Introduction

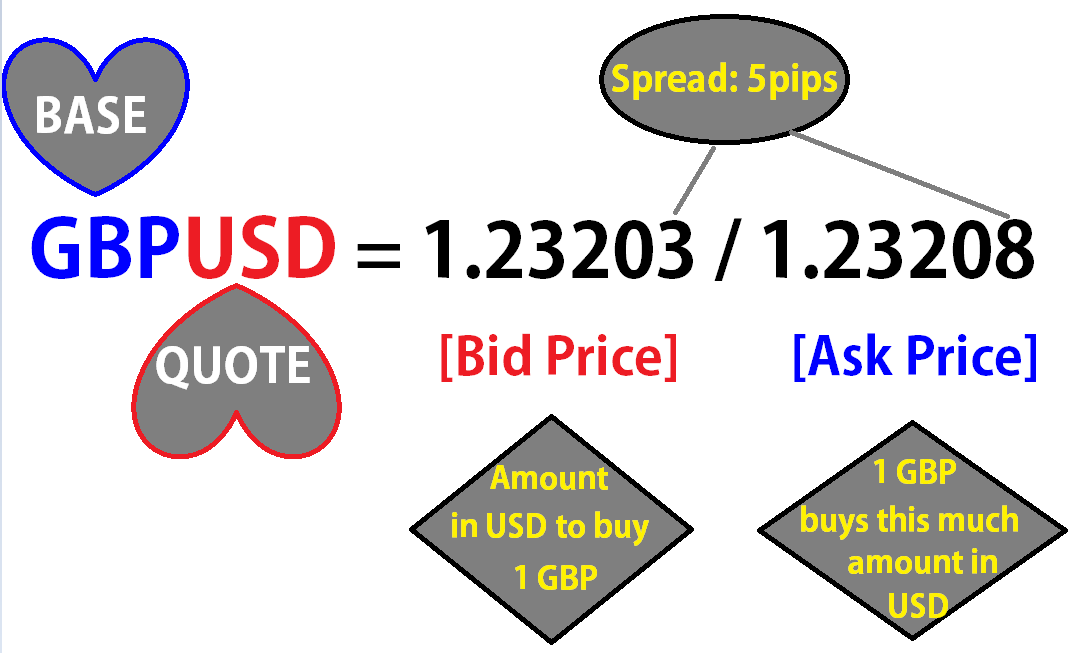

In the dynamic realm of forex trading, understanding market dynamics is paramount. One such intriguing phenomenon arises when the bid price, which represents the highest price a buyer is willing to pay for a currency pair, exceeds the ask price, the lowest price a seller is willing to accept. This seemingly paradoxical situation can leave traders puzzled, and it’s essential to delve into its implications to navigate forex markets effectively.

Image: freeforexcoach.com

What Occurs When Bid Exceeds Ask?

When the bid surpasses the ask in forex, a unique market situation transpires. Typically, the ask price is higher than the bid price, representing the spread—the profit margin for market makers who facilitate currency exchange. However, when the bid temporarily exceeds the ask, it signifies a momentary imbalance in supply and demand.

Reasons for a Higher Bid Than Ask

Several factors can contribute to this reversal of the bid-ask spread:

- Sudden Surge in Demand: If buyers eagerly seek a particular currency pair, they may outnumber sellers, leading to an increase in bid prices to entice holders to sell.

- Market News Catalysts: Breaking news, economic data, or geopolitical events can trigger a shift in sentiment, causing a sudden influx of buying or selling, resulting in a bid-ask price reversal.

- Low Liquidity and Market Thinness: In thin markets with limited participants, even a small influx of orders can drastically alter prices, leading to situations where the bid exceeds the ask.

- Technical Trading: Some traders utilize technical analysis to identify opportunities, and when their trading strategies trigger buy or sell signals, it can amplify market imbalances and contribute to bid-ask price reversals.

Consequences of a Higher Bid Than Ask

This anomalous market condition can have significant consequences for traders:

- Profitable Trading Opportunities: For astute traders, this situation can present a rare opportunity to profit. By selling at the ask price when the bid exceeds it, traders can capture the spread and potentially realize gains.

- Execution Challenges: When bid exceeds ask, executing trades can become challenging. Market orders may not be filled immediately, and limit orders may not be reached.

- Increased Market Volatility: The imbalance between supply and demand can exacerbate market volatility, making it difficult to predict price movements with certainty.

Image: eatradingacademy.com

Expert Insights and Actionable Tips

Seasoned forex traders offer valuable insights and practical tips to navigate this market anomaly:

- Monitor News and Sentiments: Keep abreast of market-moving news and events that can trigger bid-ask price reversals.

- Utilize Technical Indicators: Leverage technical indicators, such as order flow indicators or volume analysis, to gauge market momentum and potential imbalances.

- Manage Risk Conservatively: In markets where bid exceeds ask, volatility is often heightened. Practice prudent risk management strategies and limit position sizes to protect your capital.

- Seek Professional Guidance: If you encounter persistent challenges executing trades or managing risk, consider consulting with an experienced forex advisor for personalized guidance.

What Happens When Bid Is Higher Than Ask In Forex

Conclusion

Understanding what happens when bid exceeds ask in forex is crucial for successful trading. By grasping the factors influencing this market phenomenon and employing the insights and tips provided by experts, traders can navigate these situations with confidence. Remember, in the ever-evolving forex markets, adapting to changing dynamics and making informed decisions can lead to profitable outcomes.