In the labyrinth of financial markets, where currencies dance and fortunes are made, there lies a hidden realm of unrealized forex gain or loss that holds both promise and peril for investors. As we delve into this enigmatic territory, let’s unravel its complexities and empower you to harness its transformative potential.

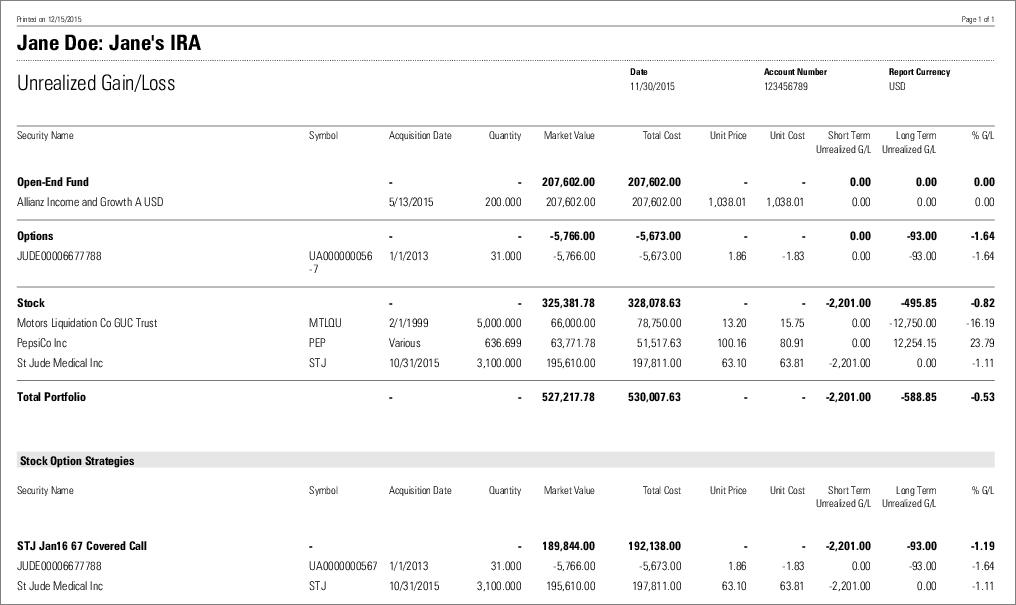

Image: awgmain.morningstar.com

Unrealized forex gain or loss is a concept that arises when you hold an investment that is denominated in a currency other than your own. As exchange rates fluctuate, the value of that investment in your home currency changes, resulting in either a gain or a loss – but only when the investment is sold. Until then, these gains or losses remain unrecorded and unrealised.

Imagine holding shares in a company listed on a foreign exchange, denominated in a foreign currency. As the value of your local currency weakens against the foreign currency, your investment increases in value in your home currency. This difference represents an unrealised forex gain. Conversely, if the local currency strengthens, the value of your investment decreases, leading to an unrealised forex loss.

While unrealised forex gain or loss may not have immediate financial consequences, it can significantly impact your investment decisions. For one, it can provide a buffer against exchange rate fluctuations. If you hold an investment in a foreign currency that gains value, the unrealised forex gain can offset any potential loss due to currency depreciation when you eventually sell.

Conversely, if the foreign currency loses value, the unrealised forex loss can amplify the decline in the value of your investment. It’s a double-edged sword that can enhance or diminish your returns.

To effectively manage the impact of unrealized forex gain and loss, it’s crucial to consider the long-term outlook of the currencies involved. If you anticipate the foreign currency to strengthen against your home currency, you may hold onto your investment to realise the potential gain. Conversely, if you foresee the foreign currency weakening, you might consider selling to minimise the potential loss.

However, it’s important to exercise caution and avoid excessive currency speculation. Forex markets are inherently volatile, and accurately predicting exchange rate movements can be challenging. Diversify your portfolio across different currencies, asset classes, and geographic regions to mitigate forex-related risks.

In the world of investments, knowledge is power, and understanding the intricacies of unrealised forex gain or loss empowers you to navigate the currency markets with confidence. By embracing the concept, monitoring exchange rate movements, and making informed decisions, you can unlock the potential of this hidden realm to enhance your investment returns.

Image: hypufiyuyuq.web.fc2.com

Unrealised Forex Gain Loss On Unsold Investment