When the global financial markets awaken with the break of each new day, a symphony of electronic transactions fills the airwaves, signaling the opening of the world’s largest and most liquid market: the foreign exchange (forex) market. At the heart of this dynamic exchange lies a concept that often perplexes novice traders and seasoned veterans alike – the ask-bid spread. Delve into this comprehensive guide to illuminate the significance, mechanics, and strategies surrounding this fundamental aspect of forex trading.

Image: www.cursoforexgratuito.com

Understanding the Forex Market – A Global Tapestry of Currency Exchange

The forex market, an over-the-counter (OTC) marketplace, facilitates the buying, selling, and exchange of currencies between individuals, businesses, and financial institutions worldwide. With no central exchange or physical location, it operates 24 hours a day, five days a week, spanning across various global financial centers. As the world’s largest financial market, the forex market boasts a staggering daily trading volume exceeding $5 trillion, making it a formidable force shaping global economic landscapes.

The Ask-Bid Spread – A Gateway to Profitability

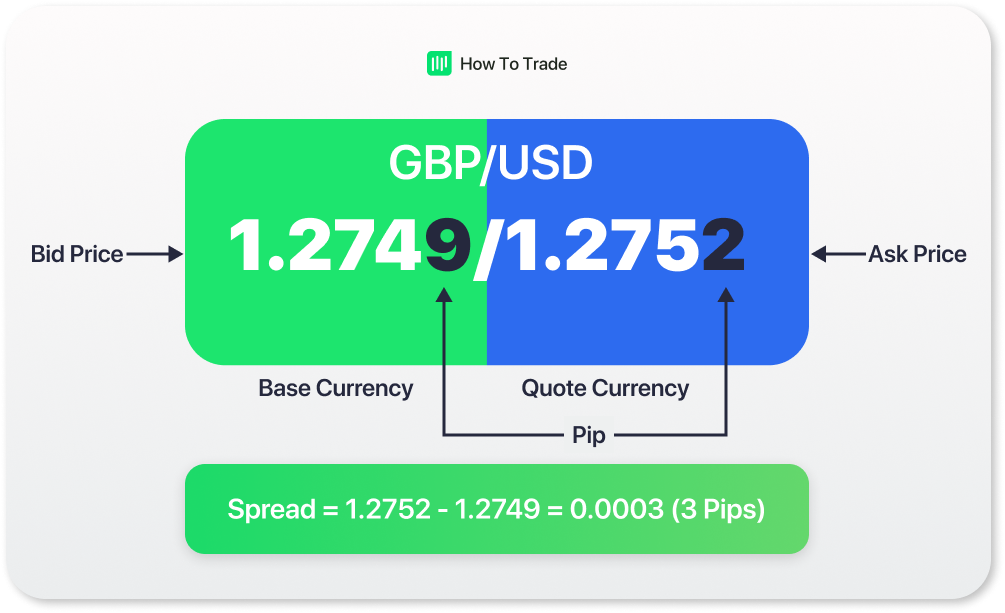

Within the dynamic ecosystem of the forex market, the ask-bid spread plays a pivotal role. It represents the difference between the ask price, the price at which a currency pair can be bought, and the bid price, the price at which it can be sold. This seemingly minuscule gap holds immense significance, as it serves as the foundation for traders’ profits and losses. For instance, when a trader buys a currency pair at the ask price and simultaneously sells it at the bid price, the difference between these two prices constitutes their spread-based profit. Conversely, if a trader buys at the bid price and sells at the ask price, they will incur a loss equivalent to the spread.

The Ask-Bid Spread – A Reflection of Market Forces

The ask-bid spread is not merely an arbitrary figure but rather a reflection of the underlying market forces of supply and demand. When the demand for a currency pair exceeds its supply, the ask price tends to rise, while the bid price remains relatively stable. This imbalance creates a wider spread, benefiting those who sell the currency pair and adversely affecting those who buy it. Inversely, when the supply of a currency pair surpasses the demand, the bid price may rise as buyers compete to acquire the currency, leading to a narrower spread.

Image: howtotrade.com

The Impact of Liquidity – The Lifeblood of Forex Trading

Liquidity, the ease with which an asset can be bought or sold without significantly impacting its price, plays a crucial role in determining the ask-bid spread. Highly liquid currency pairs, such as EUR/USD and GBP/USD, typically exhibit narrower spreads due to the abundance of market participants willing to trade these currencies. Contrarily, less liquid currency pairs often command wider spreads as fewer traders are available to facilitate transactions.

The Spread – A Lens into Market Volatility

Forex traders often utilize the ask-bid spread as a barometer of market volatility. During periods of heightened uncertainty and market turbulence, spreads tend to widen as traders demand a higher premium for assuming risk. Conversely, in tranquil market conditions, spreads generally narrow as the perceived risk associated with currency trading diminishes. By monitoring spread fluctuations, traders can gain valuable insights into the prevailing market sentiment.

Strategies for Navigating the Ask-Bid Spread – Maximizing Profitability

Harnessing a nuanced understanding of the ask-bid spread can empower traders to optimize their trading strategies. One common approach involves trading during periods of low spread, thereby minimizing transaction costs and maximizing potential profits. Additionally, traders may seek out brokers who offer competitive spreads or employ trading strategies tailored to wide-spread environments.

When Forex Market Opens Difference In Ask And Bid Price

Conclusion – The Ask-Bid Spread: A Cornerstone of Forex Trading

The ask-bid spread, an integral component of the forex market, presents a multifaceted concept that profoundly influences trading outcomes. By comprehending its dynamics, traders can gain a competitive edge, navigate market fluctuations, and enhance their profitability. Like a skilled conductor orchestrating a symphony, proficient traders master the art of navigating the ask-bid spread, unlocking the full potential of the world’s most dynamic financial market.