If you’re entering the currency market, understanding the concept of “covering the exposure” in forex (foreign exchange) is crucial. It’s a strategy used to offset potential losses in currency exchange rate fluctuations. As you trade in forex, you’re essentially betting on the value of one currency against another, and when these exchange rates shift rapidly, you may suffer financial losses if you haven’t covered your exposure effectively.

Image: www.studocu.com

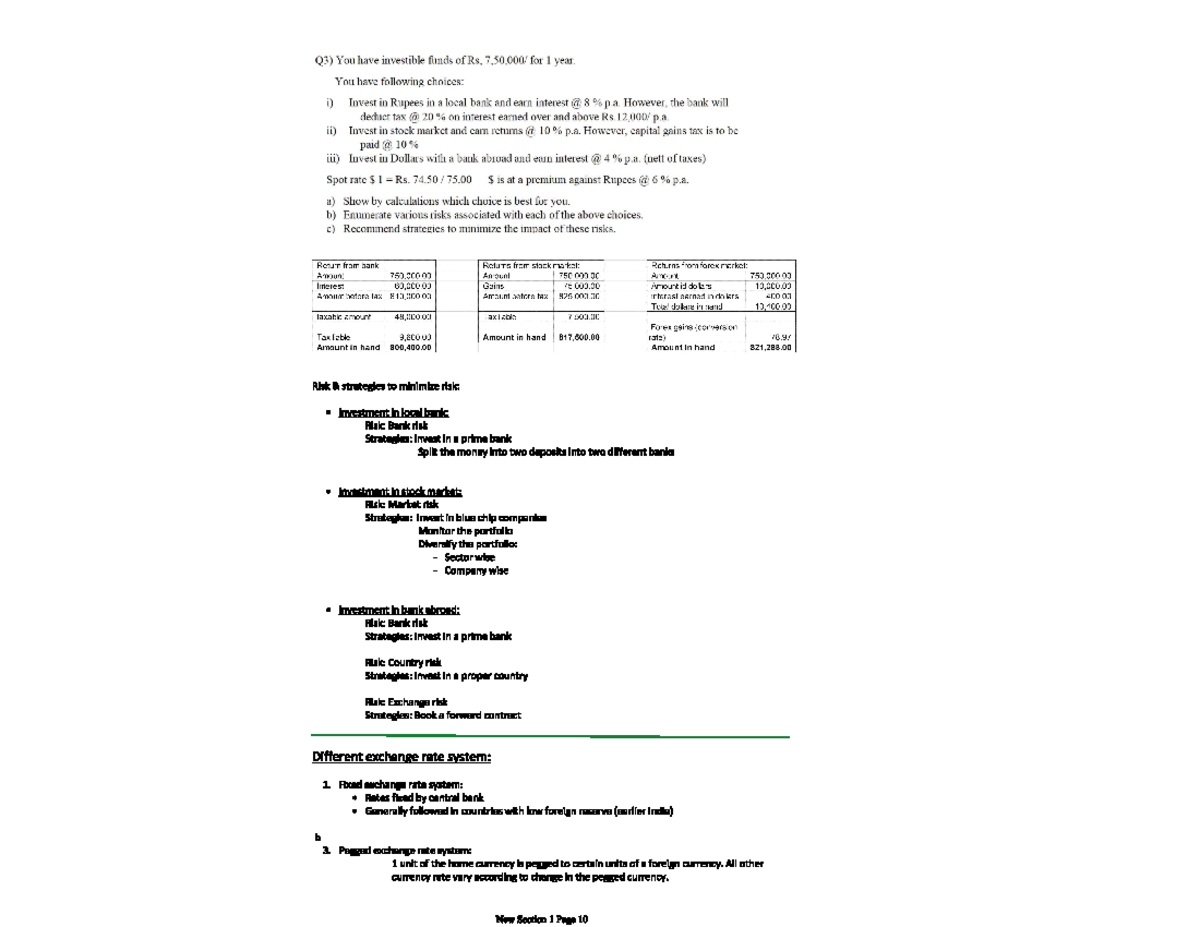

Managing Currency Fluctuations

Exchanges in the global market can have significant effects on the value of currencies, especially considering geopolitical events, economic changes, and market sentiments. Given how the value of one currency can fluctuate against another, businesses and individuals engaged in forex assume a level of risk. Covering the exposure helps reduce these uncertainties – ensuring stability in your financial transactions.

There are essentially two options to mitigate this risk:

- Hedging: Through counterbalancing trades or financial instruments, hedging allows traders to secure their preferred exchange rates. These transactions are usually short-term, specifically designed to protect against unexpected exchange rate movements.

- Natural Hedging: This strategy uses financial assets that complement each other – their movements often offsetting one another. By strategically pairing certain assets like commodities with currencies, the trader can balance out any potential risks.

Practical Implementation

In practice, covering the exposure involves forecasting future exchange rate movements. This forms the basis for deciding whether to initiate hedging or natural hedging strategies. For instance, if you anticipate the Euro strengthening against the US dollar, you could purchase Euro futures. If your prediction is accurate, the profit from the futures contract will offset any losses incurred from the depreciating dollar.

Natural hedging, on the other hand, draws on knowledge about the correlation between different asset classes. For example, if you’re an exporter based in the US but selling to Europe, you may face risks from fluctuations between the dollar and the Euro. By investing in Euro-denominated bonds, the potential losses from a weaker dollar are balanced as the bond value increases with a stronger Euro.

Benefits of Covering the Exposure

Implementing an effective exposure management strategy is crucial for several reasons:

- Risk Mitigation: Covering the exposure minimizes potential losses resulting from currency fluctuations.

- Enhanced Predictability: It provides a framework for predicting financial outcomes and decision-making.

- Cost Savings: Effective exposure management can reduce the expenses incurred due to exchange rate risks.

- Improved Cash Flow: Mitigating currency risks stabilizes cash flow, avoiding unexpected expenses.

- Competitive Advantage: Covering the exposure gives businesses an edge in the global market, as they can quote prices with confidence.

Image: www.shutterstock.com

Conclusion

In the realm of forex, “covering the exposure” is a fundamental concept that safeguards against the uncertainties of currency fluctuations. With a sound understanding of the topic and the strategies involved, you can protect your investments and make informed decisions. Remember to stay vigilant and adapt your exposure management approach as market dynamics evolve.

Are you ready to embark on a journey towards successful forex trading and mitigate the risks of exposure? Learn more about the latest trends, expert advice, and proven strategies through our comprehensive resources. Engage with our community and gain insights from fellow traders, enriching your knowledge and unlocking the path to financial success in the forex markets.

What Is Covering The Exposure In Forex

FAQs

- What does “covering the exposure” mean in forex?

It refers to strategies employed to mitigate potential losses arising from currency exchange rate fluctuations.

- Why is it necessary to cover exposure in forex?

To protect against the financial risks associated with currency fluctuations, which can impact the value of investments and transactions.

- How can I cover my exposure in forex?

Through hedging instruments, such as forward contracts, futures, or options, or by implementing natural hedging strategies that utilize correlating assets.

- What are the benefits of covering exposure in forex?

It minimizes losses, enhances predictability, optimizes cash flow, reduces costs, and offers a competitive advantage in the global market.

- How can I stay updated with the latest trends and strategies in exposure management?

Engage with our community, access our resources, and leverage online platforms for insights from experts and experienced traders.