The bustling forex market, where currencies are traded around the globe, is a dynamic arena where every transaction hinges on two critical concepts: ask price and bid price. These two prices serve as the foundation for successful currency trading, empowering traders to navigate the fast-paced world of foreign exchange.

Image: ywivihyxa.web.fc2.com

Understanding the nuances of ask and bid prices is paramount for anyone seeking to venture into the forex market. Join us as we embark on a comprehensive journey, unraveling the intricacies of these fundamental concepts and exploring their significance in the dynamic world of forex trading.

The Essence of Ask and Bid Prices

Ask Price: The Seller’s Perspective

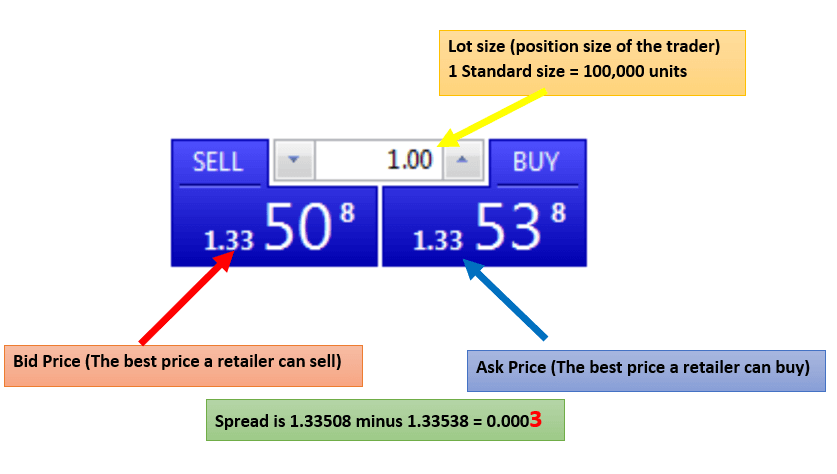

The ask price, also known as the offer price, represents the rate at which a seller is willing to sell a specific currency. It signifies the minimum amount a seller is ready to accept in exchange for the currency they are offering. When a trader places an order to buy a currency, they are essentially seeking to purchase it at the ask price set by sellers in the market.

Bid Price: The Buyer’s Perspective

On the other hand, the bid price, often referred to as the buying price, denotes the maximum amount a buyer is prepared to pay for a particular currency. It reflects the highest price a buyer is willing to offer in return for the currency they wish to acquire. Traders who place orders to sell a currency are effectively indicating their willingness to part with it at the bid price quoted in the market.

Image: carlfajardo.com

The Spread and its Significance

The difference between the ask price and the bid price is known as the spread. This spread represents the profit margin earned by market makers, the entities that facilitate currency trading. The spread varies depending on factors such as currency liquidity, market conditions, and the trading platform used.

A tighter spread generally indicates higher market liquidity, making it easier for traders to execute orders at favorable prices. Conversely, a wider spread implies lower liquidity, resulting in potentially less advantageous trade executions.

Influences on Ask and Bid Prices

The ever-evolving forex market is susceptible to a myriad of factors that can impact ask and bid prices. These factors include:

- Economic data releases and central bank announcements

- Political news and events

- Supply and demand dynamics

- Market sentiment and risk appetite

- Technical factors and price charts

Traders must stay abreast of these factors and their potential implications to make informed trading decisions.

Tips for Navigating Ask and Bid Prices

As a savvy trader, understanding the following tips will prove invaluable:

- Monitor the spread: Always be aware of the spread when placing orders, as it can affect your profitability.

- Choose liquid markets: Trading in highly liquid currency pairs can often result in tighter spreads and better trade executions.

- Use limit orders: Limit orders allow you to specify the exact price at which you want to buy or sell a currency, giving you more control over your trades.

- Consider market conditions: Pay attention to the overall market sentiment and economic conditions, as they can influence ask and bid prices significantly.

- Stay informed: Continuously keep yourself updated with the latest news and market developments to make informed trading decisions.

FAQ on Ask Price and Bid Price

- What is the difference between ask and bid price?

- How does the spread affect traders?

- What factors can influence ask and bid prices?

- How can I trade effectively using ask and bid prices?

Ask Price And Bid Price Forex

https://youtube.com/watch?v=Gbu75YA84lM

Conclusion

Ask price and bid price form the cornerstone of successful forex trading. By grasping the intricacies of these concepts and applying the strategies discussed, traders can navigate the dynamic forex market with confidence.

Remember, staying informed about market trends and utilizing a strategic approach will help you maximize your trading potential. Are you ready to embark on your forex trading journey equipped with this newfound knowledge?