The world of currency exchange, or forex, is a fast-paced and evolving landscape, where the bid and ask prices play a pivotal role. Understanding these key concepts is crucial for success in forex trading, enabling traders to make informed decisions and navigate the markets with confidence.

Image: www.wikifx.com

What are Bid and Ask Prices?

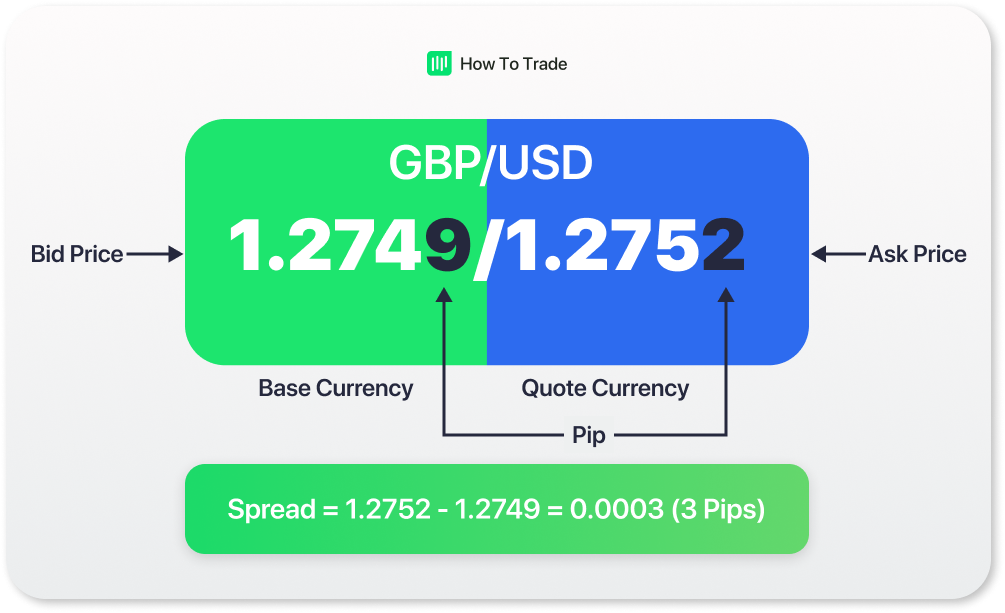

Every trade in the forex market involves two parties: a buyer and a seller. The bid price represents the highest price that a buyer is willing to pay for a currency pair, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices, known as the spread, determines the profit potential for traders.

Why are Bid and Ask Prices Important?

- Accurate Market Assessment: Bid and ask prices provide real-time insights into the market sentiment and the perceived value of a currency pair.

- Trading Strategy Formulation: Traders use bid and ask prices to determine entry and exit points, as well as to calculate potential profits and losses.

- Market Volatility: The spread between bid and ask prices can indicate market volatility and liquidity. A wide spread may suggest a more volatile market, while a narrow spread implies a more stable market.

- Order Execution: Understanding bid and ask prices ensures that traders can execute their orders efficiently, reducing slippage and minimizing potential losses.

- Profit Maximization: Profitable forex trading revolves around buying currencies at a bid price lower than the ask price of a profitable sale.

Factors Influencing Bid and Ask Prices

- Supply and Demand: Market forces like supply and demand drive bid and ask prices. High demand for a currency pair leads to higher bid prices, while increased supply leads to lower ask prices.

- Interest Rates: Differences in interest rates between countries affect currency values and, consequently, bid and ask prices.

- Economic Conditions: Economic factors, such as inflation, unemployment, and gross domestic product (GDP) growth, influence market sentiment and impact bid and ask prices.

- Political Factors: Political events, like elections, referendums, and geopolitical conflicts, can trigger market volatility and affect bid and ask prices.

- News and Rumors: Market-moving news and rumors can cause sudden fluctuations in bid and ask prices, creating opportunities for traders.

Image: howtotrade.com

Trading Strategies Based on Bid and Ask Prices

- Scalping: Scalping involves placing multiple small trades based on small price movements between bid and ask prices.

- Spread Trading: This strategy exploits the difference between bid and ask prices, executing trades when the spread is wider or narrower than anticipated.

- Breakout Trading: Traders identify critical support and resistance levels and use bid and ask prices to anticipate potential breakouts, placing trades accordingly.

- Range Trading: Range trading focuses on trading within a defined price range, using bid and ask prices to determine potential trading boundaries.

- Trend Trading: Trend traders analyze bid and ask prices to identify underlying market trends and execute trades in line with those trends.

Latest Trends and Developments in Bid and Ask Prices

- Algorithmic Trading: Algorithmic trading uses computer programs to execute trades based on pre-defined parameters, reducing human error and optimizing profit potential.

- Enhanced Spreads: Electronic Communication Networks (ECNs) and retail forex brokers have improved bid and ask spreads, offering tighter liquidity and better trading conditions.

- Mobile Trading: Mobile trading platforms allow traders to monitor bid and ask prices and execute trades from anywhere with an internet connection.

- Social Trading: Platforms like eToro enable traders to share and follow trading strategies based on bid and ask prices, fostering collaboration and knowledge sharing.

Bid And Ask Price Forex

Conclusion

Navigating the world of forex requires a thorough understanding of bid and ask prices. By grasping these concepts, traders gain the power to make informed decisions, craft effective trading strategies, and ultimately maximize their profit potential. Whether you are a novice trader or a seasoned professional, stay abreast of the latest trends and developments in bid and ask prices to stay ahead in this dynamic and rewarding market.