Imagine yourself, a seasoned trader, scanning the intricate tapestry of global currency markets, spotting a prime opportunity to capitalize on a potential currency movement. But as you eagerly prepare to enter the trade, a nagging question lingers: “What is the appropriate position size?” This seemingly simple question holds the key to unlocking consistent trading profits and minimizing the risk of crippling losses in the dynamic and potentially unpredictable world of foreign exchange trading. This is where the FX position size calculator steps in, emerging as a vital tool for navigating the treacherous waters of risk management, empowering traders to confidently control their exposure and steer towards sustainable success.

Image: appadvice.com

The FX position size calculator, a digital arsenal for risk-averse traders, is a powerful tool that helps determine the optimal quantity of a currency pair to buy or sell based on your individual risk tolerance, account balance, and the desired level of risk per trade. By meticulously analyzing these critical factors, the calculator provides traders with an invaluable framework to navigate the complex world of position sizing, ensuring that their trades align perfectly with their predetermined risk parameters. Let’s delve deeper into the inner workings of this invaluable tool and explore how it empowers traders to navigate the exciting and often challenging landscape of forex trading.

Understanding the Essence of Position Sizing

Position sizing, the art of determining the right amount of currency to buy or sell, is an essential pillar of successful forex trading. It’s akin to choosing the right size of boat for a fishing trip, balancing your desire to catch a large haul with the limitations of your vessel. In the forex market, your “boat” is your account balance, and the “fish” represents your potential profits (or losses).

Overtrading, placing excessively large positions relative to your account size, can quickly lead to a disastrous domino effect. A single unfavorable price movement can quickly erode your hard-earned capital, potentially leading to a margin call or even account closure. On the other hand, undertrading, with positions too small to make a meaningful impact on your overall portfolio, may leave you feeling frustrated with meager profits or unrewarded for your astute analysis.

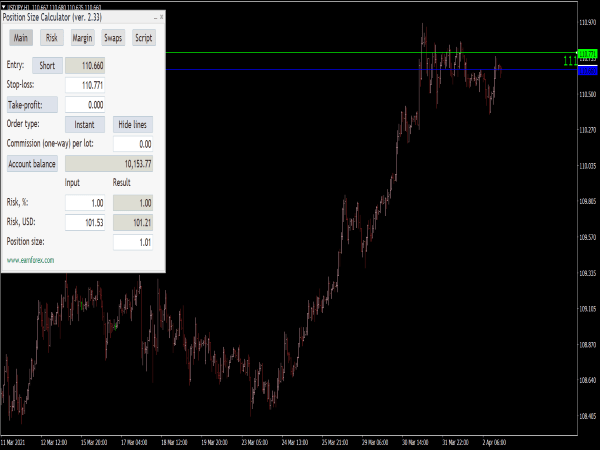

The Anatomy of an FX Position Size Calculator

The FX position size calculator employs a straightforward yet effective formula to determine the ideal position size :

The Formula:

**Position Size = (Risk % x Account Balance) / (Stop Loss x Pip Value)**

- Risk %: This figure represents the percentage of your account balance you are willing to risk on a single trade. It’s a crucial decision reflecting your personal risk appetite and trading strategy. For example, a risk % of 2% indicates that you are willing to risk 2% of your account balance on a single trade.

- Account Balance: Your current account balance, which is the foundation upon which your position size is calculated.

- Stop Loss: The predefined price level where you will close your trade to limit potential losses. Stop loss orders act as a safety net, ensuring that your losses are contained even if the market moves unexpectedly against your position.

- Pip Value: The monetary value of one pip (point in percentage), which varies depending on the specific currency pair and trade size.

Image: howtotradeonforex.github.io

Navigating the Calculator’s Functionality

The typical FX position size calculator functions like a user-friendly interface, often presented as a web-based tool. Simply input the necessary figures – account balance, risk percentage, stop-loss size, and the currency pair you’re trading – and the calculator will instantly calculate the appropriate position size.

The user-friendliness of these calculators makes them accessible to traders of all experience levels, from novice investors to seasoned professionals. However, a deeper understanding of the underlying formula empowers traders to take control of their risk management strategies, fine-tuning the calculator’s inputs to achieve their specific trading goals.

Beyond the Calculator: A Holistic Approach to Position Sizing

While the FX position size calculator provides a valuable framework for calculating trade size, it’s crucial to remember that it’s just one piece of a larger risk management puzzle.

- **Risk Tolerance:** Identify your personal risk appetite. Are you a conservative trader comfortable with minimal risk, or do you embrace higher-risk opportunities with the potential for greater rewards?

- **Account Balance:** Factor in your overall account balance and ensure your position size aligns with your risk tolerance. Avoid overextending yourself on a single trade, even if the potential payout seems alluring.

- **Trading Strategy:** The type of trading strategy you employ significantly influences your position size. Scalping, a high-frequency trading approach, generally involves smaller trades with quicker exits, while swing trading, which focuses on larger price movements, typically requires larger position sizes.

Real-World Scenarios: Putting the Calculator into Practice

Let’s dive into a concrete example to illustrate how the FX position size calculator works in practice. Imagine you have an account balance of $10,000 and are trading the EUR/USD currency pair. You’ve identified a potential trading opportunity, with a favorable setup for a long position. Your risk tolerance is 2%, and you’ve set a stop-loss order at 50 pips away from your entry point.

Using the FX position size calculator, you input the following data:

- Account Balance: $10,000

- Risk %: 2%

- Stop Loss: 50 pips

- Pip Value: $1 (assuming a standard lot size)

The calculator will output the appropriate position size:

**Position Size = (2% x $10,000) / (50 x $1) = 4 standard lots**

Therefore, you should enter a long trade on the EUR/USD currency pair with a position size of 4 standard lots to align with your desired risk parameters.

Emerging Trends in FX Position Sizing

The FX position size calculator is a dynamic tool, constantly evolving alongside the ever-changing landscape of foreign exchange trading. Recent trends highlight the growing importance of:

- Algorithmic Position Sizing: Sophisticated algorithms, powered by machine learning and artificial intelligence, are being leveraged to dynamically adjust position sizes based on real-time market conditions, further enhancing risk management and potentially optimizing trading outcomes.

- Risk Management Suite Integration: Position size calculators are increasingly becoming integrated into comprehensive trading platforms and risk management suites, offering a seamless and holistic experience for traders.

Fx Position Size Calculator

Conclusion: Empowering Traders with Informed Risk Control

The FX position size calculator emerges as a fundamental tool for navigating the complexities of foreign exchange trading, empowering traders to effectively manage risk and maximize profitability. By carefully considering your individual risk tolerance, account balance, and trading strategy, you can utilize this powerful tool to determine the optimal position size for each trade, ensuring that your trading endeavors align with your risk management goals and pave the way for sustainable success. Remember, informed risk control is not about eliminating risk but rather about embracing it consciously and strategically, maximizing your potential while safeguarding your hard-earned capital.