The world of Forex trading can be both thrilling and daunting. It’s a global marketplace where currencies dance and fortunes are made – or lost. But navigating this intricate landscape requires not just knowledge, but also a clear understanding of risk management. One tool that can empower traders to make informed decisions is the Forex.com margin calculator.

Image: www.forex.academy

Imagine you’re a seasoned Forex trader, ready to dive into the market with a strategy honed over years of experience. However, as you analyze potential trades, a nagging question arises: “How much margin do I need to secure this position?” The answer lies within the Forex.com margin calculator, a powerful tool that transforms complex calculations into easily digestible insights, enabling you to confidently navigate the Forex market.

The Forex.com Margin Calculator: Your Trading Compass

The Forex.com margin calculator acts as your trading compass, guiding you through the complexities of margin requirements. Understanding margin is vital for successful Forex trading. In essence, margin is the amount of money you need to deposit with your broker to open and maintain a trading position. This deposit serves as collateral, ensuring that you can cover potential losses.

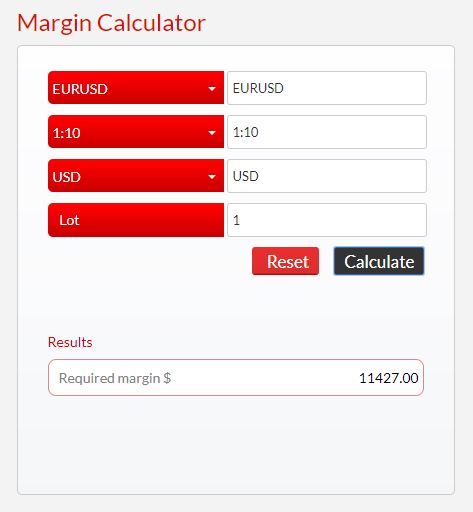

The margin calculator works by taking into account factors like the chosen currency pair, the size of your desired trade, and the broker’s leverage requirements. It then calculates the exact margin needed to execute the trade. This allows traders to assess their risk appetite and adjust their positions accordingly.

Unveiling the Margin Magic: Key Features

The Forex.com margin calculator boasts a user-friendly interface, making it accessible even to novice traders. Its key features include:

- Intuitive Interface: The calculator is designed to be simple and straightforward, requiring minimal technical expertise.

- Real-Time Calculations: The margin calculator provides live, up-to-the-minute calculations, reflecting current market conditions and ensuring accurate information.

- Comprehensive Data Inputs: Traders can input various parameters, including the chosen currency pair, desired position size, and leverage levels, enabling comprehensive margin analysis.

- Clear Output: The calculator presents the calculated margin amount in an easily understandable format, allowing traders to make informed decisions.

- Flexibility and Customization: The margin calculator can be used for various trading scenarios, adapting to individual trading styles and preferences.

Using this calculator allows traders to strategize more effectively. It simplifies complex margin calculations, enabling traders to make sound financial decisions without the risk of overwhelming calculations. This approach empowers Forex traders to manage risk effectively, maximizing their trading potential.

Mastering Margin: A Winning Strategy

Understanding margin is crucial for successful Forex trading. It’s not only about meeting the minimum requirements; it’s about understanding how much capital you need to allocate to each position, so you can make wise decisions about trade size and leverage.

The Forex.com margin calculator allows traders to see how margin requirements can vary based on the traded currency pair and leverage. This visibility can empower you to make informed decisions about your trading strategy. By leveraging the Forex.com margin calculator, you can gain a distinct advantage in the dynamic Forex market, making decisions with greater confidence.

Image: forextraininggroup.com

Expert Tips: Navigating the Margin Landscape

Here are some expert tips for maximizing the benefits of the Forex.com margin calculator:

- Start Small: As you begin your Forex journey, consider making smaller trades. This allows you to test your strategies while minimizing potential losses, giving you a solid foundation for future trading.

- Don’t Overextend: Avoid taking on too much leverage, as it can amplify both profits and losses. Always analyze your risk tolerance and choose leverage levels accordingly.

- Diversify: Spreading your trading across multiple currency pairs can help mitigate risk. This diversification can help to balance your portfolio and minimize potential losses.

- Regularly Review: It is essential to regularly review your trading strategy, margin requirements, and risk tolerance to ensure you remain on track with your goals.

- Be Patient: Success in Forex trading takes time and patience. Avoid impulsive trading decisions and let your strategies guide your trades.

Utilizing the Forex.com margin calculator as a tool and practicing these tips will help you build a strong foundation for success. Remember, Forex trading is not just about technical analysis or financial acumen; it’s also about responsible risk management and a clear understanding of the tools available to you. With the right approach, you can open the doors to a rewarding and profitable trading experience.

Frequently Asked Questions

Q: What is the purpose of margin in Forex trading?

Margin in Forex trading acts as a security deposit with your broker to guarantee that you can cover potential losses on your trades. The margin requirement depends on the currency pair, the trade size, and the broker’s leverage policy.

Q: How does leverage work in Forex trading?

Leverage in Forex trading allows you to control a larger position with a smaller initial investment. For example, 1:100 leverage lets you control $100,000 of currency with a $1,000 margin deposit. While leverage can magnify profits, it amplifies losses as well, so it should be managed carefully.

Q: Is it safe to use the Forex.com margin calculator?

The Forex.com margin calculator is a safe and reliable tool provided by a reputable Forex broker. It uses real-time market data to provide accurate margin calculations, helping you make informed trading decisions.

Q: Can I adjust my margin requirements after opening a trade?

In most cases, you can adjust your margin requirements after opening a trade by adding or withdrawing funds from your trading account. However, this should be done strategically to minimize trading risks and ensure that you have sufficient margin to cover potential losses.

Q: What are some common Forex trading mistakes to avoid?

Common Forex trading mistakes include overtrading, not using stop-loss orders, not managing risk effectively, neglecting market news and analysis, and failing to adapt your strategies to changing market conditions. Learning from these mistakes can help you improve your overall trading performance and profitability.

Forex.Com Margin Calculator

Unlocking Your Forex Trading Potential

The Forex.com margin calculator is an incredible tool for traders of all levels. It removes the stress and uncertainty of complex calculations, allowing you to focus on strategy and risk management. Are you ready to unlock your Forex trading potential? By using the Forex.com margin calculator and following these expert tips, you can gain a competitive edge in the dynamic world of Forex trading.

Do you find this information helpful? Are you ready to start using the Forex.com margin calculator in your trading? Let us know in the comments below!