Navigating the Dynamics of International Exchange

In today’s globalized economy, understanding foreign exchange rates is crucial for seamless international transactions. Whether you’re a business conducting international trade or an individual planning an overseas trip, exchanging currencies is an integral part of the process. HDFC Bank, one of India’s leading financial institutions, offers a range of foreign exchange services, including the conversion of US Dollars (USD) to Indian Rupees (INR). This article delves into the factors that influence the USD to INR forex rate at HDFC Bank and provides insights into how you can optimize your currency exchange experience.

Image: designerslucky.mystrikingly.com

Understanding the USD to INR Forex Rate

The value of one currency relative to another is constantly fluctuating, influenced by a complex interplay of economic, political, and social factors. The USD to INR forex rate is the price at which one US dollar can be exchanged for a certain number of Indian rupees. This rate is determined by market forces, with supply and demand playing a key role. Additionally, factors such as interest rate differentials, inflation rates, and political stability also impact the exchange rate.

HDFC Bank’s Role in Currency Exchange

HDFC Bank plays a vital role in facilitating currency exchange transactions in India. Its extensive network of branches and online platforms allows customers to conveniently exchange currencies at competitive rates. Through its partnership with various financial institutions worldwide, HDFC Bank offers real-time forex rates and ensures swift and secure transactions.

Factors Affecting the USD to INR Forex Rate at HDFC Bank

The USD to INR forex rate at HDFC Bank is subject to the dynamics of the global currency market. However, certain factors specifically influence this rate:

- Economic Growth: Strong economic growth in India strengthens the demand for INR, leading to an appreciation of its value against the USD.

- Interest Rates: Higher interest rates in India make it more attractive for investors to invest in INR-denominated assets, which increases demand for INR and strengthens its value.

- Inflation: High inflation rates in India can weaken the value of INR against the USD as investors seek refuge in foreign currencies.

- Political Stability: Political stability and economic reforms that promote foreign investment can positively impact the value of INR against the USD.

- Global Economic Conditions: The overall health of the global economy, particularly the performance of the US economy, can influence the demand for USD and impact the exchange rate.

Image: pdfprof.com

Tips for Optimizing Currency Exchange Transactions

- Monitor Exchange Rates: Stay informed about currency market trends and track the USD to INR forex rate regularly.

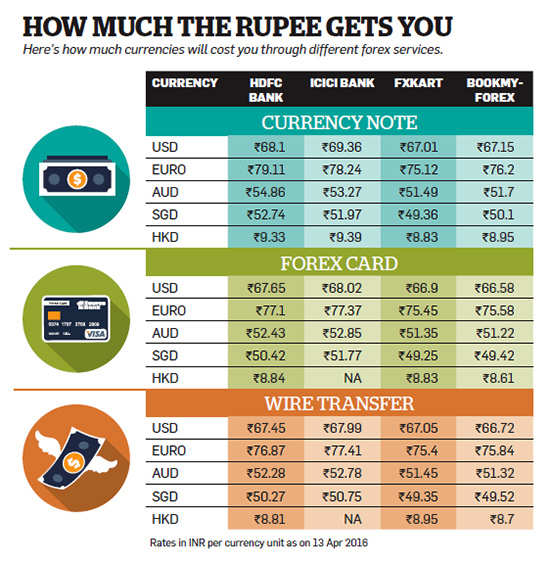

- Shop Around: Compare rates offered by different banks and financial institutions to secure the best deal.

- Consider Margins and Spreads: Banks typically charge margins or spreads on currency exchanges, so be aware of these costs and factor them into your calculations.

- Utilize Online Platforms: HDFC Bank offers online currency exchange services, which provide real-time rates and convenient transaction processing.

- Secure Your Transfers: Ensure that you are transacting with reputable banks or financial institutions to safeguard your funds and personal details.

Expert Advice: Navigating the Uncertainties of Foreign Exchange

- Plan Ahead: Foreign exchange rates can fluctuate rapidly, so it’s advisable to plan your currency exchange needs well in advance.

- Hedge Against Risks: Consider hedging strategies, such as forward contracts, to mitigate potential losses arising from unfavorable exchange rate movements.

- Stay Informed: Keep abreast of economic news and market updates to make informed decisions about currency exchange timing.

- Trust a Reliable Partner: Choose a financial institution with a proven track record in foreign exchange services, such as HDFC Bank, for secure and efficient transactions.

Frequently Asked Questions

-

What is the current USD to INR forex rate at HDFC Bank?

Check the HDFC Bank website or mobile app for real-time currency exchange rates. -

How do I exchange currencies at HDFC Bank?

You can exchange currencies at HDFC Bank branches or online through its NetBanking platform. -

Are there any fees associated with currency exchange at HDFC Bank?

Yes,HDFC Bank charges a margin or spread on currency exchange transactions, which varies depending on the amount and currency involved. -

Is it possible to lock in a future exchange rate at HDFC Bank?

Yes, HDFC Bank offers forward contracts that allow you to fix an exchange rate for a future date, mitigating the risk of adverse currency fluctuations.

Usd To Inr Forex Rate Hdfc Bank

Conclusion

Understanding the dynamics of USD to INR forex rate at HDFC Bank is crucial for optimizing your currency exchange experiences. By staying informed, comparing rates, and utilizing the services of a trusted financial institution, you can minimize risks and maximize the value of your transactions. Whether you’re a seasoned traveler or a business embarking on international expansion, this guide has provided valuable insights into navigating the complexities of foreign exchange.

Are you ready to delve deeper into the world of currency exchange and explore the latest trends and developments in global markets? HDFC Bank’s dedicated forex experts are always available to provide personalized guidance and assist you in making informed financial decisions.