In the thriving landscape of global finance, foreign exchange rates play a pivotal role in shaping international trade, investment decisions, and economic policies. Among the numerous currency pairs, the USD vs INR (United States Dollar versus Indian Rupee) syndicate forex rate stands out as a key indicator of economic trends and market sentiment between the world’s largest economy and one of the fastest-growing emerging markets.

Image: howtotradeonforex.github.io

The dynamics of the USD/INR forex rate is a reflection of intricate macroeconomic factors, geopolitical events, and central bank policies. Understanding these intricacies empowers traders, investors, and businesses to make informed decisions in the labyrinthine world of foreign exchange.

Factors Influencing the USD/INR Exchange Rate

A multitude of factors conspire to influence the ever-fluctuating USD/INR exchange rate. These include:

- Economic Growth: A robust Indian economy, characterized by high GDP growth, attracts foreign investors, leading to an appreciation of the INR against the USD.

- Inflation: Higher inflation in India compared to the US exerts downward pressure on the INR, as foreign investors seek havens in currencies with lower inflation.

- Interest Rate Differentials: Wide interest rate differentials between India and the US influence capital flows, with higher Indian interest rates attracting foreign capital and boosting the INR.

- Geopolitical Events: External shocks, such as trade wars or conflicts, can impact investor confidence and influence the USD/INR rate.

- Central Bank Intervention: The Reserve Bank of India (RBI) can intervene in the forex market to curb excessive volatility or support the INR during periods of turbulence.

Trading the USD/INR Pair

The USD/INR forex pair presents unique opportunities for traders due to its high volatility and liquidity. However, it’s imperative to approach trading with caution and adhere to sound risk management principles.

Tips for Trading USD/INR

Here are some expert tips to enhance your USD/INR trading strategy:

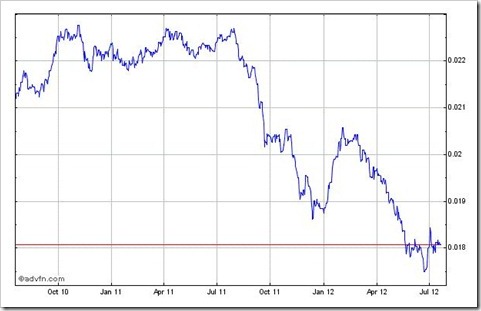

- Technical Analysis: Study historical price charts and use technical indicators to identify trends and potential trading opportunities.

- Monitor News and Events: Stay abreast of economic and geopolitical events that could impact the exchange rate.

- Manage Risk: Use stop-loss orders to limit potential losses and position sizing to avoid overexposure.

- Trade with a Reputable Broker: Choose a licensed and regulated forex broker to ensure transparency and security.

Image: trak.in

FAQ on USD/INR Exchange Rate

Q: What is the current USD/INR exchange rate?

A: The live USD/INR exchange rate can be checked on reputable forex trading platforms or financial news websites.

Q: What factors affect the USD/INR exchange rate in the long run?

A: Macroeconomic fundamentals, such as GDP growth, inflation, interest rates, and government policies, play a significant role in shaping the long-term trend of the exchange rate.

Q: How can I make money trading USD/INR?

A: While trading forex can be potentially lucrative, it carries significant risk. To increase your chances of success, it’s essential to develop a sound trading strategy, manage risk effectively, and trade with a reliable broker.

Usd Vs Inr Syndicate Forex Rate

Conclusion

The USD vs INR syndicate forex rate is a fascinating barometer of global economic trends and a valuable tool for investors and traders. By understanding the complex interplay of factors influencing the exchange rate and adopting prudent trading practices, it’s possible to navigate the dynamic forex market and capitalize on potential opportunities.

Are you interested in delving deeper into the world of USD/INR exchange rate and exploring its implications for global finance? Share your thoughts and questions in the comments section below.