Unveiling the Financial Powerhouse behind the American Economy

The United States, a beacon of economic might and global influence, holds a staggering amount of foreign exchange reserves, amounting to a colossal sum that reflects its financial prowess and economic dominance. In 2018, these reserves reached an astounding $121.2 billion, a testament to the nation’s economic resilience and its unwavering position as a pillar of the international monetary system.

Image: www.investmentwatchblog.com

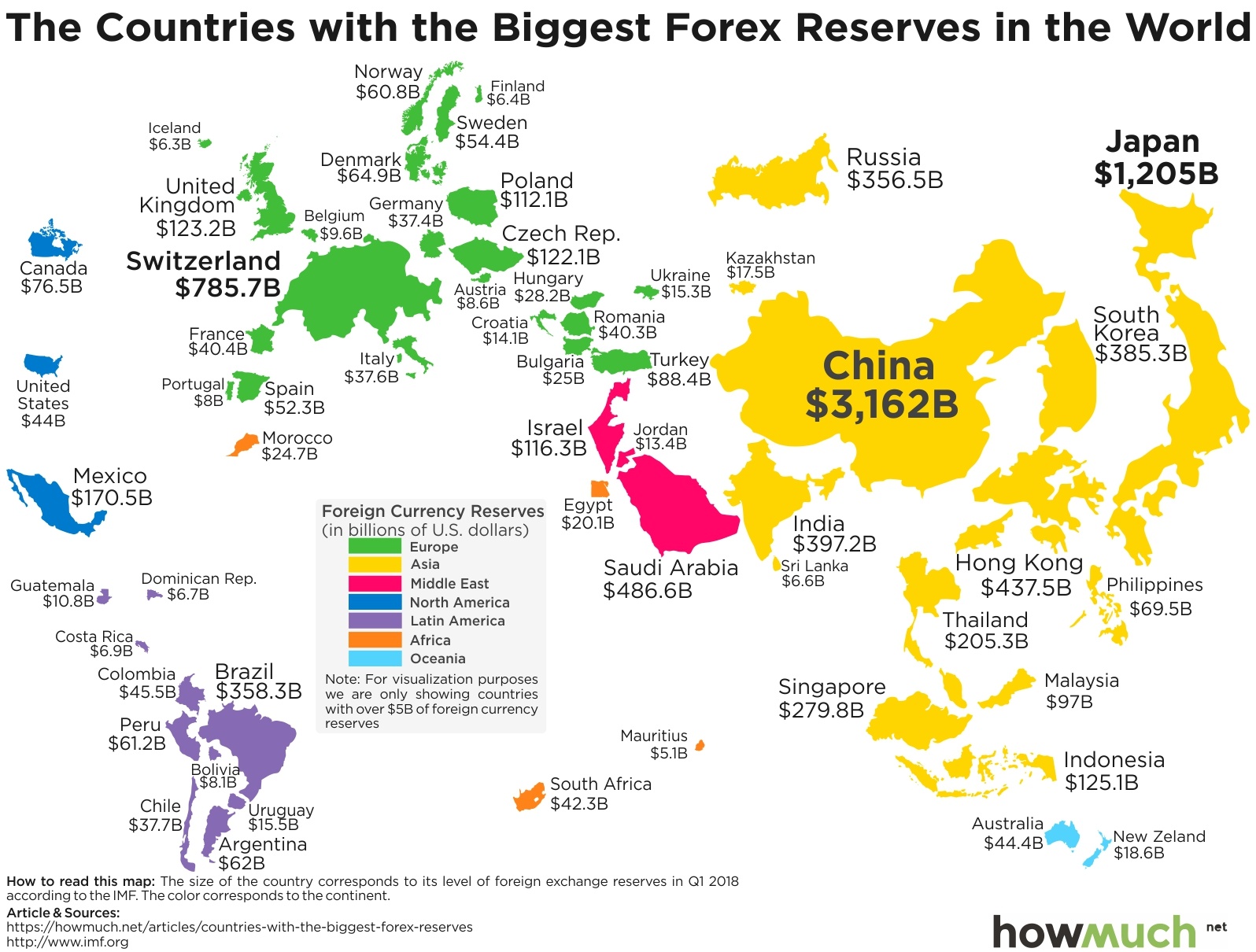

Delving into the intricate world of foreign exchange reserves, we uncover their essence as a nation’s holdings in foreign currencies, precious metals, and other financial assets. These reserves serve as a vital financial lifeline, providing a safety net during economic downturns and safeguarding against currency fluctuations. They also empower nations to intervene in currency markets, exerting influence on exchange rates and promoting economic stability.

The United States, with its vast and diversified economy, has long maintained a substantial level of forex reserves. These reserves stem from various sources, including trade surpluses, foreign investments, and international financial transactions. As the world’s largest economy, the U.S. commands a significant role in global trade and finance, contributing to the accumulation of such substantial forex reserves.

In 2018, amidst global economic uncertainties, the U.S. forex reserves remained remarkably stable, a beacon of resilience in the face of market volatility. This stability underscores the strength of the American economy and its financial institutions, inspiring confidence among investors and international partners.

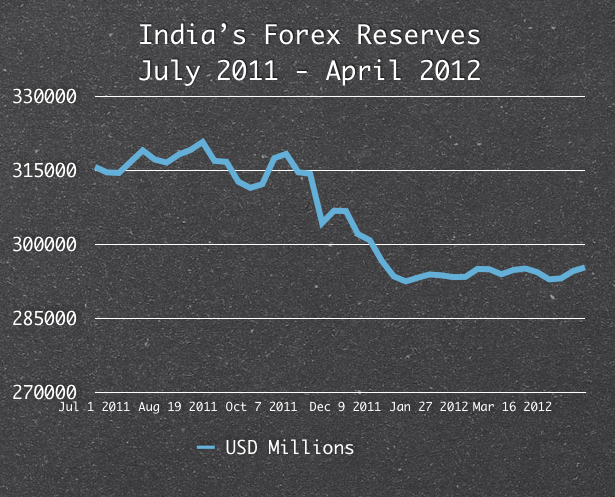

However, it’s crucial to note that forex reserves are not static but rather undergo constant fluctuations in response to economic conditions and market dynamics. Central banks, such as the Federal Reserve in the U.S., carefully manage these reserves, aiming to maintain a balance between liquidity, safety, and returns. They employ strategic investment strategies to maximize yields while preserving the reserves’ value.

The presence of substantial forex reserves provides the U.S. with unparalleled financial flexibility. It enables the nation to navigate economic challenges, meet international obligations, and support its currency’s stability. In times of economic turmoil or financial crises, these reserves can be mobilized to provide liquidity and mitigate market disruptions.

Furthermore, forex reserves play a significant role in international trade and finance. They facilitate global payments, reduce exchange rate risks, and foster international economic cooperation. The U.S. dollar, backed by its vast forex reserves, remains the world’s dominant reserve currency, underpinning the global financial system and facilitating international trade.

In essence, the USA’s forex reserves in 2018, amounting to a colossal $121.2 billion, symbolize the nation’s economic prowess, financial resilience, and global economic influence. These reserves serve as a testament to the strength of the American economy and its unwavering commitment to fostering international economic stability and prosperity.

Image: www.onemint.com

Usa Forex Reserves 2018 In Million