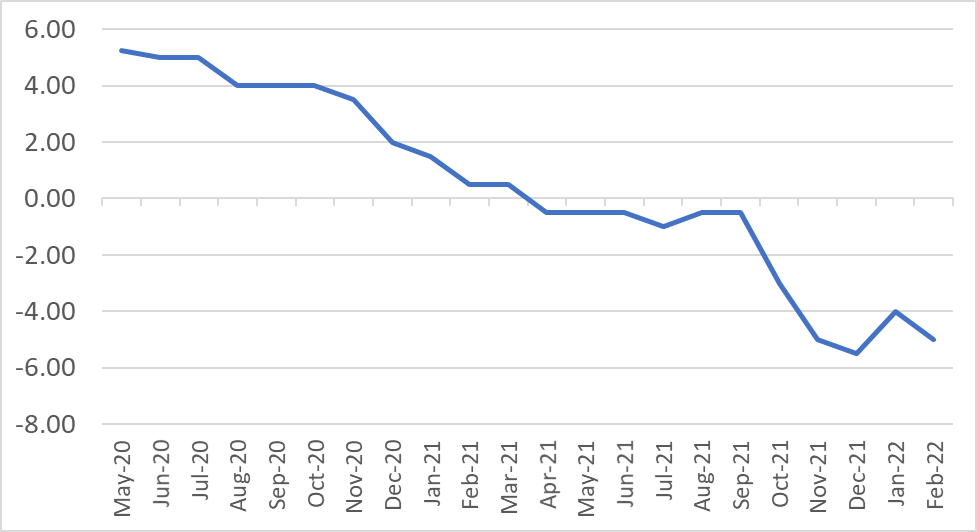

Interest rates, the cornerstone of monetary policy, are the cost of borrowing money. When the Fed decides to raise or lower interest rates, it sends ripples through the financial landscape, influencing exchange rates.

Rate Hikes: A Dollar Boost

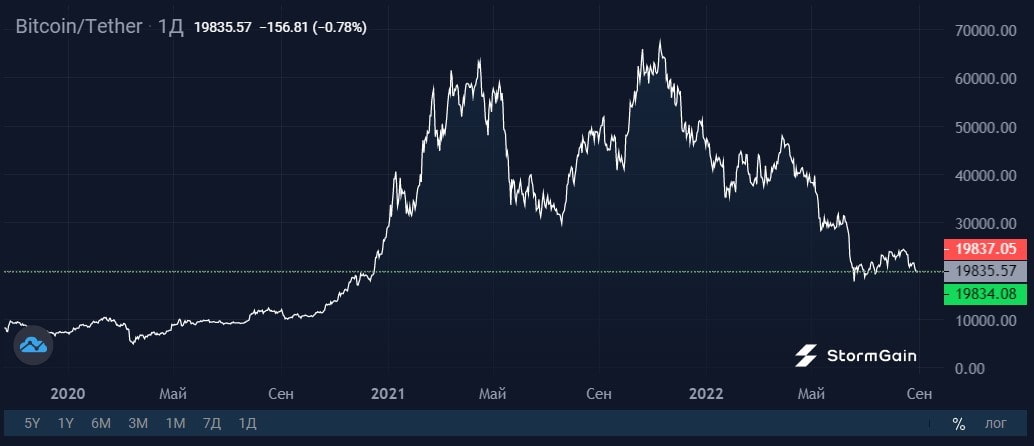

When it’s time to tame rampant inflation or curb economic overheating, the Fed raises rates. This makes borrowing more expensive, attracting foreign capital seeking higher yields. The influx of foreign investment bolsters the demand for the US dollar, pushing up its value against other currencies.

Image: stormgain.com

Rate Cuts: Dollar Devaluation

To stimulate economic activity during times of recession or sluggish growth, the Fed lowers rates. The cheaper cost of borrowing encourages spending and investment, but it also dents the dollar’s appeal as a high-yield investment. Foreign investors withdraw their money, leading to a depreciation of the US dollar.

Quantitative Easing and Quantitative Tightening: Expanding and Shrinking the Money Supply

In times of financial distress, the Fed deploys extraordinary measures like quantitative easing (QE). QE involves purchasing vast quantities of government bonds and mortgage-backed securities, injecting liquidity into the financial system. By increasing the supply of money, QE weakens the currency’s value.

Quantitative tightening (QT), on the other hand, is the Fed’s tool for reversing the effects of QE and reining in inflation. By reducing its bond holdings, the Fed takes money out of circulation, raising interest rates and bolstering the currency’s value.

Fed Communication: A Symphony of Subtlety

The Fed’s decisions are not made in isolation, and understanding the nuances of its communication is paramount. Fed officials regularly release economic assessments, give speeches, and hold press conferences to convey the central bank’s stance and policy intentions.

Traders pay rapt attention to these communications, scrutinizing each word for hidden signals that could sway currency markets. A hawkish tone, signaling a more aggressive approach to tightening, tends to strengthen the dollar. Conversely, a dovish tone, suggesting a cautious approach to rate hikes or QE, usually weakens the dollar.

Global Interplay: When the World Responds to the Fed

The Fed’s actions not only impact the US economy and currency but also trigger reactions in global financial markets. Other central banks often adjust their own policies in response to the Fed’s moves, influencing exchange rates in a complex web of interconnections.

For instance, if the Fed raises rates and other central banks follow suit, the relative attractiveness of different currencies may shift, affecting currency pairs. The resulting adjustments in capital flows can fuel further volatility in forex markets.

Seizing Forex Opportunities with Fed Awareness

By attuning yourself to the Fed’s machinations and global market responses, you can gain a competitive edge in the dynamic world of forex trading. Here’s how:

What Is Fed In Forex News

https://youtube.com/watch?v=eJYDXBCe-vk

Conclusion: The Fed as Market Maestro

The intricacies of the Fed’s decisions and global policy shifts present both challenges and opportunities for those seeking to navigate the ebb and flow of forex markets. By demystifying the language of central banking and understanding the wider implications of Fed actions, you equip yourself with the knowledge to exploit market movements and enhance your trading performance.

Always remember, the financial markets are ever-evolving, and no strategy guarantees success. However, embracing a proactive approach, grounded in thorough research and a keen eye on the Fed’s machinations, can set you on the path to a more informed and potentially lucrative forex trading journey.