Introduction:

Image: www.youtube.com

In the realm of foreign exchange trading, or forex, the term “spread” holds immense significance. It’s the silent whisper behind every trade, a subtle yet pervasive force that shapes market dynamics and influences profitability. Understanding the nature of spread is akin to deciphering the heartbeat of forex, revealing the intricate workings of this global financial marketplace.

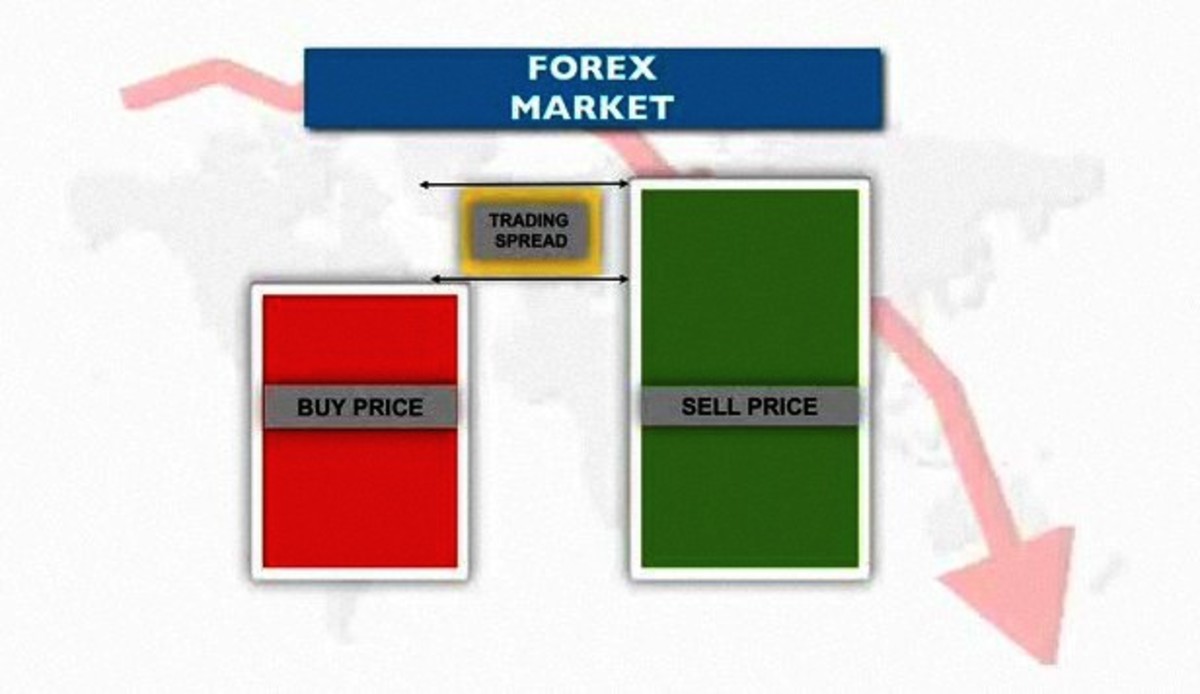

Forex spread, in its simplest form, represents the difference between the bid price and the ask price of a currency pair. The bid price is the value at which a trader is willing to purchase, while the ask price reflects the value at which they are prepared to sell. This seemingly innocuous difference in pricing acts as a buffer, ensuring liquidity in the market and compensation for market makers who facilitate currency exchanges.

Delving into the Dynamics of Spread:

Navigating the complexities of forex spread necessitates a thorough comprehension of its underlying dynamics. Spreads primarily arise due to factors like market volatility, liquidity conditions, and the underlying supply and demand for currency pairs. During periods of high market volatility, spreads tend to widen, reflecting the increased risk and uncertainty within the market. Conversely, when liquidity is abundant and trading activity is robust, spreads typically narrow, offering more favorable conditions for traders.

Moreover, the liquidity of a currency pair also plays a crucial role in determining its spread. Major currency pairs, such as EUR/USD or USD/JPY, often boast tighter spreads due to their significant trading volume, enhanced liquidity, and numerous market participants. In contrast, spreads for exotic or less-traded currency pairs tend to be wider, reflecting their limited market presence and reduced liquidity.

Impact of Spread on Forex Trading:

As traders venture into the forex arena, grasping the impact of spread on their trading endeavors becomes imperative. Spread directly translates into trading costs, representing the percentage difference between the entry and exit prices. For instance, if the spread for EUR/USD is 2 pips (increments of price movement), and a trader enters a long position at 1.1100, they would need the value to appreciate to 1.1102 (plus the spread) simply to break even.

While it may seem like a minuscule amount, the cumulative effect of spread can significantly impact profitability, especially when trading with smaller account balances or engaging in frequent trading activities. Therefore, traders must diligently consider the spread when evaluating trading opportunities and devising their strategies.

Harnessing Spread to One’s Advantage:

Contrary to popular belief, spread does not always pose a hindrance to traders. By understanding the mechanics of spread and incorporating it into their trading strategies, traders can turn this potential obstacle into an opportunity.

One approach involves selecting currency pairs with typically narrower spreads. This strategic choice allows traders to minimize trading costs and enhance their profitability over time.

Additionally, trading during periods of low market volatility is a prudent strategy to reduce the impact of spread. When volatility subsides, spreads tend to tighten, providing more favorable conditions for executing trades with tighter stop-loss levels and favorable risk-to-reward ratios.

Conclusion:

The concept of spread in forex trading is an intricate yet integral part of understanding the complexities of this global financial marketplace. By unraveling its nature, traders can gain a competitive edge, minimizing trading costs, and capitalizing on opportunities.

The key to successful forex trading lies in not merely acknowledging spread but harnessing its power to one’s advantage. By embracing the strategic principles outlined in this article, traders can navigate the market dynamics with greater confidence and efficacy, transforming this hidden force into a catalyst for their trading success.

Image: robotforexwebsite.blogspot.com

What Is Called Spread In Trading In Forex